November 13, 2024

How to Quickly Set Up Sales Tax Automation Shopify For Merchants

Sales tax compliance shouldn’t slow your Shopify business down. Yet, for many merchants, managing sales tax rates, tax filings, and tax calculations across multiple states can feel overwhelming. Manual Process often lack accuracy and create inefficiencies, leading to missed deadlines, costly penalties, and mounting stress. Keeping up with changing regulatory updates and maintaining consistent tax compliance is crucial for businesses operating across jurisdictions.

The solution? Sales tax automation. With the right automated solutions, Shopify merchants can improve efficiency, ensure accuracy, and eliminate the manual burden of tax filings. By integrating sales tax automation software designed for streamlined sales tax compliance, merchants can automate rate calculations, reporting, and nexus tracking, saving valuable time. This guide will help you automate your sales tax on Shopify within minutes using platforms like Kintsugi, ensuring you can easily meet your obligations without compromising growth.

Why Sales Tax Automation Matters for Shopify Merchants

For e-commerce businesses, achieving sales tax compliance is no longer optional—it’s a requirement. States aggressively enforce the collection of sales tax rates, especially as regulatory updates around economic nexus laws evolve. Merchants operating across multiple jurisdictions face the challenge of managing transactions, tracking changing rates, and ensuring their processes meet state-specific compliance standards. Without automated solutions, this task becomes cumbersome, with a high risk of inaccuracies.

According to a Shopify survey, businesses relying on automation for tax compliance significantly reduce errors in reporting and streamline their workflows. Tools that integrate directly with Shopify offer better accuracy and time-saving efficiency, improving overall operations. The 2024 Buyer Behavior Report highlights that businesses prioritize software integrations that enhance efficiency. By leveraging tools like Kintsugi, Shopify merchants can automate sales tax calculations, maintain precise sales tax rates, and simplify their transactions across multiple states. Automation ensures that businesses remain compliant with minimal effort.

The Benefits of Automating Sales Tax on Shopify

Implementing sales tax automation offers numerous benefits for Shopify merchants:

Efficiency: Eliminate manual processes by automating sales tax rate calculations, reporting, and filings across jurisdictions.

Accuracy: Improve tax calculations for every transaction, ensuring error-free compliance with local tax laws.

Seamless Integrations: Platforms like Kintsugi provide direct integrations with Shopify, simplifying workflows.

Reduced Risk: Avoid missed deadlines, inaccuracies, and penalties by automating your sales tax compliance processes.

A study from Inbox Insight emphasizes the importance of automated solutions in driving efficiency and reducing compliance errors. Sales tax automation platforms can provide merchants with scalable solutions for sales tax automation that deliver long-term benefits.

Why Choose Kintsugi for Shopify Sales Tax Automation?

Kintsugi stands out as the ultimate platform for sales tax compliance with Shopify. Its automated features ensure accurate tax calculations, streamlined reporting, and seamless integrations.

Automated Solutions: Kintsugi calculates sales tax rates in real-time, improving accuracy and ensuring compliance for every transaction.

Integration Efficiency: Shopify merchants benefit from seamless software integrations that simplify workflows.

Nexus Tracking: Monitor economic and physical nexus thresholds to stay updated with changing regulatory updates.

Effortless Reporting: Consolidate data and automate tax compliance filings across all jurisdictions.

This press release highlights how businesses leveraging automated solutions gain a competitive edge in managing compliance challenges. With Kintsugi, Shopify merchants can achieve unmatched efficiency and accuracy in managing tax workflows.

Step-by-Step Guide to Setting Up Kintsugi on Shopify

For Shopify merchants who have already switched to Kintsugi’s automation sales tax tool, the setup process is a breeze thanks to Kintsugi’s seamless no-code integration.

Here’s what to do.

