November 4, 2024

Simplify Compliance: Top Ecommerce Sales Tax Software Solutions in 2025

Table of contents

In today’s rapidly expanding ecommerce landscape, navigating sales tax compliance has become increasingly complex. From understanding changing tax laws and ensuring accuracy in every transaction to managing scalability as your business grows, the right ecommerce sales tax software can make all the difference.

By leveraging automation, integrations with your existing tools, and robust tax engines, you can simplify the process of tracking tax rates, filing returns, and keeping pace with evolving regulations. Choosing the ideal platform not only improves efficiency but also helps you remain confident in your compliance posture as you focus on growth and customer satisfaction.

Below, we’ve highlighted top ecommerce sales tax software solutions that cater to various business models, from startups to large enterprises, no matter what your sales channels are. Each of these platforms—including well-known names like Avalara and TaxJar—addresses distinct needs, ensuring you find the right fit. We’ve included key details about integration options, pricing structures, and how to get started with each tool. By selecting a tax engine with strong ecommerce capabilities, you can streamline sales tax compliance, maintain accuracy in determining tax rates, and keep up with tax laws, no matter where you sell.

Kintsugi

Kintsugi is a modern ecommerce sales tax software tool designed to support B2B SaaS and ecommerce merchants. It employs a powerful tax engine to automate calculations, handle filings, and keep pace with shifting tax laws. With Kintsugi’s approach, you can scale effortlessly as you enter new markets, ensuring both accuracy and ease of compliance.

Ideal for: Growth-focused businesses seeking flexibility and automation-first functionality.

Integrations: Kintsugi offers seamless integrations with leading ecommerce platforms and billing systems like Shopify, BigCommece, Amazon, Stripe, QuickBooks , Chargebee and more.

Pricing: Its pricing often scales with transaction volume, making it suitable for businesses of all sizes. Kintsugi offers flexible pricing plans with no annual commitments. Check out Kintsugi plans and pricing.

Getting Started: To begin, you can sign up for its Free plan for $0 that offers several free features like risk assessment, exposure monitoring, address validations, and sales tax nexus to name a few. You can also book a demo. The Kintsugi onboarding team provides step-by-step guidance, making it easier to achieve and maintain sales tax compliance from day one.

Avalara

Avalara is a renowned provider of ecommerce sales tax software and a robust tax engine designed to manage domestic and international obligations. With coverage spanning multiple jurisdictions, Avalara ensures that your sales tax compliance remains steady even as you expand. It automates calculations, tracks tax rates accurately, and files returns, letting you stay ahead of evolving tax laws. For enhanced accuracy and broad coverage, Avalara stands out as a top choice.

Ideal for: Established businesses seeking a comprehensive compliance suite.

Integrations: Avalara boasts a wide range of integrations with ecommerce platforms, ERPs, and accounting software. It integrates well with its over 1,200 partners, including Stripe, Oracle, WooCommerce, WordPress, Etsy, Sage, Amazon, BigCommerce, Shopify and more.

Pricing: Pricing is typically customized based on transaction volume and complexity.

Getting Started: You can reach out to Avalara by calling them at 877-224-3650 or via chat or form to get started.

