November 25, 2024

How to Integrate Kintsugi Sales Tax Automation with Stripe: A Step-by-Step Guide

If you’re using Stripe’s payment platform and considering a sales tax automation tool, you’re on the right track—automation is the future of efficient tax management. According to this survey, 52% of businesses believe sales tax automation improves tax management, and 84% consider seamless integration a key requirement, as highlighted in The State of SaaS Integrations Report. This guide will help you find the best sales tax automation partner for Stripe.

About Stripe

Stripe is a leading payment processing platform that provides businesses with a suite of financial services, including online payments, billing, invoicing, subscriptions, and fraud prevention. It enables businesses to accept payments globally, offering support for credit cards, digital wallets, and alternative payment methods while also providing tools for managing transactions and financial reporting.

However, while Stripe does offer basic sales tax calculation through Stripe Tax, it does not automatically collect, remit, or file sales taxes on behalf of businesses. Merchants are still responsible for tracking their tax obligations, registering with the appropriate tax authorities, and filing returns—which is why integrating an automation tool like Kintsugi can help streamline compliance and prevent costly tax errors.

Does Stripe Automatically Collect Sales Tax?

Stripe offers financial services and is one of the best online payment processors due to its flexibility. However, it is not designed to manage sales taxes.

Stripe Tax is designed to automate sales tax, value-added tax (VAT), and services tax (GST) for businesses that use Stripe for payment and billing. However, Stripe does not automatically collect sales taxes.

Stripe Tax is an additional service that Stripe users must pay to automate sales tax. Stripe Tax works like Kintsugi, except that the latter offers more free services and has the most effortless onboarding and seamless integration you will ever experience.

Who is Kintsugi?

Kintsugi is your partner for seamless sales tax automation. The company was founded in 2021, three years following the 2018 Supreme Court ruling requiring internet retailers to collect and remit sales taxes even if they do not have a physical presence. The decision makes managing sales taxes from different jurisdictions challenging, as each has its own rules and regulations.

Kintsugi was created to help business owners stay compliant by making the process a breeze. Kintsugi will automate your sales tax compliance in three simple steps:

Connect and monitor

Register and collect and

Remit and file Our platform promises to put your sales tax on autopilot in just three minutes. Kintsugi wants you to focus on the more significant part of your business – growing it! Our software helps you track your sales tax nexus and tax liabilities, import your transaction, handle voluntary disclosure agreements (VDAs), and more.

CQ “Achieving compliance is not an activity that is going to generate any revenue but many businesses are spending hundreds of hours each year doing this work,” said Kintsugi CEO Pujun Bhatnagar. “Our technology can help them hugely reduce that.”

Why Choose Kintsugi For Stripe?

Kintsugi is the best sales tax automation provider for Stripe users because its transparent pricing model delivers and offers many free services for those who don’t want to pay but want to enjoy automation. Kintsugi offers flexible pricing with no annual commitments. View Kintsugi plans and pricing.

Aside from transparent pricing, Kintsugi is designed to be intuitive and offers fast and easy onboarding and seamless integration. It calculates tax accurately and has responsive customer support. Kintsugi delivers and doesn’t disappoint.

Benefits of Kintsugi and Stripe Partnership

Smooth sales tax automation: With Kintsugi, you will enjoy smooth and secure sales tax compliance because our tool does everything for you, from monitoring nexus, registration, collection, calculation, filing, and remittance.

Seamless onboarding and integration: One of the great things Kintsugi offers its users is the best customer experience, from effortless onboarding to trouble-free integration. With just a click, you can connect Kintsugi to your Stripe account and enjoy seamless sales tax automation.

Enhanced customer satisfaction: Customers will feel more confident doing business with you because Kintsugi exercises solid security measures and demonstrates transparency, boosting your brand’s reputation and customer trust.

Setting Up Your Stripe Account for Automation: Step-by-Step Integration Guide

Kintsugi’s no-code integration makes it easy for Stripe users to use our sales tax automation tool. However, there are some things to consider. In this section, you’ll learn everything you need to integrate Stripe with Kintsugi.

Prerequisite for Integration

Kintsugi requires that you use Stripe Invoices instead of Stripe Payments. Stripe has a dedicated page for Stripe Invoicing, where you will find everything you need to learn about it.

