November 29, 2024

Integrating Kintsugi with Chargebee: A Step-by-Step Guide For A Seamless Experience

If you're looking to integrate a reliable sales tax automation tool with Chargebee, Kintsugi is the perfect solution. Known for its high-quality service and free features, Kintsugi has quickly gained popularity since its founding in 2022, even doubling its valuation in 2025.

While Chargebee excels as a leading revenue and subscription growth platform, it doesn’t automate sales tax compliance—making Kintsugi the ideal partner for seamless tax management. This guide will walk you through the integration process, starting with an overview of both platforms.

Who is Kintsugi?

Kintsugi is dedicated to changing how people view sales tax by automating the entire process from end to end. It uses its proprietary AI-powered system, Kintsugi Intelligence, to keep updated with the ever-changing sales tax laws in real time, which can differ from state to state. Kintsugi handles everything from sales tax management to nexus monitoring, calculations, registration, filing, remittance, product classifications, and more.

By putting the U.S. sales tax regulations into thousands of lines of code, the platform eliminates human error. So, it is more accurate and faster than CPAs and other tax experts. It also comes with Kintsugi Sheets, the most intelligent, no-code data management and reporting tool for sales tax compliance.

Key Features

Kintsugi has tons of great features that Chargebee customers will love because Shopify merchants and Stripe customers adore us for the same reason. Here are some of them.

Automate sales tax compliance: Kintsugi’s purpose is to automate your sales tax compliance, and it delivers. Kintsugi can automate your compliance in three simple steps:

Connect and monitor

Register and collect

Remit and file

Handles exemption and special tax situations: Kintsugi stays up-to-date with changing tax laws across different states, including local taxes, VAT, and GST, and automatically applies the correct tax rates based on the customer’s location and transaction details. It also allows you to mark customers exempt from sales tax, specify products or services exempt from sales tax or subject to special tax rates, and create custom tax rules to accommodate unique tax situations, which is helpful for businesses operating with complex tax regulations.

Seamless Integration: Kintsugi offers no-code integration with Chargebee and numerous other ERP, HR, and e-commerce systems to make sales tax automation fast and easy. You can integrate Kintsugi with your other existing tools that the platform supports in minutes.

Easy Onboarding: Kintsugi is dedicated to making sales tax automation a breeze and we respect your time, so this tax solution comes with an intuitive design. Even those who are not tech-savvy will approve of this because it’s one of the easiest-to-use and navigate apps available in the market.

Reliable Customer Support: Kintsugi will be with you every step of the way. You can contact us 24/7 if you need assistance with onboarding, integration, or any other concerns. We can also connect you to a tax expert when you need one. Our knowledgeable and responsive customer support is among the things our customers love about us.

Who is Chargebee?

Chargebee is the leading revenue growth management (RGM) platform for subscription businesses of all sizes. It offers comprehensive tools for managing subscriptions, invoicing, payments, financial reporting, etc. Chargebee’s multi business entity solution allows you to manage multiple businesses as independent entities in one platform. Chargebee’s Product Catalog helps business owners define their products and offerings aside from packaging them to customers via subscriptions. It can be set up by defining product families, plans, addons, charges, coupons, and coupon sets.

Chargebee also supports multiple types of payment methods (online payment methods, online payment methods with offline checkout and offline payment methods) and various payment gateways in over 50 countries and integrates with them, making it a top choice among business owners when it comes to billing for their subscription services. It also integrates seamlessly with other business tools like CRM systems, accounting software, and marketing platforms to conveniently manage an entire subscription lifecycle from a single platform. Thousands of merchants and businesses worldwide use the Chargebee, including Toyota, Linktree, Calendly, Typeform, and more.

Key Features

Multi business entity: Enables entrepreneurs to manage subscription data and streamline operations from all their business entities in one Chargebee site.

Automate recurring billing: Chargebee streamlines the billing cycle by automating subscription renewals, upgrades, downgrades, and cancellations.

Manage subscriptions: Chargebee handles customer subscriptions with flexible pricing models, trials, discounts and promotional offers.

Mobile subscriptions: Connects your mobile app businesses with your Chargebee site and lets you access all subscription data in a unified dashboard.

Process payments: Chargebee integrates with multiple payment gateways to accept payments globally, supporting various currencies and payment methods.

Handle invoicing and taxes: Chargebee generates professional invoices automatically and ensures compliance with global tax regulations, including sales tax, VAT, and GST, by allowing you to integrate your Chargebee Billing site with third-party tax providers like Kintsugi.

Gain financial insights: Chargebee integrates analytics tools to help you track and manage critical metrics.

RevenueStory: This will help you identify the elements that will drive revenue, subscriptions, and signups by associating your product metrics with revenue metrics and the customers’ buying patterns.

Benefits of Integrating Kintsugi and Chargebee

Integrating Kintsugi with Chargebee offers numerous advantages such as streamlining billing processes and enhancing tax compliance. These two apps have different purposes and complement each other well. Here is a list of the benefits you will enjoy with the Kintsugi and Chargebee integration.

Automatic and accurate sales tax calculation: Kintsugi keeps up to date with sales tax regulations and rates in real time and calculates the correct sales tax in each transaction processed through Chargebee. Automation reduces the risk of human errors in tax calculations, ensuring that each invoice is accurate.

Better customer experience: Kintsugi’s transparent invoicing allows customers to see the accurate tax amounts and deductions during checkouts, which builds customer trust. In addition, automated calculations speed up transaction time.

Streamlined billing operations: By integrating Kintsugi with Chargebee, businesses can manage subscriptions and tax calculations in a single platform. You don't need to switch between different systems for a smooth billing cycle for recurring payments.