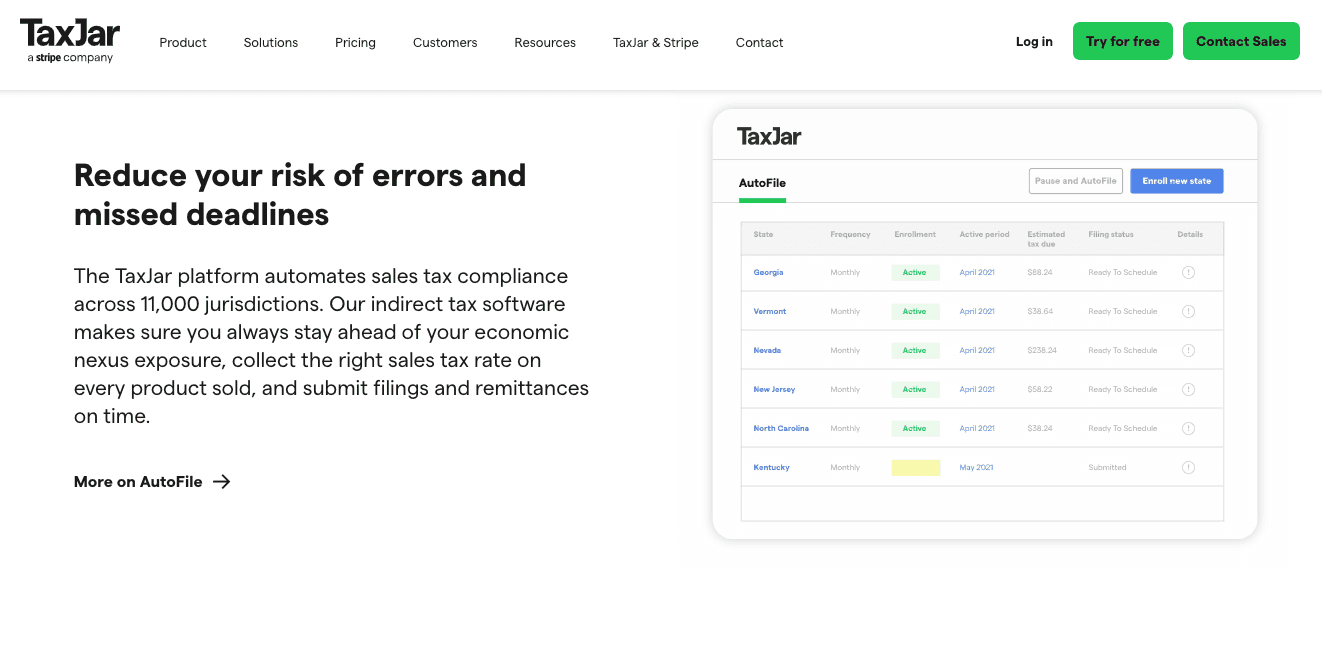

TaxJar

TaxJar, another leading name in ecommerce sales tax software, specializes in simplifying U.S. sales tax compliance. Its intuitive dashboard clarifies what you owe and when, and its tax engine ensures that tax rates are always up-to-date. Ideal for ecommerce businesses focused primarily on domestic markets, TaxJar keeps complexity low and accuracy high. As you grow, TaxJar remains a reliable partner, handling changes in tax laws effortlessly.

Ideal for: Small to mid-sized merchants seeking straightforward U.S.-based compliance. Integrations: TaxJar integrates directly with popular ecommerce platforms like Shopify, Amazon, and WooCommerce.

Pricing: Its tiered pricing is based on monthly order volume, providing predictable costs as you scale.

Get Started: TaxJar offers a free 30-day trial with full access to its Professional plan. TaxJar’s onboarding guides and responsive support ensure a smooth setup.

EB Make taxes predictable—download our survival guide and stop guessing \ Get the Guide \ https://trykintsugi.com/resource/ecom-sales-tax-survival-guide

Quaderno

Quaderno excels at managing global ecommerce by automatically adjusting tax rates for international VAT, GST, and more. Its tax engine keeps pace with shifting tax laws across borders, ensuring sales tax compliance in multiple countries. With Quaderno, scaling your ecommerce presence worldwide becomes more manageable and accurate.

Ideal for: International sellers needing global tax compliance.

Integrations: Quaderno integrates with payment processors like Stripe and PayPal, as well as leading ecommerce carts.

Pricing: Pricing scales with transaction volume and regions served. It has four plans Startup ($49/month), Business ($99/month), Growth ($149/month) and Enterprise for companies with custom needs.

Getting Started: Quaderno offers free trials for seven days for Growth, Business and Startup plans with no credit card required.

