October 29, 2024

Navigating Shopify Sales Tax: Kintsugi vs. CPAs and Manual Methods

Managing your Shopify tax compliance is a detailed and resource-intensive task for many Shopify merchants. From calculating Shopify tax rates to generating Shopify tax reports and ensuring payments are remitted correctly, the process can quickly overwhelm merchants.

With a wide range of tax obligations across states and local jurisdictions, Shopify merchants face constant pressure to stay compliant with tax laws while maintaining accurate tax records. Expanding operations only adds complexity, making it challenging for Shopify merchants to handle tax requirements effectively.

For Shopify merchants aiming to grow their e-commerce business while ensuring full compliance with Shopify tax regulations, Kintsugi provides the ultimate solution for handling Shopify tax obligations with efficiency and accuracy.

The Challenges of Manual Shopify Sales Tax Compliance

Handling Shopify tax obligations manually is time-consuming and prone to errors. Shopify merchants are responsible for tracking tax rates, generating accurate tax reports, and ensuring taxes are remitted to the correct jurisdictions on time.

As Shopify stores expand into more regions, the responsibility to calculate sales tax and manage compliance increases significantly. Merchants must ensure they meet the requirements for sales tax nexus in every state where they sell.

For example, Shopify merchants must collect sales tax for every taxable product sold and file tax returns regularly. This involves monitoring exemptions, tax rates, and state-specific obligations. Not only that, but use tax adds another layer of responsibility for sellers purchasing out-of-state goods without upfront tax collection.

Manual methods often rely on spreadsheets or basic tools to track sales tax, making it difficult for merchants to maintain accuracy. Filing late or failing to remit taxes can lead to penalties or audits, significantly affecting a business’s revenue and operations.

Shopify admins often turn to resources like the Shopify Help Center for guidance, but managing the entire process without automation can still overwhelm store owners. Kintsugi simplifies these tasks by automating calculations, ensuring accurate tax rates are applied to every transaction, and generating reliable tax reports.

This allows Shopify merchants to focus on growing their e-commerce business instead of spending countless hours handling tax compliance manually.

Sell more, stress less—let Kintsugi tackle your taxes.

Limitations of Relying Solely on CPAs for Shopify Taxes

Certified Public Accountants (CPAs) are valuable for managing tax strategies, but they are not always the best option for handling the ongoing, day-to-day tax requirements of a growing Shopify store. CPAs typically charge high fees for sales tax compliance, especially for merchants operating in multiple states.

With the expansion of sales, businesses often need to register for sales tax permits in several jurisdictions, calculate sales tax for every product sold, and ensure compliance with tax laws. While CPAs excel in addressing complex tax scenarios, their reliance on manual processes slows down operations.

Businesses relying solely on CPAs may face delays in filing tax reports or remitting taxes, increasing the risk of non-compliance. Many merchants have turned to automation to handle routine tax tasks efficiently to combat this.

Kintsugi’s tax automation platform offers Shopify merchants an alternative to these traditional workflows. By automating tax collection, generating tax reports, and streamlining tax calculations, it reduces the dependency on manual processes while ensuring that Shopify admins comply with all sales tax obligations. This allows merchants to focus on optimizing their Shopify sales without worrying about meeting complex tax requirements.