Time and cost savings: Sales tax automation is fast and accurate. It gives you back the time you used to spend on manual calculations and studying the complex and ever-changing tax laws. Plus, it keeps you from potential penalties and fines associated with late filings and tax miscalculations.

Comprehensive reports and analytics: Both Kintsugi and Chargebee offer detailed reporting. However, when taken together, you will enjoy a combined report of sales data and tax information, which is more helpful for better financial planning and decision-making. Also, Kintsugi makes sales tax filing a breeze by keeping accurate data and organizing them in one place so they are readily available when needed for instances like an audit.

Prerequisites for Integrating Kintsugi with Chargebee

Kintsugi’s no-code integration with Chargebee makes the process a breeze. However, there are a few things that you should do before the integration to ensure a smooth experience.

First, you should have an account on Kintsugi and Chargebee. Then, you need to configure a few things from both platforms.

Chargebee Account

For your Chargebee account, you should have the following ready:

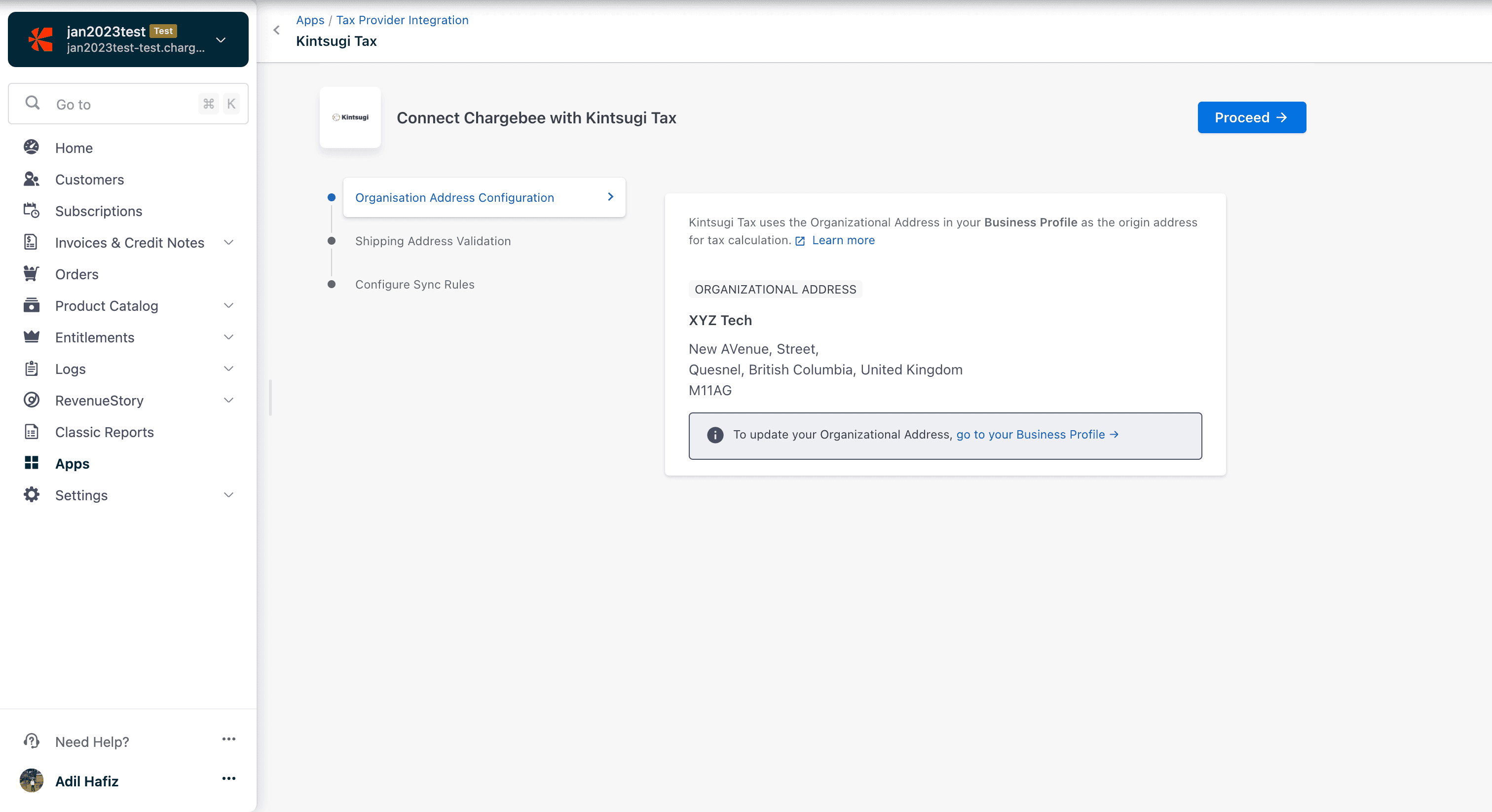

Organization Address: Kintsugi uses the organization address as the origin address for tax calculations. Make sure that the address is up to date. You can find that by navigating Settings > Configure Chargebee > Business Profile.

Address for Tax Determination: Chargebee uses the customer’s shipping address to calculate taxes for physical goods. If the shipping address is unavailable, the billing address is used, which is the same information used for calculating taxes for digital goods.

When using a Hosted Page, you can do the setup by doing the following:

Navigate to Settings > Configure Chargebee > Checkout & Portal > Fields.

Enable the Shipping/Billing Address fields.

Mark the Zip Code, Country and State fields as mandatory.