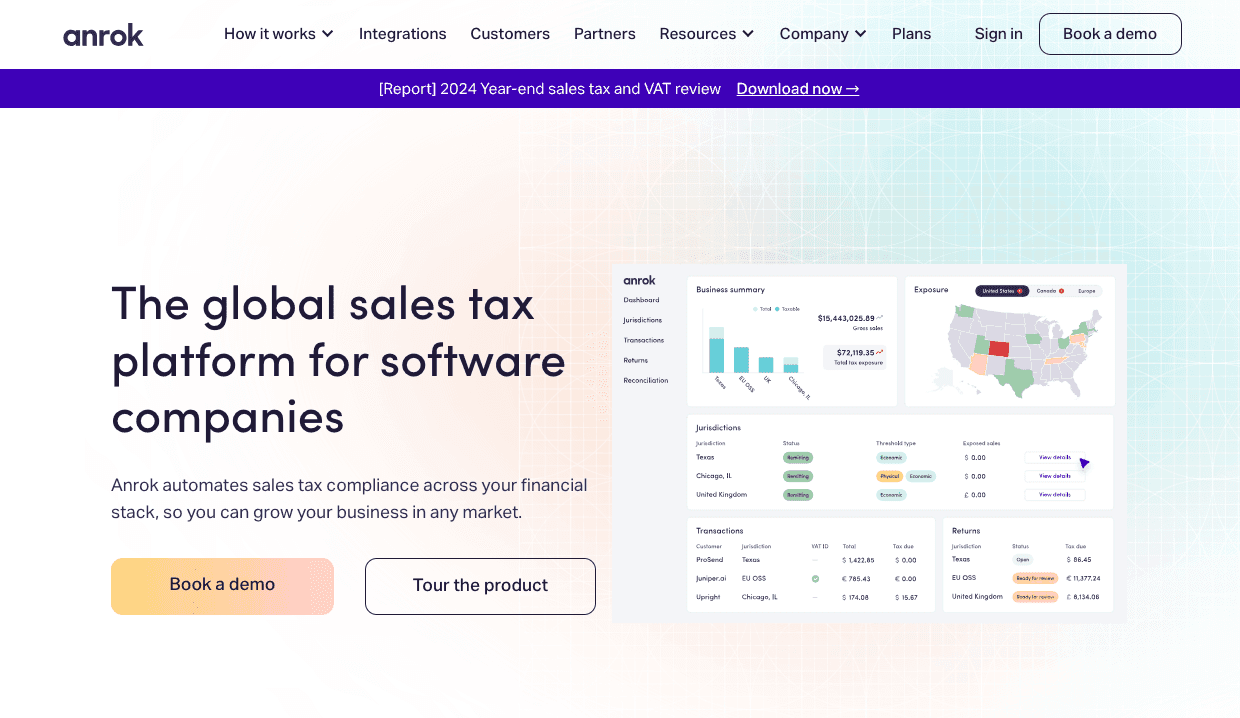

Anrok

Anrok caters to ecommerce companies offering subscription services. Its tax engine integrates seamlessly with billing platforms to ensure accurate tax calculations on recurring charges. With built-in scalability, Anrok helps you maintain continuous sales tax compliance and transparency across every billing cycle.

Ideal for: SaaS and subscription-based businesses with recurring billing.

Integrations: Anrok aligns with subscription billing tools like Stripe Billing and Chargebee.

Pricing: Anrok's pricing reflects billing complexity and supported regions. Anrok has three plans available Starter, Core and Growth. Its plan has flat rates and Anrok charges usage fees and sales tax on top of that.

Getting Started: Anrok encourages potential customers to try the Starter plan for free. You can also book a 30-minute demo with an expert to get a feel of their platform.

Sovos Taxify

Sovos Taxify automates calculations, return filings, and nexus tracking, making it an effective ecommerce sales tax software solution for businesses operating across various states and platforms. It keeps you compliant with evolving tax laws, improving accuracy and reducing risk.

Ideal for: Multi-channel U.S. sellers needing a centralized compliance hub.

Integrations: Taxify integrates with top ecommerce carts and marketplaces like Magento, Microsoft, Oracle NetSuite, QuickBooks, SAP, and Shopify.

Pricing: Pricing is often tiered by the number of returns.