Step-by-Step Integration Process

Here's the step-by-step integration guide that you should follow to link Kintsugi with Stripe.

Step 1: Access the Stripe Account

1. If you already have a Stripe account:

a. Navigate to Stripe Login.

b. Enter your email and password, then click Sign In.

2. If you don’t have a Stripe account:

a. Click Sign Up and follow the on-screen instructions to create a new account.

b. Once registered, log into Stripe.

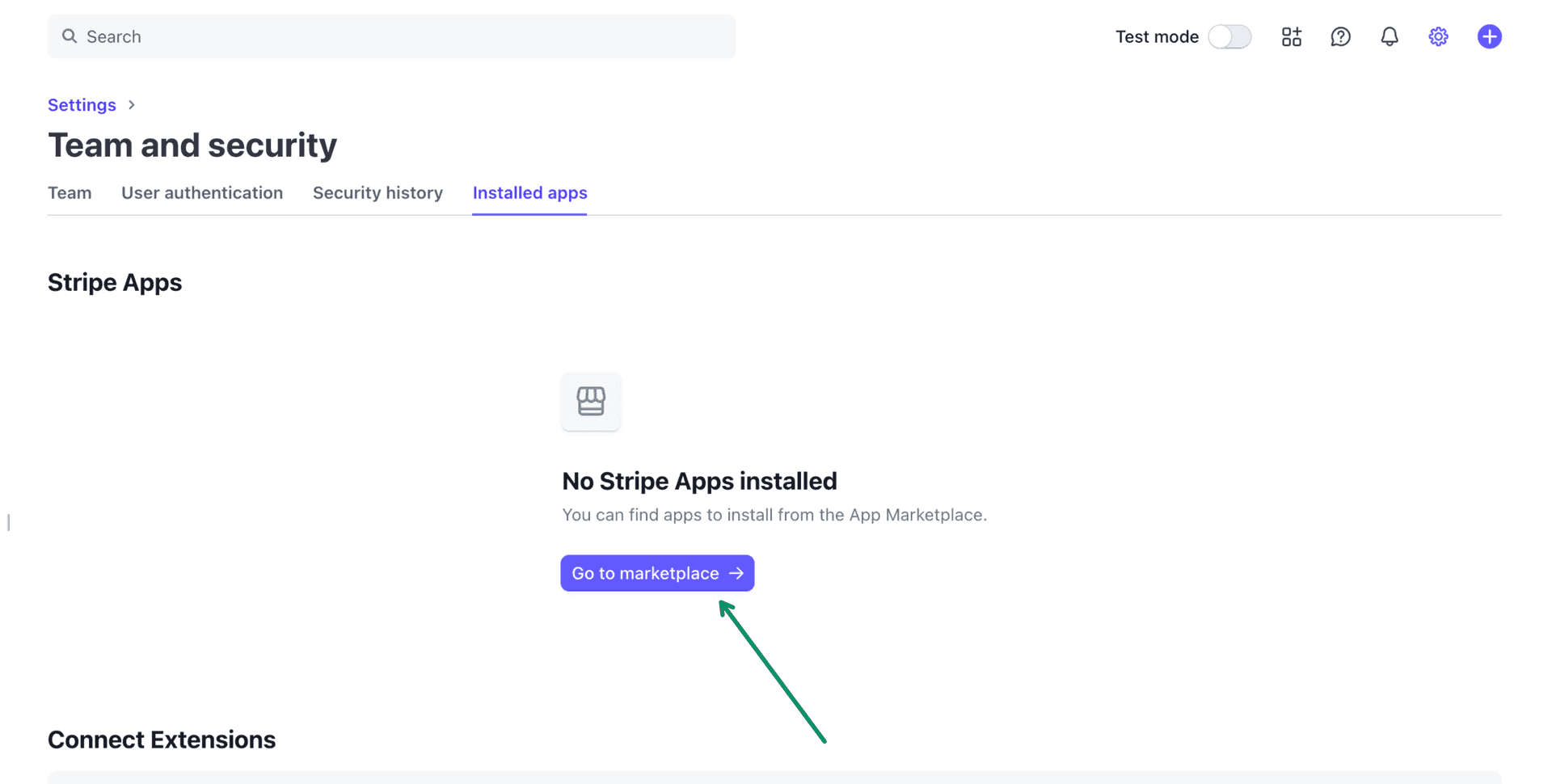

Step 2: Access the Stripe App Marketplace

In the Stripe Dashboard, go to the Apps section.

