When it comes to understanding which states don’t have sales tax, one must actually understand the regional tax policies and their impact on businesses and consumers. Only a handful of states stand out as entirely sales tax-free, presenting unique opportunities and challenges. Let’s take a closer look at these states and what their policies mean for the broader economic landscape.

The States Without Sales Tax

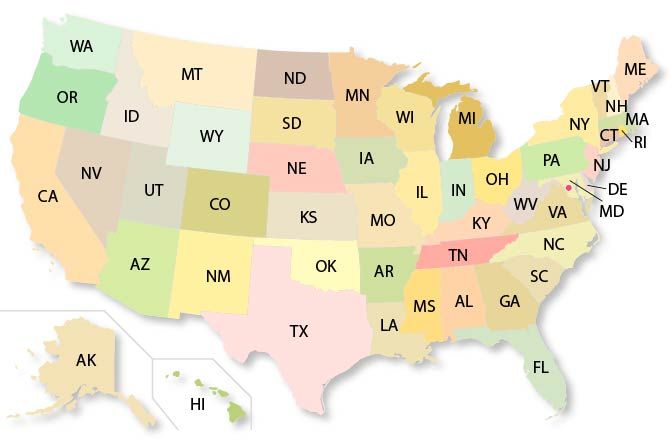

At present, Alaska, Delaware, Montana, New Hampshire, and Oregon do not impose a statewide sales tax. This sets them apart from the majority of U.S. states and creates a distinctive tax environment for businesses and residents. However, understanding the nuances—such as local sales taxes and use tax obligations—is crucial to fully grasping their tax frameworks.

These states often rely on other forms of revenue, such as property taxes, gross receipts taxes, use taxes, or excise taxes, to fund public services and infrastructure. Each state’s unique tax strategy influences its economic environment, affecting businesses and residents' decisions. By examining their policies, you can better understand how these states maintain fiscal balance without imposing a statewide sales tax. Many resources are available to help you learn more about tax policies in these states. For example, Kintsugi’s sales tax by state guide has in-depth explanations on sales tax in states without sales tax.

Alaska: Local Tax Exceptions

While Alaska doesn’t have a statewide sales tax, local jurisdictions often impose their own local sales tax. For example, some municipalities levy sales taxes, creating a patchwork of local obligations. In contrast, areas like Anchorage are entirely tax-free, diversifying the tax landscape and causing businesses to stay vigilant about local regulations. The absence of a state sales tax in Alaska is balanced by these local sales levies, which help municipalities generate revenue.

Alaska’s tax framework presents both opportunities and challenges. Businesses operating in tax-free zones benefit from lower operational costs, enabling competitive pricing strategies. However, companies must also consider the administrative difficulties of tracking and complying with various local sales tax and use tax rates. The absence of a statewide sales tax reduces overall costs for consumers, but local taxes can still affect pricing depending on the municipality. Alaska's property taxes and excise taxes play a significant role in funding their local governments and maintaining statewide services.

Delaware: A True Sales Tax-Free Model

Delaware’s lack of sales tax applies uniformly across the state, positioning it as a haven for tax-conscious shoppers and businesses. With no state sales tax or use tax Delaware appeals to companies aiming to minimize administrative overhead with compliance. Its approach underscores the benefits of a straightforward state tax policy. According to the Tax Foundation, Delaware’s reliance on the gross receipts tax and other revenue streams compensates for the absence of sales tax. Businesses looking to understand their tax liability should explore tools like Kintsugi Intelligence to better understand their compliance needs.

Delaware’s model offers significant business advantages, particularly for retailers and e-commerce platforms. Companies save time and resources without the need to calculate or remit sales tax or use tax, focusing instead on growth and customer experience. Shoppers in Delaware enjoy lower prices, particularly on big-ticket items, driving a steady influx of out-of-state consumers. This tax-free environment also boosts real estate and business investment as companies look to capitalize on the state’s attractive tax policies. Corporate income tax, however, still plays a crucial role in funding statewide initiatives.

Montana: Revenue Without Sales Tax

Montana’s absence of a statewide sales tax is complemented by its reliance on property taxes and other forms of revenue. Businesses operating in Montana benefit from reduced compliance requirements, while consumers enjoy tax-free purchases. The state’s low population density further alleviates potential strain on public services, helping to sustain its no-sales-tax model. While Montana has no state sales tax, the government uses alternative tax mechanisms, including excise taxes and gross receipts tax, to maintain its revenue.

Montana’s approach fosters a business-friendly environment, particularly for industries such as tourism and retail. Tourists flock to Montana for its natural beauty and tax-free shopping opportunities, adding significant revenue opportunities to local economies. For businesses, the simplicity of operating without sales tax fosters innovation and growth. However, Montana’s reliance on other taxes, such as property tax and individual income taxes, highlights the need for a balanced fiscal strategy to support public services without a sales tax base.