A Kintsugi Account

Sign up and set up your Kintsugi account. If you need help, you can check the Kintsugi User Guide.

Adjust your Settings: Configure your Tax Rates and Jurisdiction to capture what you want to tax.

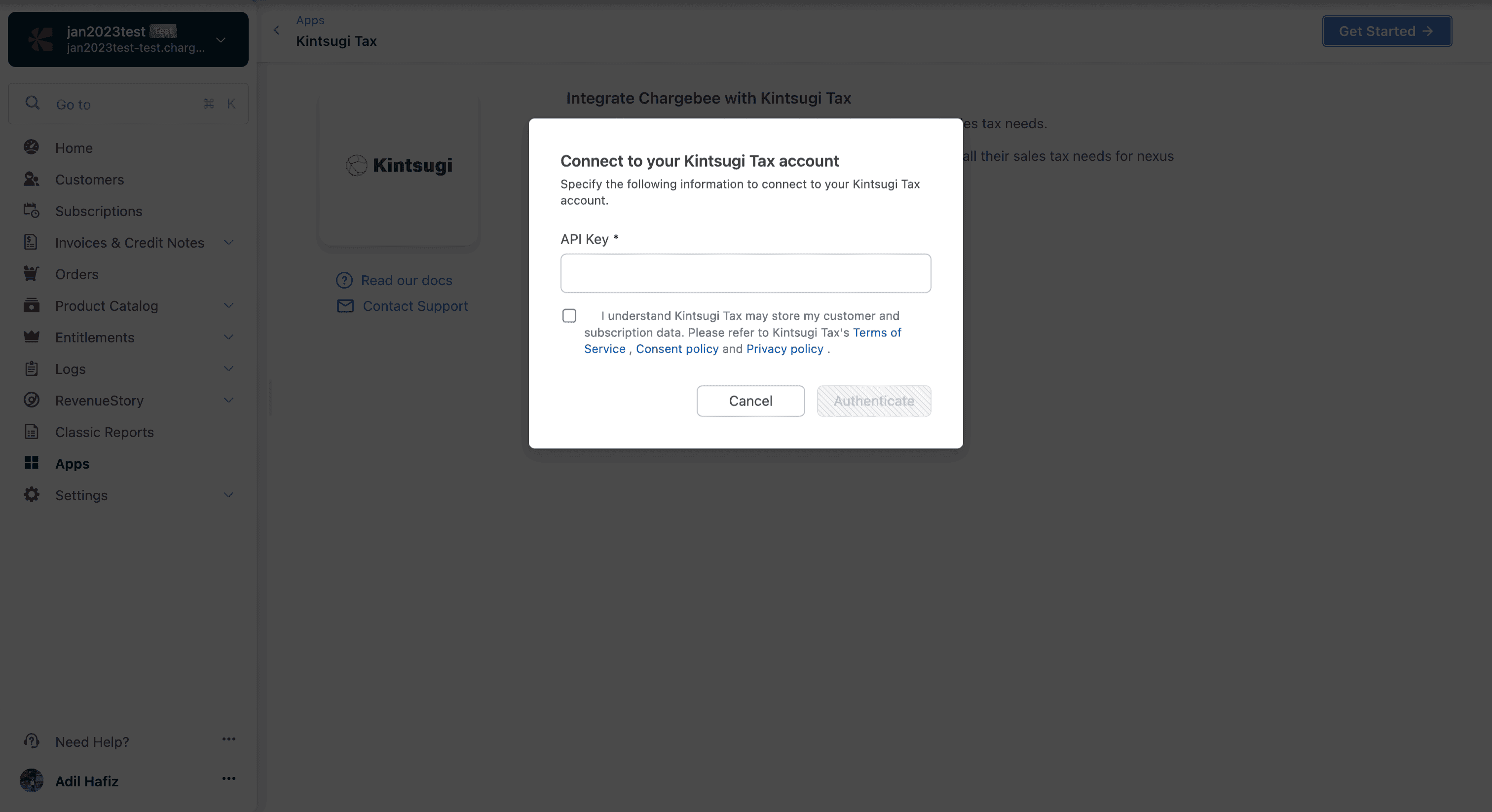

Set up Your API Keys: Retrieve your API keys, which will be needed for the integration process. To do this, log in to Kintsugi and navigate to Profile > Account > Organization API Keys.

Step-by-Step Integration Guide for Kintsugi and Chargebee

Here's the configuration to connect your Chargebee and Kintsugi accounts.