Click on Go to marketplace.

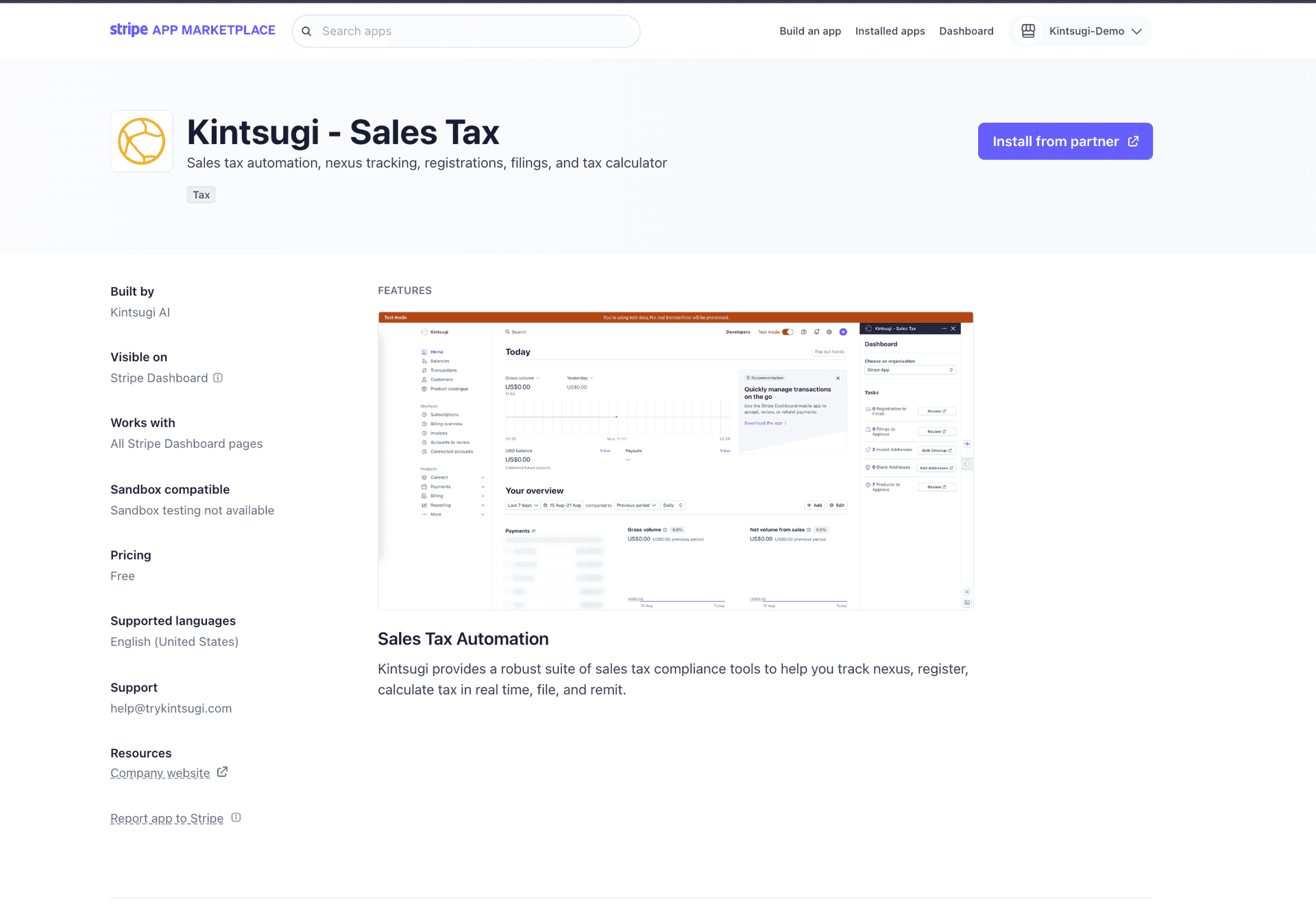

In the search bar, type Kintsugi - Sales Tax.