New Hampshire: A Tax-Free State

New Hampshire’s no-sales-tax policy reinforces its business-friendly reputation. The absence of both state and local sales taxes simplifies transactions, enabling businesses to operate with minimal tax-related complexity. The policy translates to greater purchasing power and less administrative hassle for residents. Additionally, New Hampshire compensates for the lack of sales tax with relatively higher property tax rates and levies. According to the Tax Foundation, New Hampshire’s balanced tax strategy supports its economy while maintaining its tax-free shopping appeal. If you plan to visit New Hampshire, you must look at Kintsugi’s New Hampshire tax guide before booking.

For businesses, New Hampshire’s tax structure reduces overhead, encouraging investment and entrepreneurship. The state’s focus on property taxes ensures that local governments have a steady revenue stream while maintaining the appeal of a no sales tax state. Consumers benefit significantly from this system, particularly high-value goods like electronics and furniture. This unique tax environment positions New Hampshire as a model for balancing consumer-friendly policies with effective revenue generation. Additionally, its proximity to other Northeastern states with sales taxes further enhances its attractiveness as a shopping destination.

Tennessee: Unique Sales Tax Dynamics

Tennessee is not a sales tax-free state, but it is worth noting for its absence of state income tax. Instead, the state relies heavily on sales tax and excise taxes to generate revenue. With one of the nation's highest statewide sales tax rates, Tennessee balances its tax burden by avoiding personal income tax. This approach makes Tennessee attractive to residents seeking to avoid state income taxes while local governments benefit from robust sales tax collections. Businesses operating in Tennessee must carefully manage compliance with statewide and local tax regulations.

Oregon: A Consumer-Driven Approach to Tax Rates

Oregon’s tax-free status attracts shoppers from neighboring states, boosting local economies without relying on sales tax revenue. While the state compensates through higher income tax rates, the lack of sales tax provides a seamless purchasing experience for consumers. Businesses in Oregon benefit from the simplicity of operating in a tax-free retail environment. Local jurisdictions in Oregon do not impose sales tax either, making it one of the most consumer-friendly states in terms of taxation.

Oregon’s approach drives cross-border shopping, particularly from residents of neighboring states like Washington and Idaho. Retailers in Oregon enjoy a competitive edge, leveraging the state’s tax-free reputation to attract consumers. However, the reliance on income tax necessitates efficient fiscal management to sustain public services. Businesses and policymakers must navigate these dynamics carefully to ensure economic stability while maintaining Oregon’s tax-free appeal. The lack of sales tax also simplifies compliance for businesses, enabling them to allocate resources to strategic initiatives rather than administrative tasks.

What This Means for Businesses and Consumers in American Tax Free States

Operating in sales tax-free states offers businesses the advantage of reduced compliance burdens. Companies can streamline their operations and focus on growth without navigating complex tax systems. Consumers benefit from lower costs, especially on high-value items, often with significant tax savings in these states. For example, businesses in South Dakota and other states with streamlined tax policies may face fewer administrative hurdles compared to states with more complex tax codes. To streamline their sales tax compliance, we suggest businesses use an automation platform like Kintsugi to simplify compliance and maximize efficiency.

However, businesses should remain aware of local sales taxes, particularly in Alaska, and be mindful of sales tax nexus rules when selling across state lines. For instance, a business in Oregon may still be required to collect sales tax in states where it has a nexus. For consumers, the benefits of shopping in sales tax-free states extend beyond cost savings. The simplicity of tax-free transactions enhances the overall shopping experience, fostering customer loyalty and satisfaction. However, shoppers should be aware of additional taxes, such as property or income taxes, that may offset the absence of sales tax in certain states.

The Nexus Challenge with States Without Sales Tax

Sales tax nexus rules add an extra layer of consideration for businesses operating in tax-free states. Even if a company is based in New Hampshire, it may need to collect sales tax in states where it meets nexus thresholds, such as exceeding a certain revenue amount or transaction count. Staying compliant in these scenarios is essential to avoid penalties. For instance, states like South Dakota have established clear nexus thresholds, ensuring that out-of-state businesses contribute to tax revenue when necessary.

Nexus compliance is particularly crucial for e-commerce businesses operating across multiple jurisdictions. Leveraging sales tax automation tools like Kintsugi can help businesses track and manage their nexus obligations effectively. This proactive approach reduces non compliance risk and ensures seamless operations across state lines.

Thrive in Tax Free States with Kintsugi

The five sales tax-free states—Alaska, Delaware, Montana, New Hampshire, and Oregon—offer distinct advantages for both businesses and consumers. From streamlined compliance to tax savings, these states provide an appealing alternative to traditional sales tax structures. However, nuances like local sales taxes and nexus rules require careful attention.

For businesses navigating the complexities of multi-state operations, tools like Kintsugi’s tax automation platform simplify compliance and provide clarity across jurisdictions. Understanding the broader implications of sales tax policies empowers businesses and consumers to make informed decisions in a dynamic economic landscape. By staying informed about tax rates and state tax policies, businesses can leverage these insights to optimize their strategies and thrive in a competitive environment.