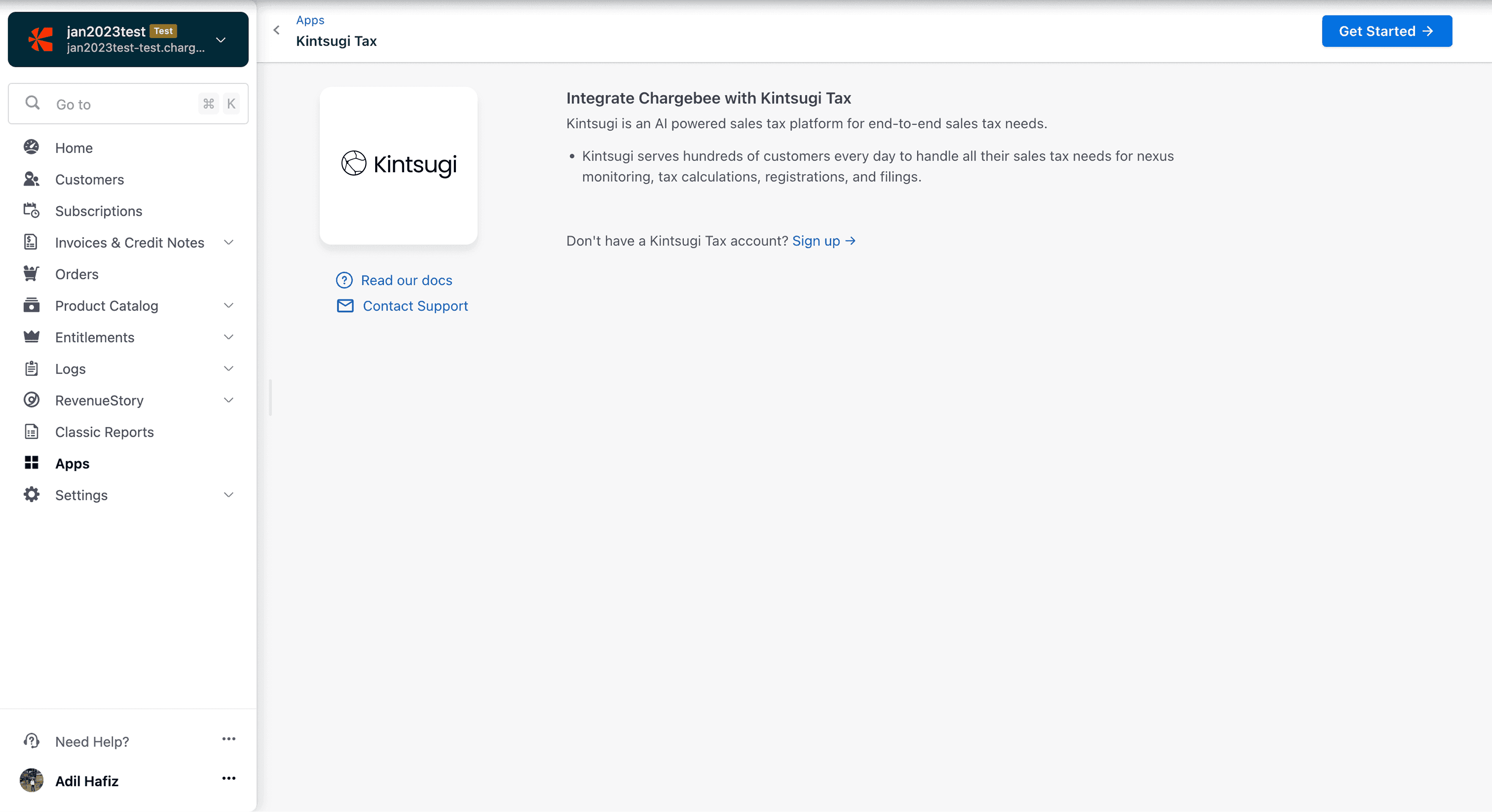

Log in to the Chargebee site and navigate Apps > Go to Marketplace > Tax Management > Kintsugi Tax.

On the Kintsugi Tax configuration page, click Get Started if you already have a Kintsugi account. Otherwise, click Sign up to create a new account and continue.

Enter your Kintsugi credentials by specifying the Kintsugi API Key. Click the "I understand Kintsugi…" checkbox for affirmation and click Authenticate.

Enter or confirm your organization address. Chargebee auto-populates the address specified in your settings; you can change this if necessary or click Proceed.