Click on the Kintsugi - Sales Tax app from the search results.

Step 3: Install the Kintsugi App

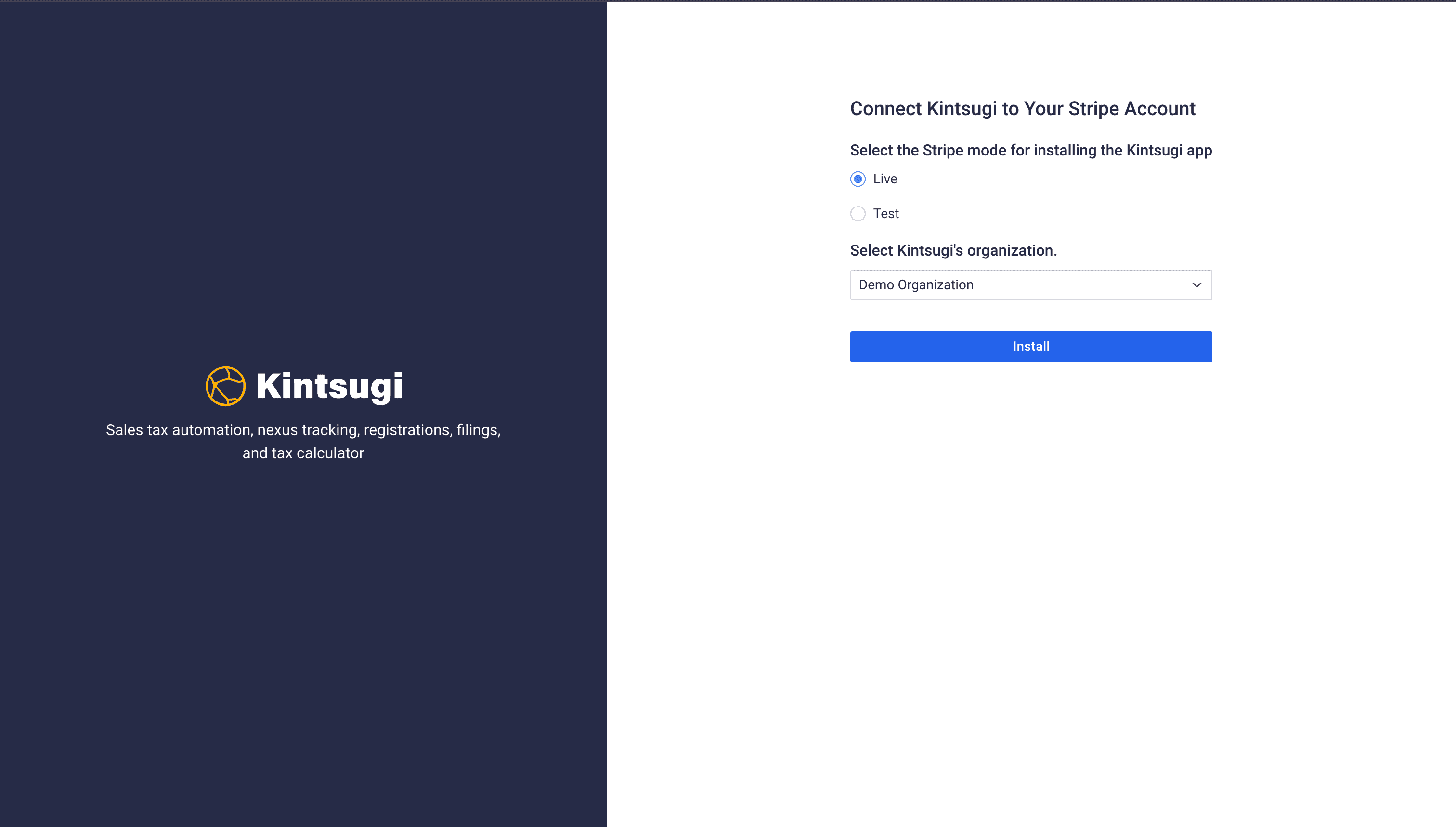

1. Click on Install from Partner.

2. You will be prompted to login to your Kintsugi account.

3. Select the mode for installation (Test Mode or Live Mode). a. Test Mode allows you to test the integration before going live. b. Live Mode enables real transactions with tax calculations.