1. Login to your Kintsugi account.

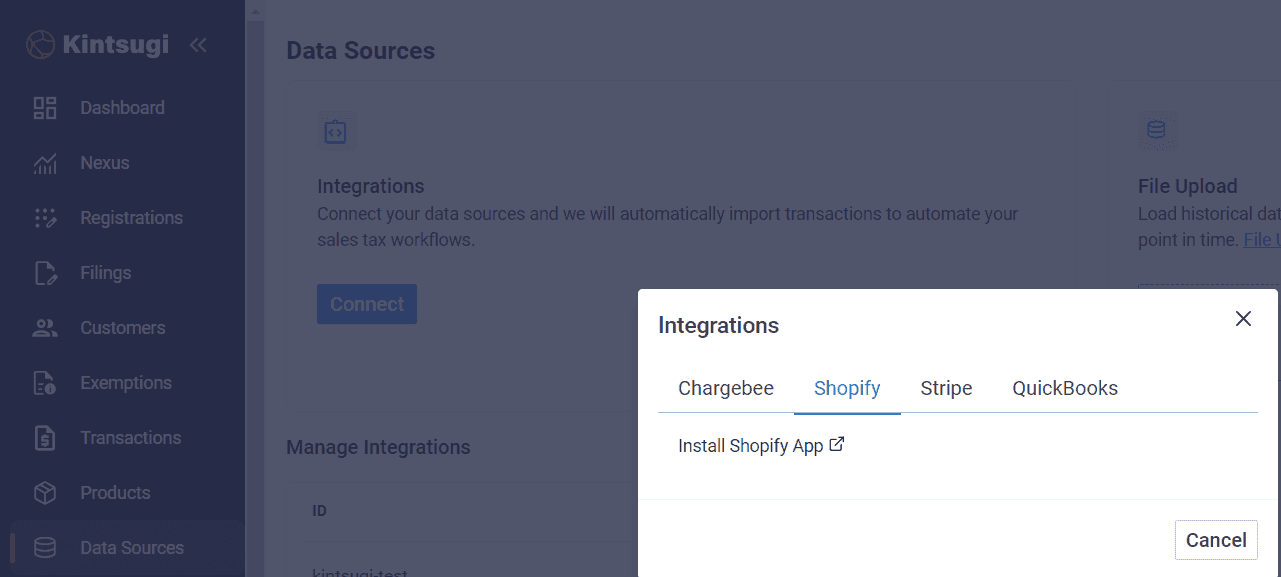

2. Navigate to Data Sources, then Integrations.

3. Click on 'Connect' and select 'Shopify'.

4. Click on 'Install Shopify App.'

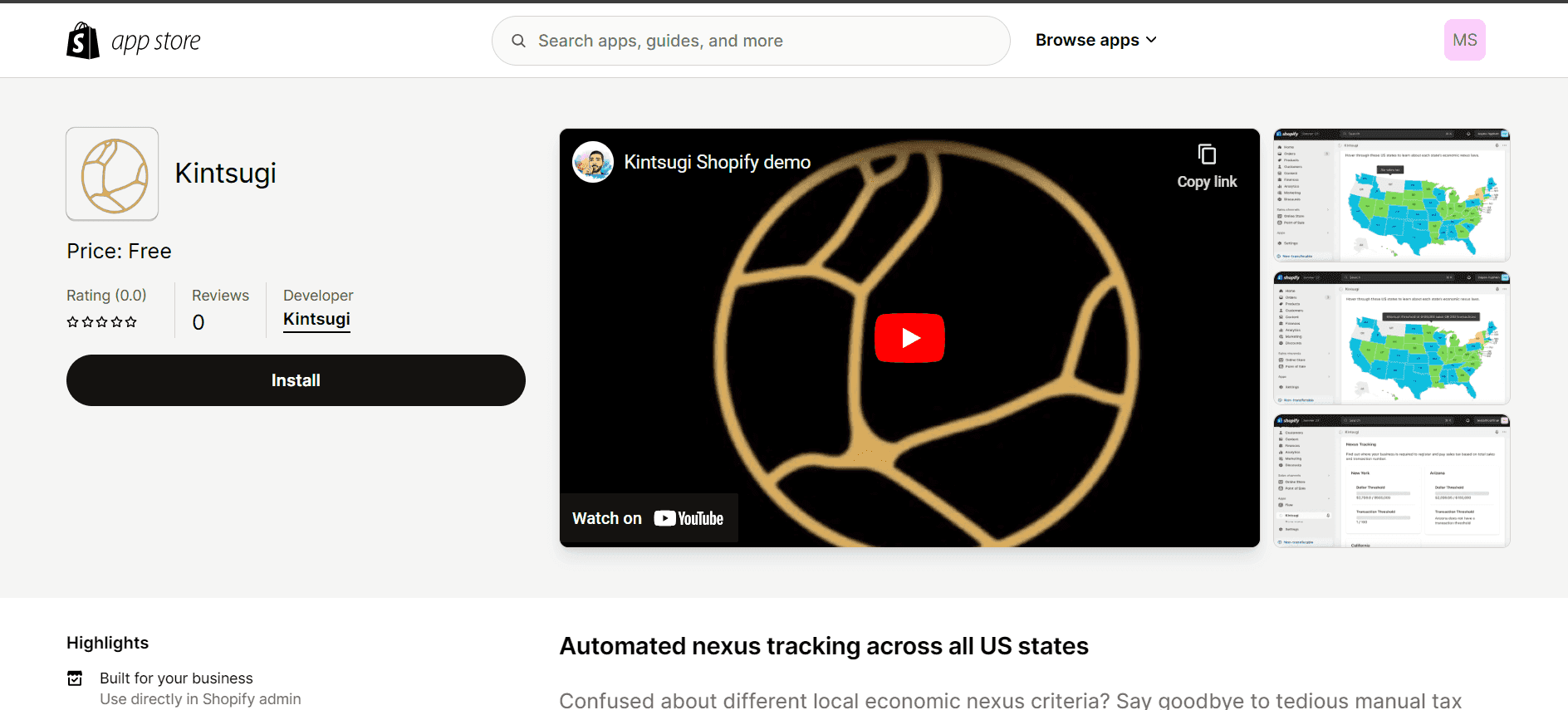

5. Search Kintsugi on Shopify’s app store page and click ‘Install.’

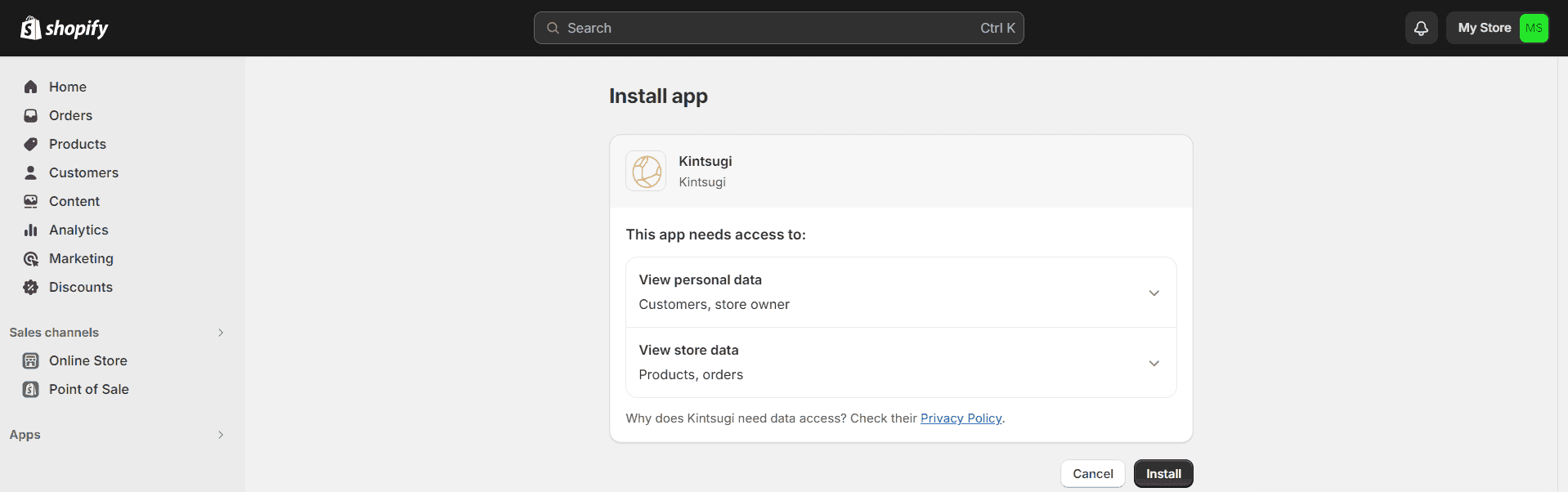

6. Click 'Install' from your Shopify store to complete the installation process.

Once the integration is successful, you will be redirected to Kintsugi and your Shopify account will be listed under the 'Manage Integrations' section on the 'Data Sources' page.

To know about the status of your integration, you can check the 'Data Sources' page, then the 'Manage Integration' section, and look for the 'Status' column. If the integration status is 'Active,' transactions are synced in real time. You can check the 'Last Synced Date' column of the 'Manage Integrations' section to see the last sync.

Here's an overview of how Kintsugi works when integration with your Shopify store is completed:

Automate Your Sales Tax on Shopify with Kintsugi Today!

Managing sales tax compliance on Shopify doesn’t need to be overwhelming. By implementing sales tax automation tools like Kintsugi, you can streamline tax calculations, simplify reporting, and achieve greater efficiency. From tracking nexus obligations to automating sales tax rates, Kintsugi delivers the tools you need to stay compliant.

With Kintsugi you enjoy flexible pricing with no annual commitments. View Kintsugi plans and pricing.