Getting Started: You can reach out to Sovos to get started and an expert will help yo u. They provide clear onboarding resources and support, helping you manage tax rates and maintain sales tax compliance effortlessly.

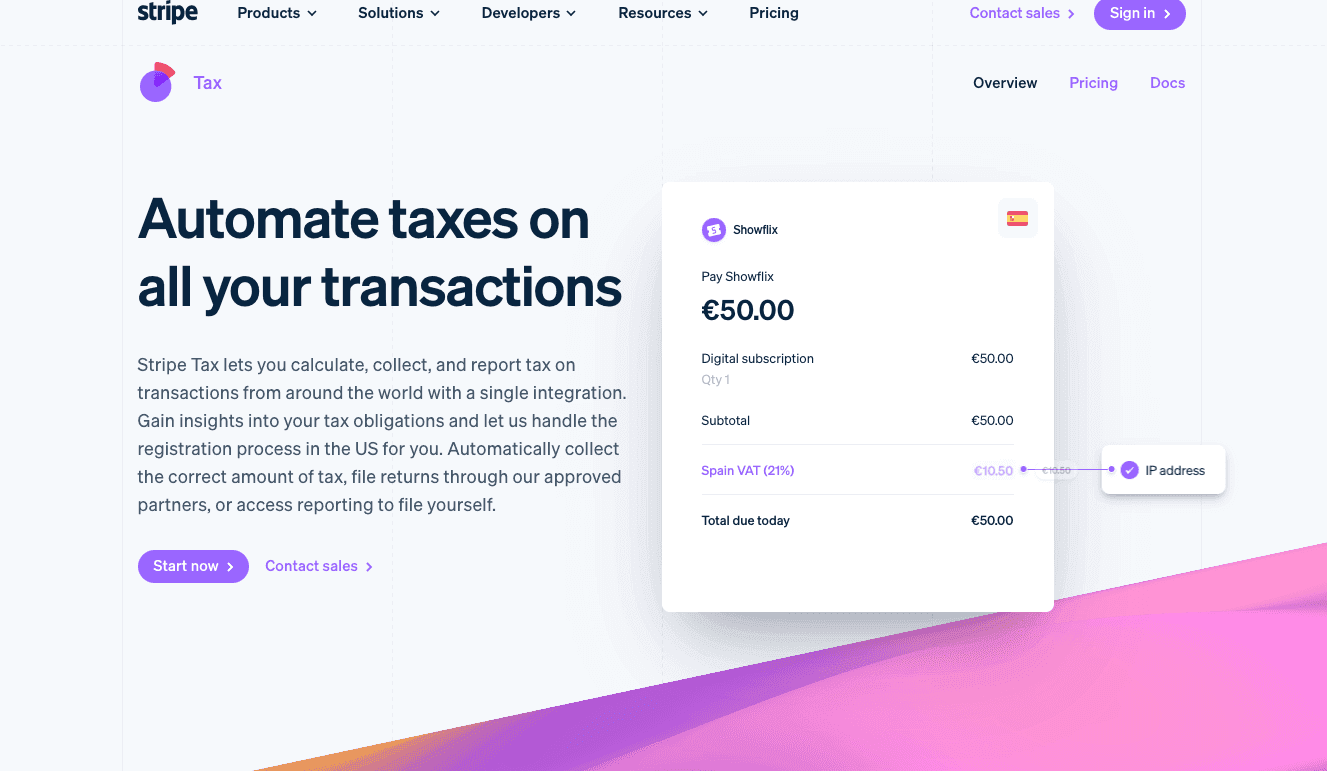

Stripe Tax

Stripe Tax is a built-in tax compliance solution offered directly within the Stripe payment ecosystem. It automatically determines and applies the correct tax rates at the point of checkout, simplifying the process of charging sales tax, VAT, and GST in multiple jurisdictions. By integrating closely with Stripe’s other financial tools, Stripe Tax reduces the complexity of managing tax laws, reporting, and remittances for businesses of all sizes using multiple tools.

Ideal for: Sellers deeply invested in the Stripe ecosystem.