Kintsugi allows customers to install the Kintsugi app in both Test and Live modes of Stripe, as it offers a dedicated testing environment, allowing users to simulate transactions and thoroughly validate their integration without impacting real data. This flexibility ensures businesses can confidently transition to live transactions. Learn more about Test Mode and Live Mode to see the best option for your use case here.

4. Choose the Kintsugi organization for which you are establishing this connection.

If you manage multiple organizations, ensure you're selecting the correct one for accurate tracking and reporting.

5. Click Install to proceed.

Step 4: Connect Kintsugi to Your Stripe Account

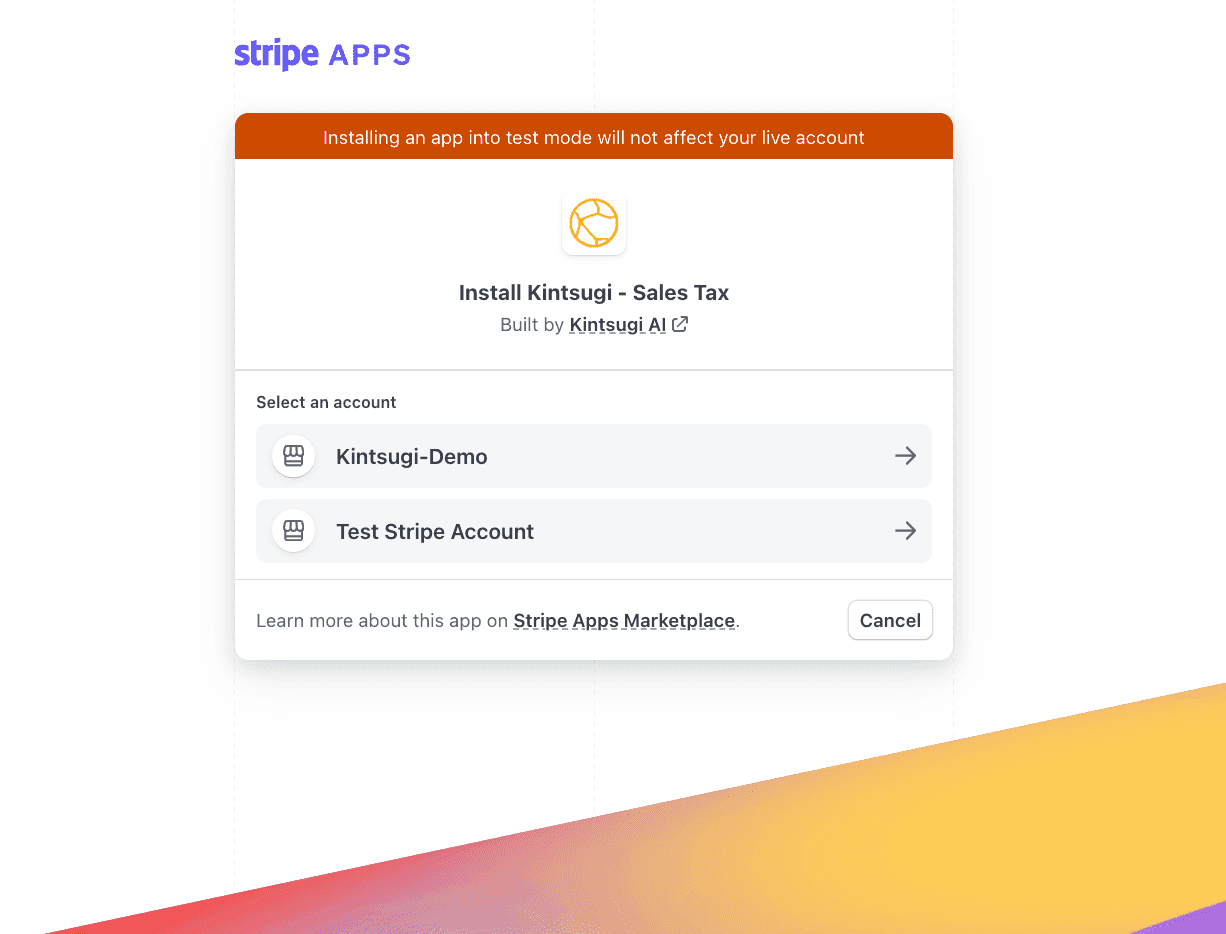

You will be prompted to select the Stripe account where you want to install the Kintsugi app.

