The start of a new year means new opportunities…and new sales tax obligations.

With over 400 rate changes already taking effect across the country, 2026 isn't wasting any time throwing compliance curveballs at growing businesses. Illinois just eliminated its 200-transaction threshold, and local rates have shifted in a couple dozen states, all in the first week of the year.

For finance teams at scaling SaaS and ecommerce companies, staying compliant isn't about reacting to every change as it happens. It's about building systems that handle the complexity automatically — so you can focus on growth instead of chasing down filing deadlines.

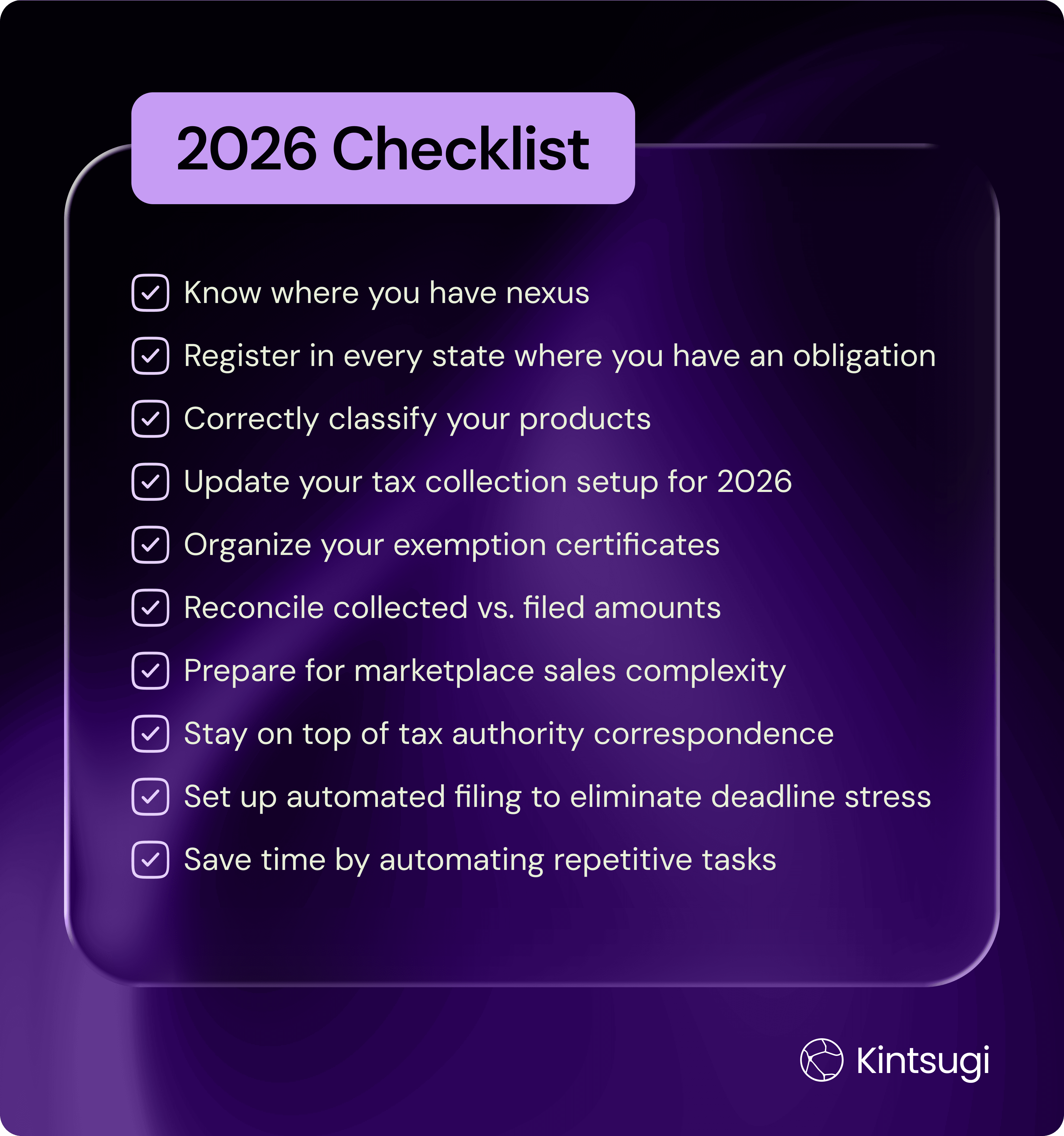

Here's your checklist for getting sales tax compliance right in 2026.

1. Know Where You Have (or Will Have) Nexus

Economic nexus isn't a one-time calculation. It's a moving target. Most states use a $100,000 sales threshold, but your business doesn't stop growing just because you crossed into a new state last quarter.

Your to-do list:

Review your 2025 sales data state-by-state to identify where you triggered nexus.

Check if you have physical nexus from offices, employees, warehouses, or even remote workers in new locations.

Set up real-time nexus monitoring so you're alerted the moment you cross a threshold in a new jurisdiction.