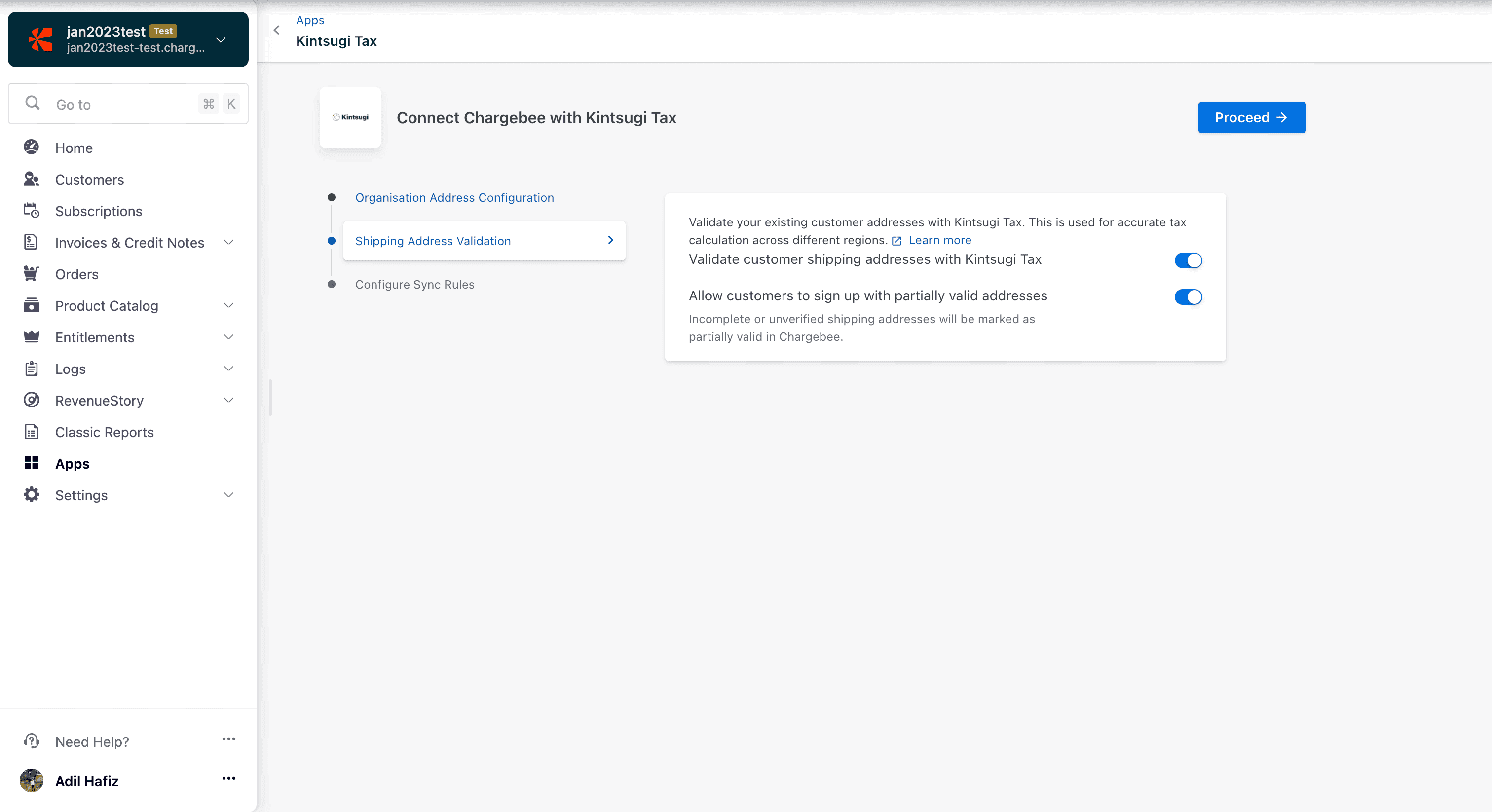

In Shipping Address Validation, enable the toggles and click Proceed. You can update your toggle choices later if necessary.

Note: After you have completed this integration process, you can run address validation checks when required. After enabling Kintsugi, the Chargebee-Kintsugi integration validates the taxable address for all new customers who subscribe to you. All the existing subscriptions' taxable addresses get validated during the first validation check run after the integration is configured.

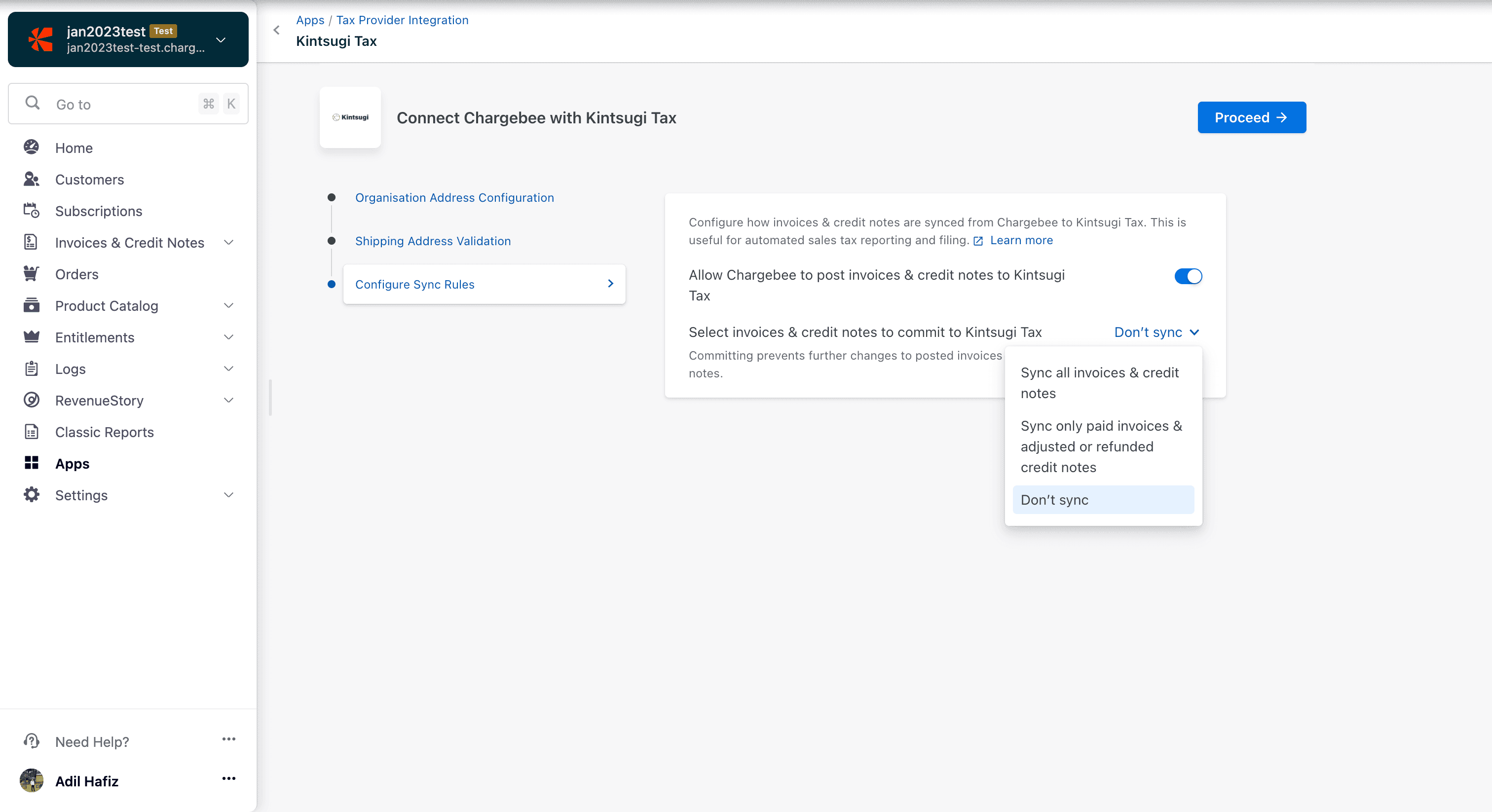

6. In Configure Sync Rules, enable the toggle button to allow Chargebee to sync invoices and credit notes to Kintsugi. Then, select Sync all invoices & credit notes from the dropdown below. Now, click Proceed. You can update your toggle choices later if necessary.