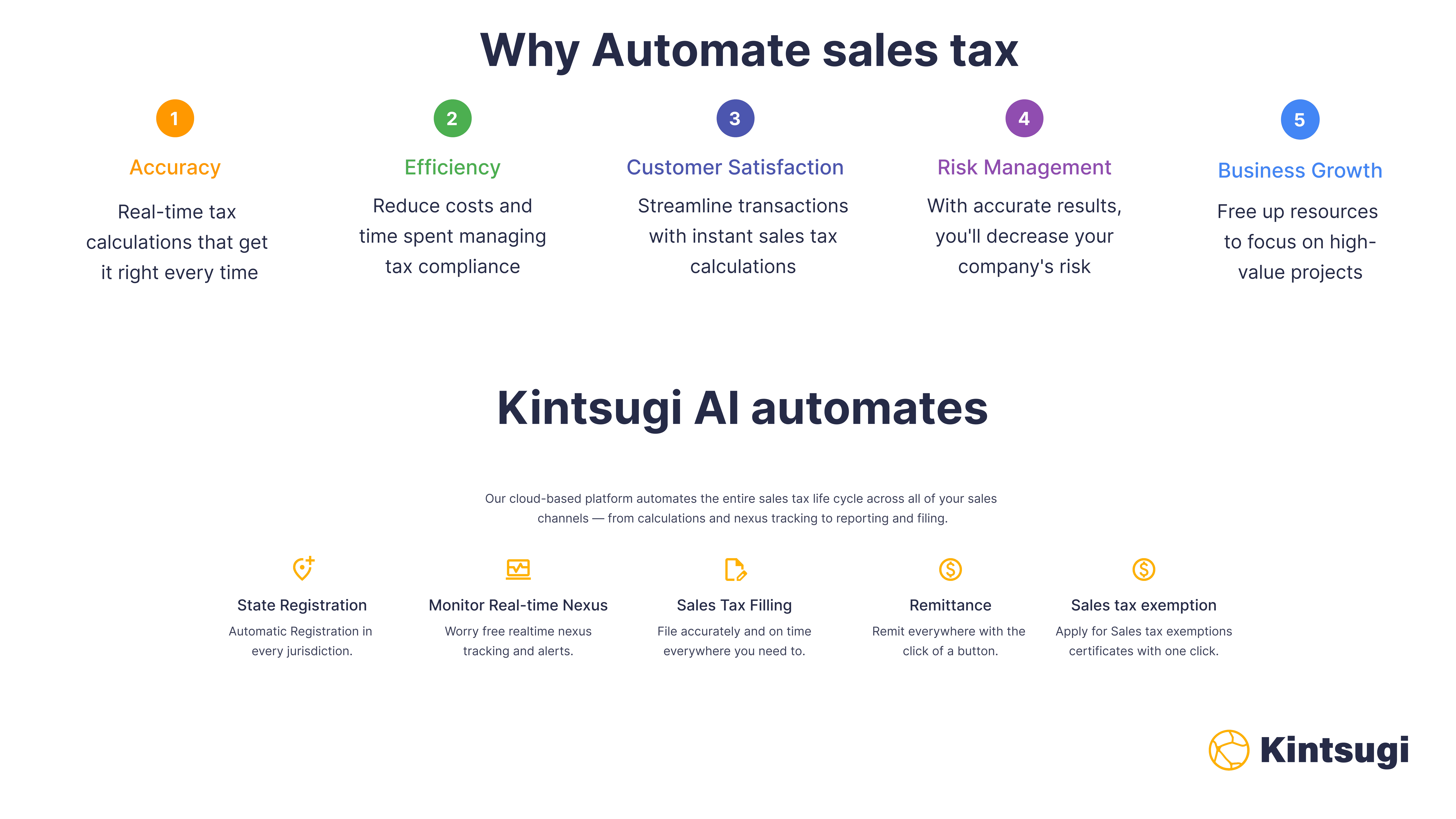

Automating Sales Tax on Shopify

Kintsugi is designed to handle the unique needs of e-commerce businesses. It automates backend processes like tax reporting, compliance monitoring, filing, and remittance. The automation pertains to compliance tasks post-transaction, not during the checkout process.

Kintsugi integrates with Shopify for seamless compliance, not directly into POS or e-commerce checkout. So, it does not alter the tax displayed at checkout. Yes, it does not function as a tax calculation engine within the checkout system.

Kintsugi is for Shopify merchants who want to monitor nexus, track sales across channels, and automate tax filings and remittances. It also generates accurate tax reports to ensure compliance after the sale.

Why Automation is Better Than Manual Methods and CPAs for Shopify Taxes

Kintsugi’s platform offers several key advantages over traditional methods of tax compliance. Unlike manual processes, which rely on spreadsheets or basic tools, Kintsugi provides real-time updates on sales tax rates, ensuring Shopify admins can collect tax accurately for every sale. The platform also reduces administrative burdens by automating the generation of tax reports and managing sales tax remittance schedules.

For Shopify sales involving multiple jurisdictions, Kintsugi ensures that merchants comply with every state’s requirements. By integrating with Shopify, the platform allows store owners to handle refunds, adjustments, and exemptions effortlessly. This is especially valuable for merchants dealing with large transaction volumes, where manual processes will likely result in errors.

Kintsugi’s ability to streamline the registration process for sales tax permits and automate tax filings means that Shopify merchants no longer need to rely solely on CPAs for compliance. The platform provides an end-to-end solution, allowing businesses to save on fees while ensuring taxes are collected and remitted accurately.

Merchants looking for a better way to handle Shopify tax obligations can explore Kintsugi’s custom Shopify tax solution.

Built for Shopify. Perfected for peace of mind. Kintsugi!