Integrations: Stripe Tax is built into Stripe, making integration seamless for ecommerce merchants already using Stripe’s payment infrastructure.

Pricing: Stripe Tax pricing has PAYG (pay-as-you-go) pricing, which is usage-based and depends on the number of transactions. It also offers subscription-based pricing -- Tier 1 ($90), Tier 2 ($430), Tier 3 ($1000) and Tier 4 ($1,500). Overage fees apply per additional transaction and API call.

Get Started: You can check this document to learn how Stripe Tax works.

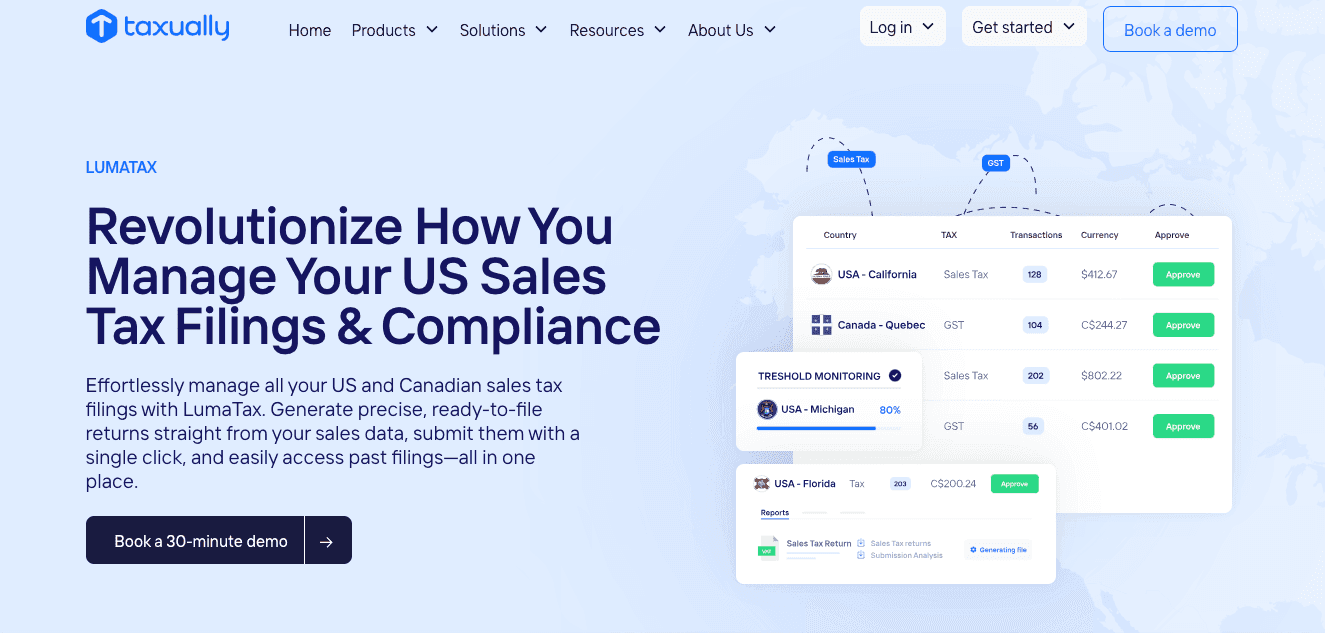

LumaTax

LumaTax, acquired by Taxually in 2023, blends automation with advisory support, giving ecommerce businesses both the technology and human insights needed for sales tax compliance. Its tax engine handles calculations and filings, while experts help you navigate tax laws, ensuring accuracy and building confidence as you grow. LumaTax can manage US and Canadian sales tax.

Ideal for: Small to medium-sized businesses seeking guidance alongside automation.

Integrations: LumaTax integrates with accounting and ecommerce platforms.

Pricing: Pricing correlates with filing complexity and advisory needs.

Get Started: To get started with LumaTax, you can book a 30-minute demo. LumaTax will analyze your business and provide personalized software while giving you a walkthrough to help you understand its sales tax software's benefit.