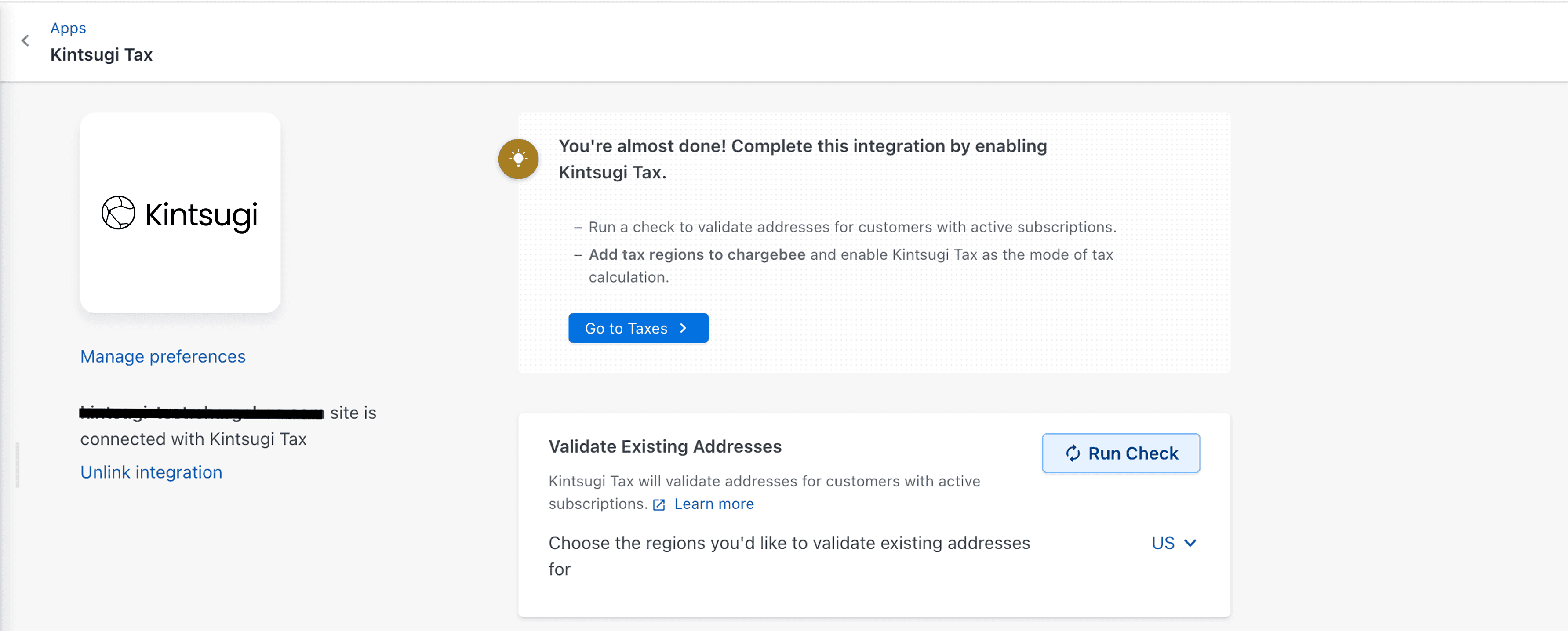

7. Click Go to Taxes to add tax regions to Chargebee.

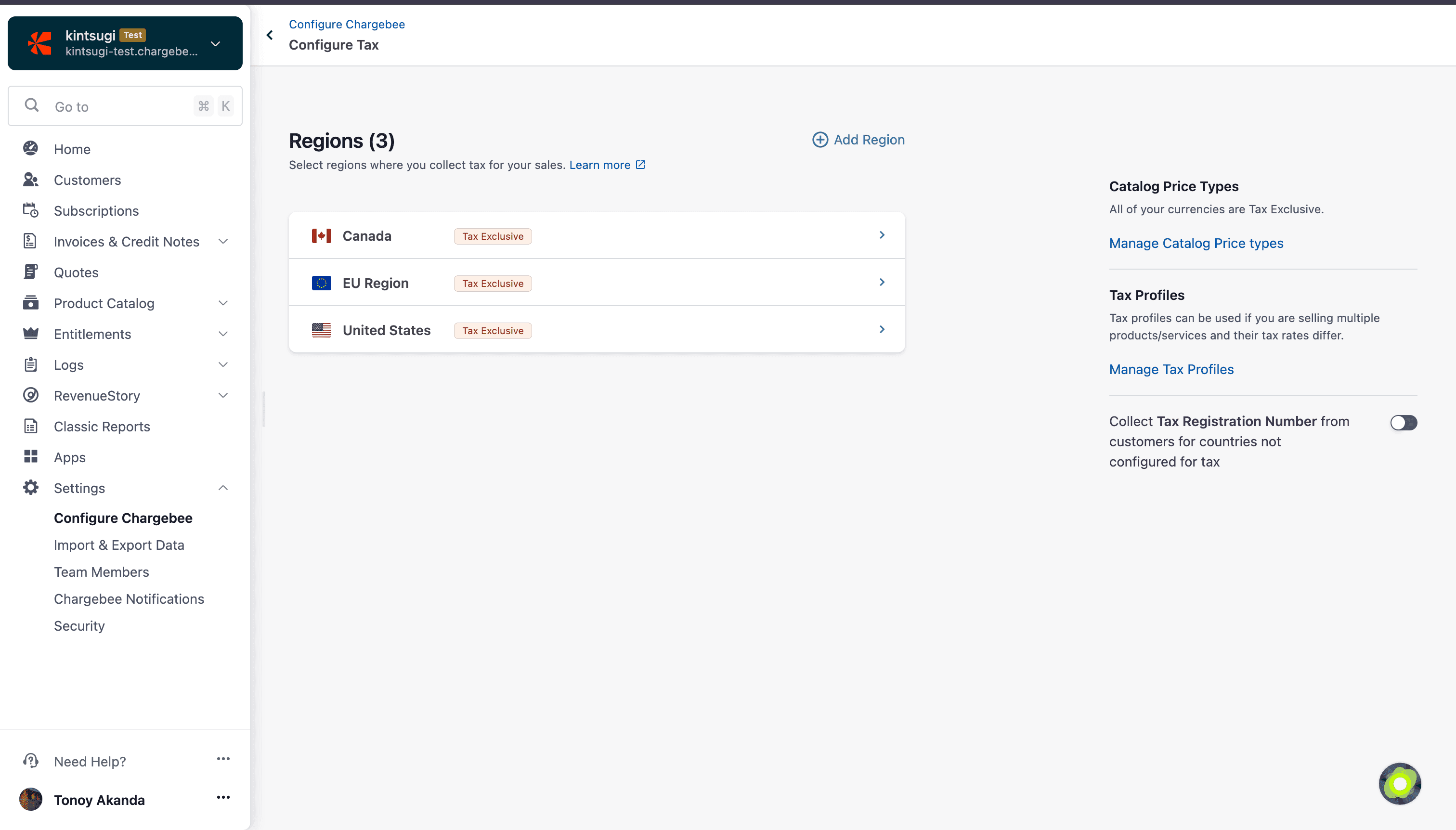

8. Select a region to enable Kintsugi's tax calculation for that location.

Note: Kintsugi currently supports automated tax calculation for the United States Canada, and Europe.