2. Register in Every State Where You Have an Obligation

Hitting a nexus threshold creates an obligation. Missing that obligation creates liability. Once you know where you need to collect tax, the next step is registration. Every state has different requirements. Sales tax automation platforms simplify nexus tracking and registration, but if you’re doing it manually, prepare to set aside a good amount of time.

Your to-do list:

Prioritize states where you crossed nexus thresholds in late 2025 but haven't registered yet.

Confirm that your existing registrations are still active and your business information is current.

Consider one-click registration tools that handle the paperwork automatically when you hit a new threshold.

3. Classify Your Products Correctly

Not all products are taxed the same way. With states continuing to update taxability rules for digital products and services, accurate classification matters more than ever.

Your to-do list:

Update classifications for any new products or services launched in 2025.

Review your product catalog and confirm each item is classified correctly for tax purposes.

Pay special attention to digital products, SaaS offerings, and subscription services — these are where rules change most frequently.

4. Update Your Tax Collection Setup for 2026 Changes

Tax rates don't stand still. With 400+ rate changes in January alone, the rates you collected last month might already be outdated.

Your to-do list:

Verify that your ecommerce platform, billing system, or payment processor is applying current 2026 tax rates.

Update tax settings for any new sales channels you added in 2025.

Test your checkout flow to confirm taxes are calculated correctly for different product types and customer locations.

5. Organize Your Exemption Certificates

If you sell B2B, exemption certificates are your documentation that certain customers don't owe sales tax. But here's the problem: certificates expire, rules change, and incomplete certificates don't hold up in audits. If you can't produce a valid certificate during an audit, you're liable for the uncollected tax — plus penalties and interest.

Your to-do list:

Review all exemption certificates from 2025 and confirm they're complete and valid.

Identify any certificates that expired or will expire in 2026.

Set up a system to automatically request renewals before certificates lapse.

6. Reconcile What You Collected vs. What You Filed

Timing differences, refunds, credits, and marketplace facilitator sales all create reconciliation challenges. Discrepancies between what you collected and what you reported create audit risk and potential back tax exposure.

Your to-do list:

Pull your 2025 sales data showing tax collected by state.

Compare this to the amounts you reported on filed returns.

Investigate and resolve any discrepancies before they become audit issues.

7. Prepare for Marketplace Sales Complexity

If you sell on Amazon, Etsy, eBay, or other marketplaces, those platforms collect and remit tax on marketplace-facilitated sales. Great! Except you're still responsible for sales through your own site, other channels, and filing returns in states where the marketplace collects on your behalf.

Your to-do list:

Separate your marketplace-facilitated sales from direct sales in your reporting.

Confirm which states require zero-dollar returns when marketplaces handle all your collections.

Track your direct sales separately to ensure you're collecting and remitting correctly outside of marketplace channels.

8. Stay on Top of Correspondence from Tax Authorities

Tax authorities send notices: Registration confirmations, filing reminders, audit requests, and more.

Your to-do list:

Consolidate all physical and electronic tax authority mail into a single system.

Review incoming notices promptly and respond to any requests for information.

Track renewal dates for registrations and permits that require periodic updates.

9. Set Up Automated Filing to Eliminate Deadline Stress

If you're collecting tax in 15 states, you could have 15+ filing obligations every month or quarter — each with different due dates, different forms, and different reporting requirements. Miss one deadline, and you're looking at late fees and penalties that eat into your margins.

Your to-do list:

Create a 2026 filing calendar with every due date for every jurisdiction where you're registered.

Confirm you have login credentials and multi-factor authentication set up for every state portal.

Enable automated filing and remittance to eliminate the manual work and missed-deadline risk.

10. Build In Time Savings by Automating the Repetitive Stuff

Let's be honest: sales tax compliance doesn't drive revenue. It doesn't improve your product. It doesn't delight customers. But it's legally required, and mistakes are expensive.

The question isn't whether to handle compliance — it's how much time you want to spend on it. Manual processes consume 10+ hours per month across nexus tracking, product classification, filing preparation, and reconciliation. That's time your team could spend on strategic work instead of administrative tasks.

Your to-do list:

Audit how much time your team currently spends on sales tax tasks each month.

Identify which tasks are repetitive and could be automated.

Implement tools that handle the manual work automatically — freeing your team to focus on growth.

Why 2026 Compliance Matters More Than Ever

With 400+ rate changes, shifting nexus rules, and states getting more aggressive about enforcement, the compliance bar keeps rising. Finance teams can't afford to treat sales tax as an afterthought anymore.

But here's the good news: the right systems make complexity manageable. Real-time monitoring catches nexus immediately. AI handles product classification so you don't need a tax attorney on speed dial. Automated filing means deadlines don't keep you up at night. And transparent pricing with no hidden fees means you can budget confidently.

Sales tax doesn't have to be a bottleneck to growth. With the right approach and the right tools it becomes something that just works. Quietly. Accurately. Automatically.

Ready to check sales tax compliance off your 2026 to-do list? See how Kintsugi handles nexus monitoring, product classification, registration, filing, and reconciliation automatically — so you can focus on scaling your business instead of managing spreadsheets.