Choose the appropriate Stripe account.

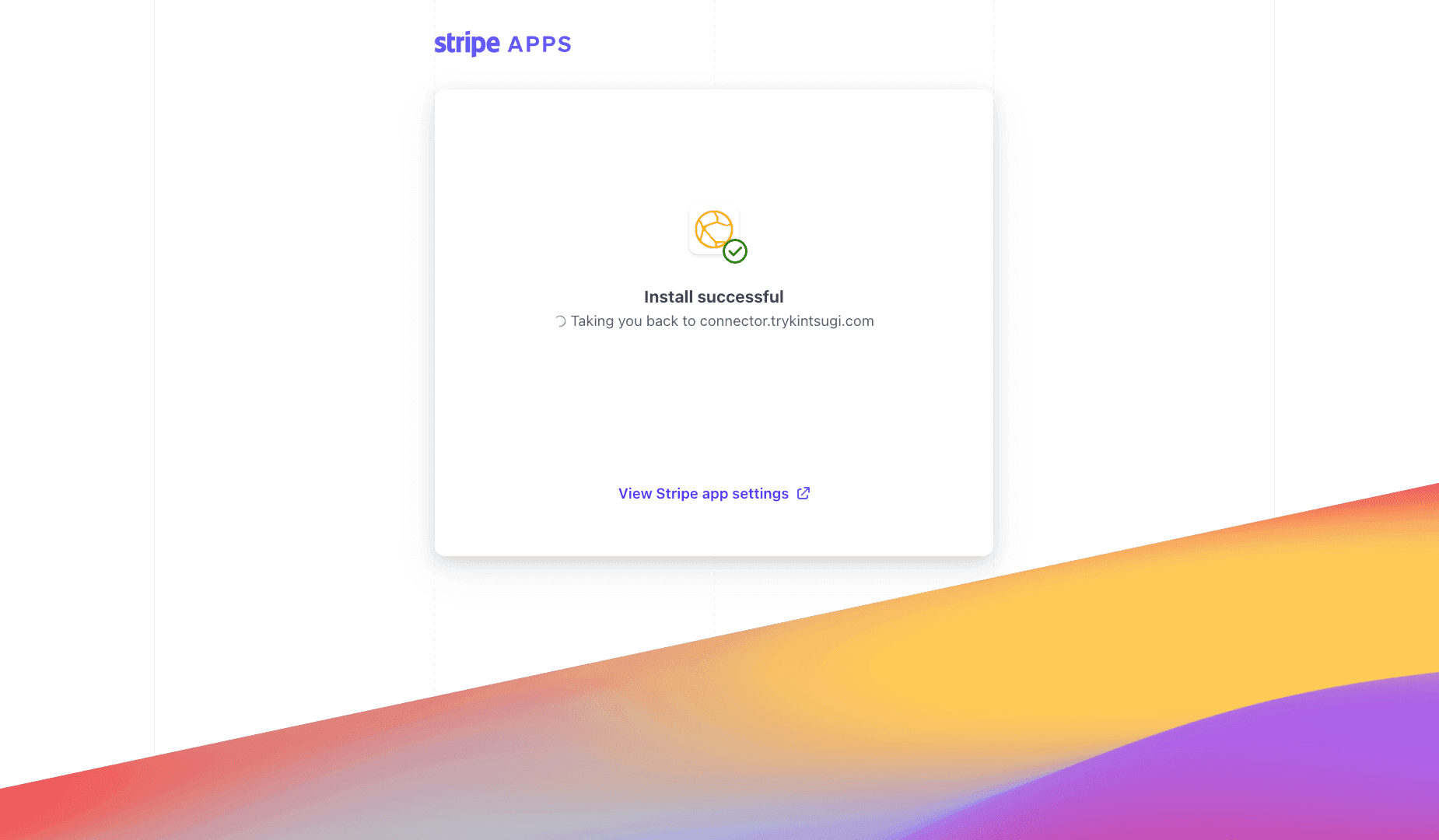

Once installation is successful, you will be redirected to connector.trykintsugi.com.