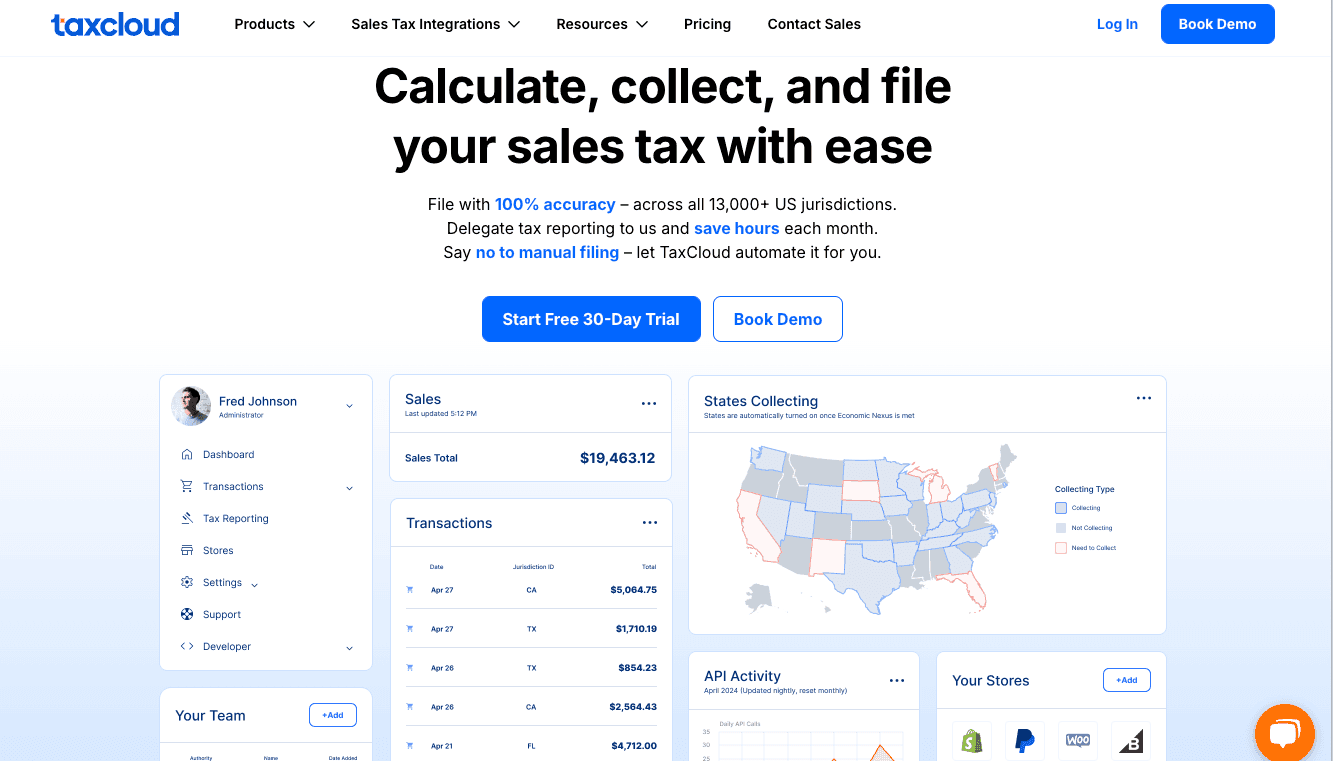

TaxCloud

TaxCloud zeroes in on domestic ecommerce, offering accurate calculations and a straightforward path to compliance. By providing free basic calculations and paid filing options, TaxCloud helps small and medium-sized businesses adapt to evolving tax laws and maintain sales tax compliance without complication.

Ideal for: U.S.-focused merchants looking for straightforward compliance.

Integrations: TaxCloud works with many ecommerce platforms and marketplaces. It integrates with BigCommerce, Shopify, Odoo, QuickBooks, NetSuite, WooCommerce, Stripe, Magento, Amazon and more.

Pricing: TaxCloud offers three plans Free ($0), Starter ($199/year) and Premium ($799/year). For Free plan, while calculations are free, you pay for filing services as needed.