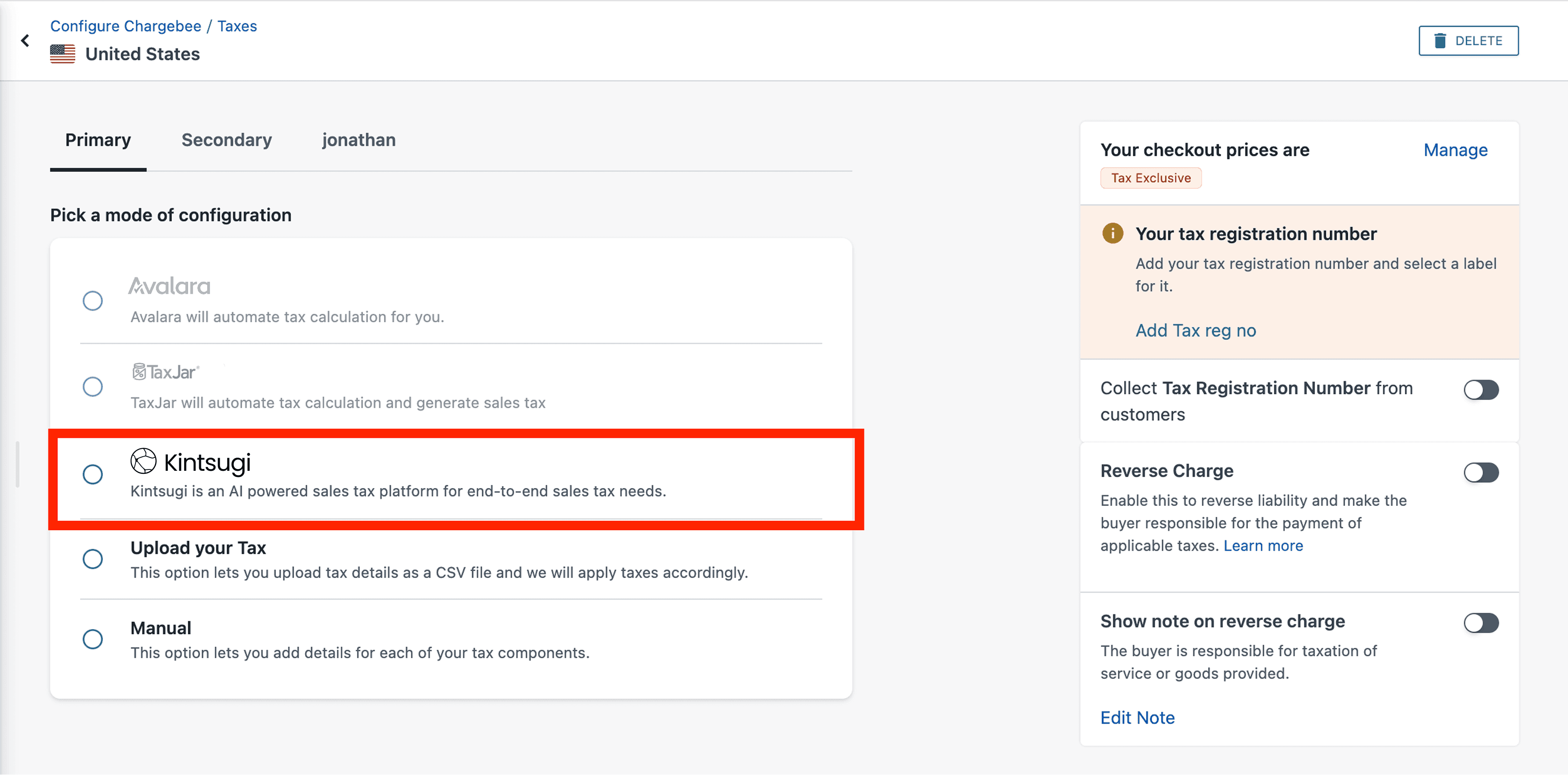

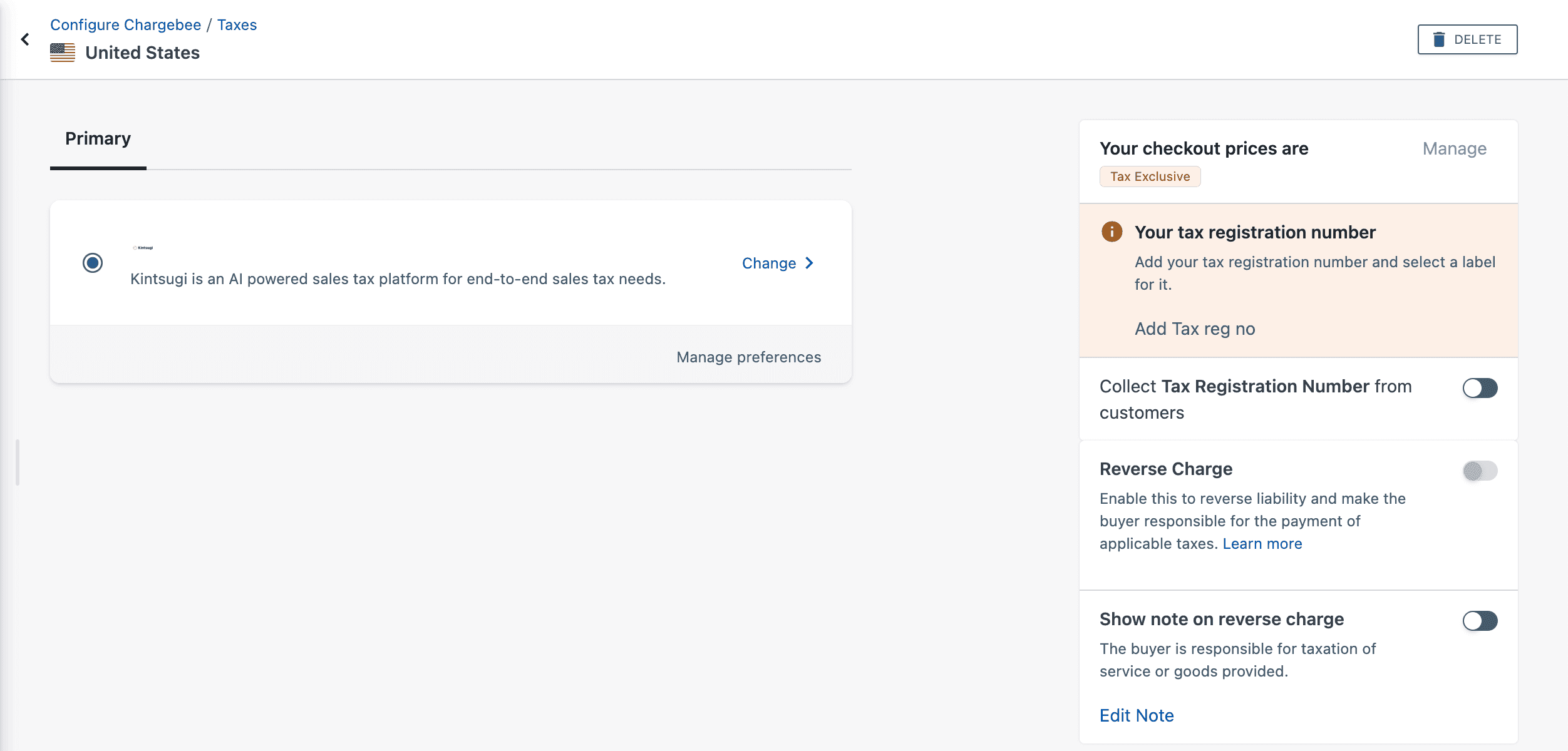

9. Choose Kintsugi from the list of available modes of configuration.

10. That's it. You've successfully integrated your Kintsugi account with your Chargebee site. Congratulations!

If you want to learn more about how to validate addresses and sync product catalogs to Kintsugi, you can check this page.

Unlinking the Integration

To unlink the Kintsugi integration from your Chargebee site, navigate to Apps > Apps Connected > Kintsugi > and click Unlink integration.

Integrate Chargebee with Kintsugi Today!

Integrating Chargebee and Kintsugi is as easy as pie. You don't need a developer, thanks to Kintsugi’s no-code integration. Just prepare your Chargebee and Kintsugi accounts for a seamless integration experience.

Kintsugi customers find our onboarding and integration process easy and painless. Our responsive and knowledgeable customer support is also available if you need assistance. By implementing the Chargebee and Kintsugi integration, you will experience more streamlined business operations just like what Stripe customers and Shopify merchants experience after doing the same.