Step 5: Verify Installation in Stripe and Kintsugi

In Stripe:

Go to your Stripe Dashboard → Apps section.

You should now see Kintsugi listed in your installed apps.

Click on the Kintsugi app to access the dashboard with the Tasks section.

In Kintsugi:

Log in to your Kintsugi account.

Navigate to Data Sources under your organization.

You should see an active Stripe connection listed there.

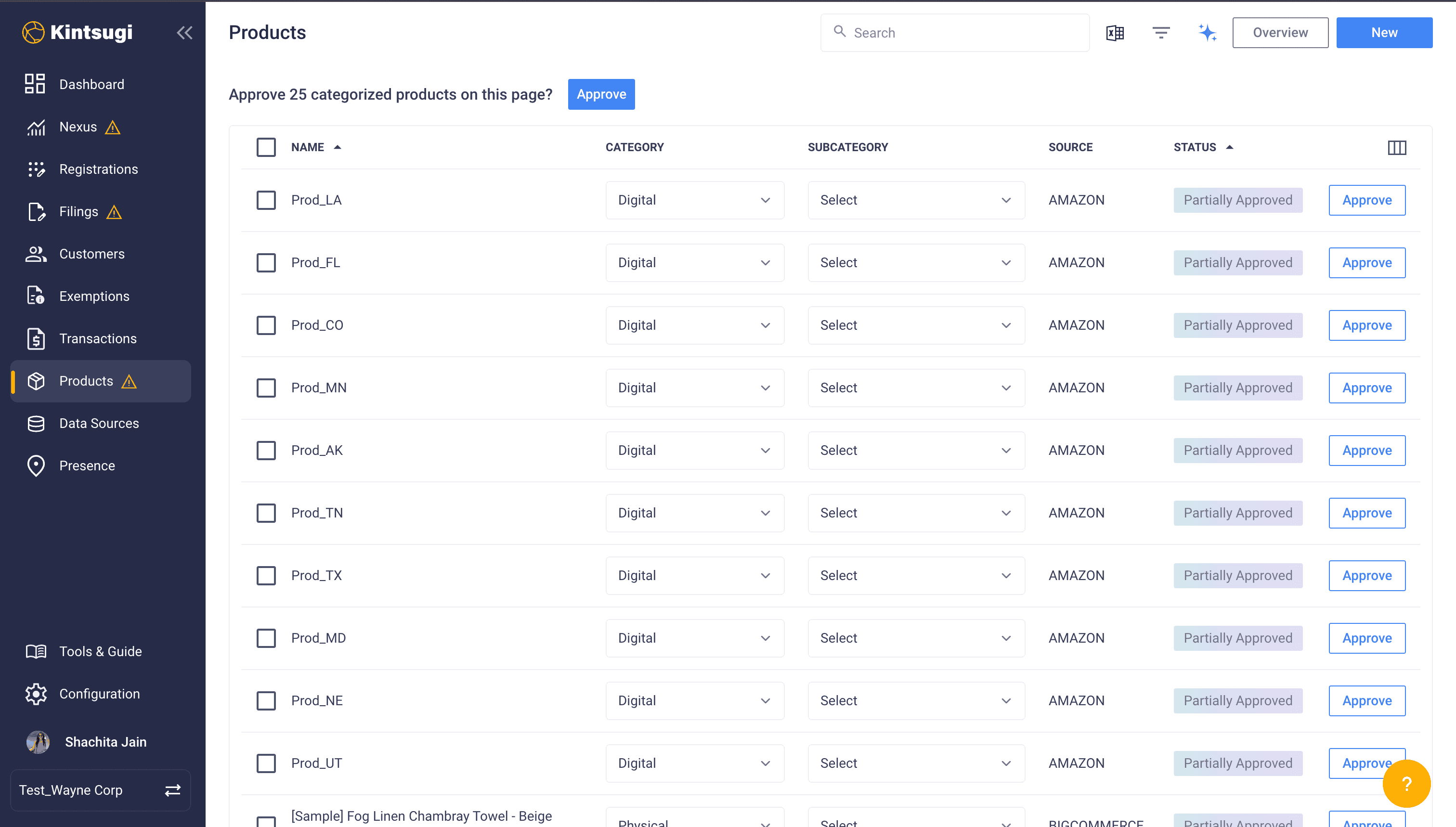

Step 6: Verify Product Classification in Kintsugi

Navigate to the Products section in your Kintsugi dashboard.

Ensure that all products are correctly classified under their respective categories and subcategories.

Proper classification ensures accurate tax calculation and product mapping.

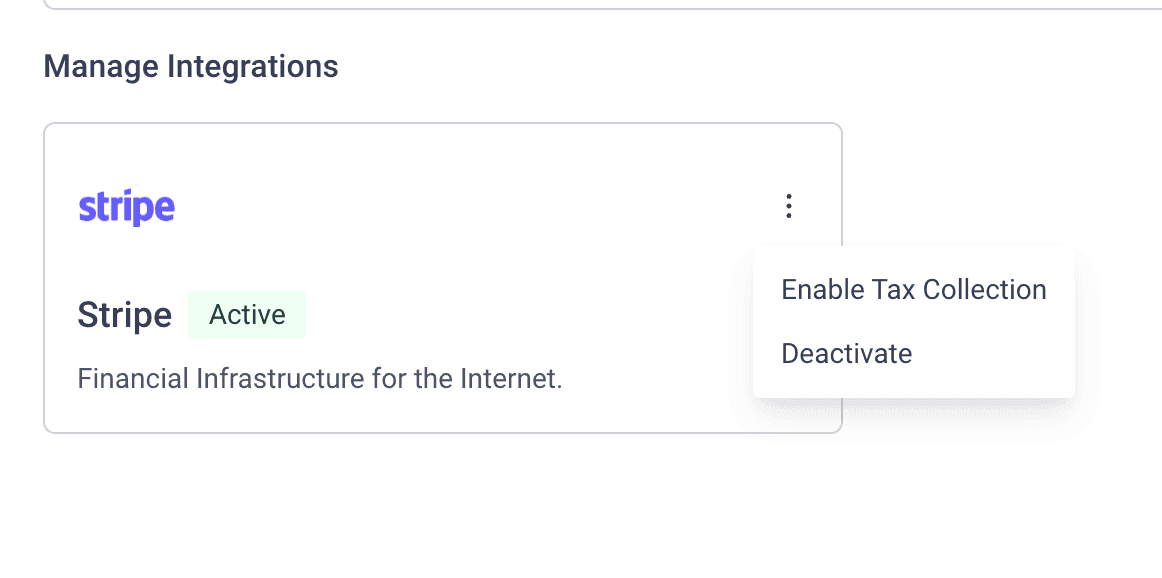

Step 7: Enable Tax Collection for Stripe

Once your Stripe connection is established and your organization is ready, you can enable tax collection in Kintsugi.

The “Enable Tax Collection” option becomes available only when the following conditions are met:

The connection to Stripe has completed its initial data import.

Your organization has established physical nexus in at least one jurisdiction.

You have at least one active tax registration.

Your organization details are fully completed in the system.

Once these requirements are fulfilled, you can enable tax collection from the Kintsugi dashboard.

Integrate Stripe With Kintsugi For The Best Sale Tax Experience

Stripe doesn’t collect taxes automatically, but Kintsugi does and it’s one of the trusted sales tax automation tools in the market. Pairing Stripe with Kintsugi is the best decision you could make for your business.

Kintsugi is a powerful sales tax automation tool that seamlessly integrates with ERP, HR, and e-commerce platforms, including Stripe. It provides real-time tax calculations and automates filings to keep businesses compliant effortlessly. Kintsugi’s no-code integration allows for seamless and stress-free connection. If you are ready to experience the power of sales tax automation book a demo now or sign up for free with Kintsugi.