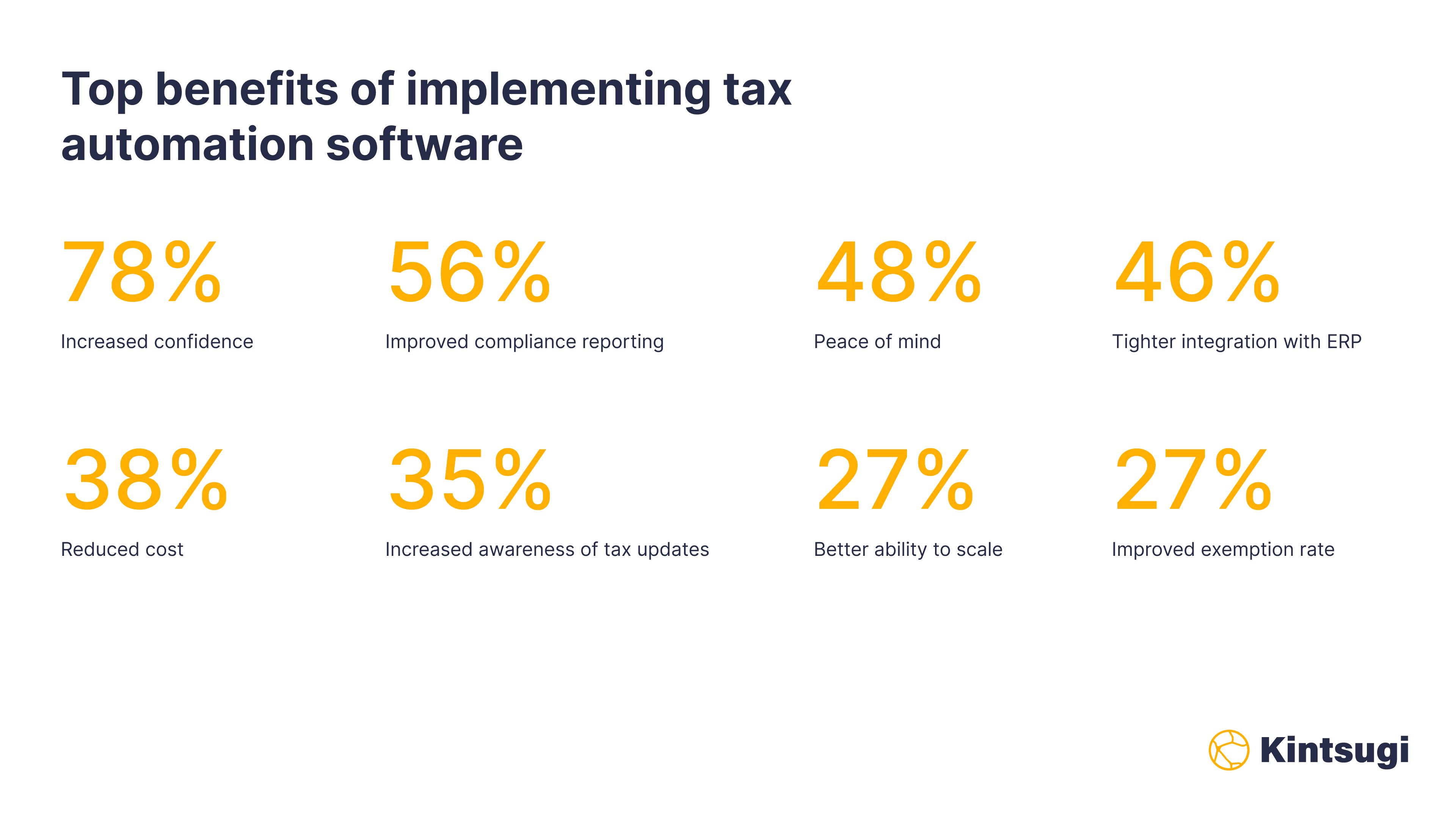

Automation’s Broader Impacts on Shopify Businesses

Automation has a transformative impact on e-commerce businesses, particularly Shopify merchants. By automating Shopify tax tasks, merchants can focus on improving customer experiences and growing revenue instead of spending time on tax compliance. Accurate tax calculations at checkout also build trust with customers, as buyers are charged the correct sales tax amount for their purchases.

Sales tax automation tools help merchants manage refunds, duties, and exempt transactions more effectively. Tax reports generated automatically by the platform ensure Shopify admins are always prepared for audits and can file tax returns on time.

Businesses that adopt automation report significant savings in time and costs, allowing them to reinvest resources into growth strategies. Shopify merchants can benefit further by integrating Kintsugi with their Shopify App Store to stay informed to manage their Shopify taxes in a more streamlined way.

Kintsugi supports this by allowing merchants to manage Shopify sales taxes and local tax obligations without disrupting their business operations.

Why Choose Kinstugi for Automating Your Shopify Sales Tax

Managing Shopify tax compliance doesn’t need to be a burden for Shopify merchants. Kintsugi Tax provides Shopify merchants with the tools and efficiency required to handle every aspect of Shopify tax compliance.

From calculating Shopify tax rates to generating Shopify tax reports and remitting Shopify taxes, it ensures accuracy and streamlines Shopify tax operations. By eliminating manual Shopify tax errors and reducing reliance on CPAs for Shopify tax filings, Kintsugi allows Shopify merchants to focus on expanding their Shopify sales and growing their Shopify stores.

With Kintsugi, Shopify merchants can confidently manage Shopify sales tax obligations, collect Shopify taxes for every transaction, and stay ahead of their Shopify tax compliance requirements. The platform simplifies Shopify tax calculations, Shopify tax reports, and Shopify tax remittances, making it the ultimate solution for Shopify merchants.