Getting Started: TaxCloud offers a 30-day free trial with no credit card required for the Premium plan. You can sign up for the trial and talk to sales.

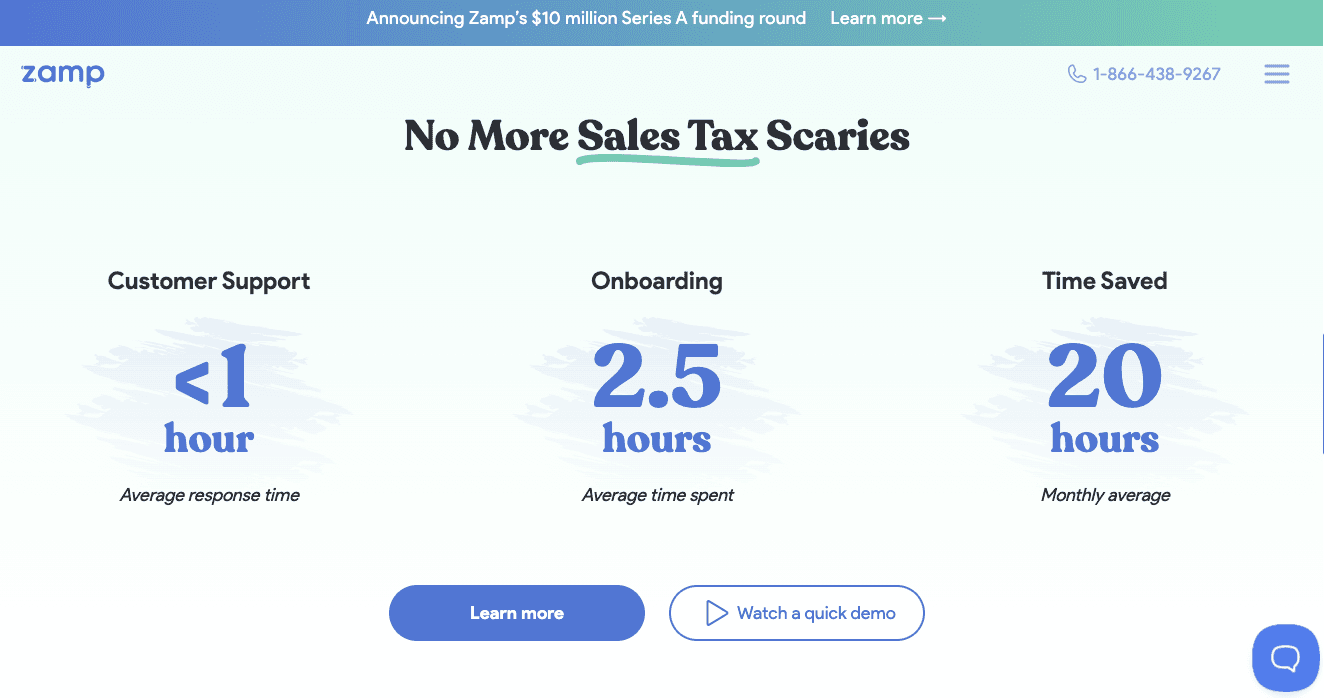

Zamp

Zamp assists ecommerce sellers in navigating multi-state taxes with automated calculations, filing reminders, and reporting.

Some customers who evaluate both Kintsugi and Zamp find Zamp’s shifting pricing and unclear feature tiers frustrating—especially since they have to schedule a call just to get a quote. At the time of writing tihs article, Zamp does not have an approved app that is approved by Shopify on the app store. Zamp also does not offer 1-click integrations to Shopify, Quickbooks that allows to inject correct sales tax to invoices in real-time.

Integrations: Zamp can work with partners like Shopify, Amazon, BigCommerce, Stripe and Intuit. At the time of writing this article, Zamp does not have an official sales tax app on the Shopify app store.

Pricing: Zamp offers tiered pricing with no hidden charges and surprise fees.

Get Started: To get started with Zamp, you can call them at 1-866-438-9267 or book a 30-minute call.

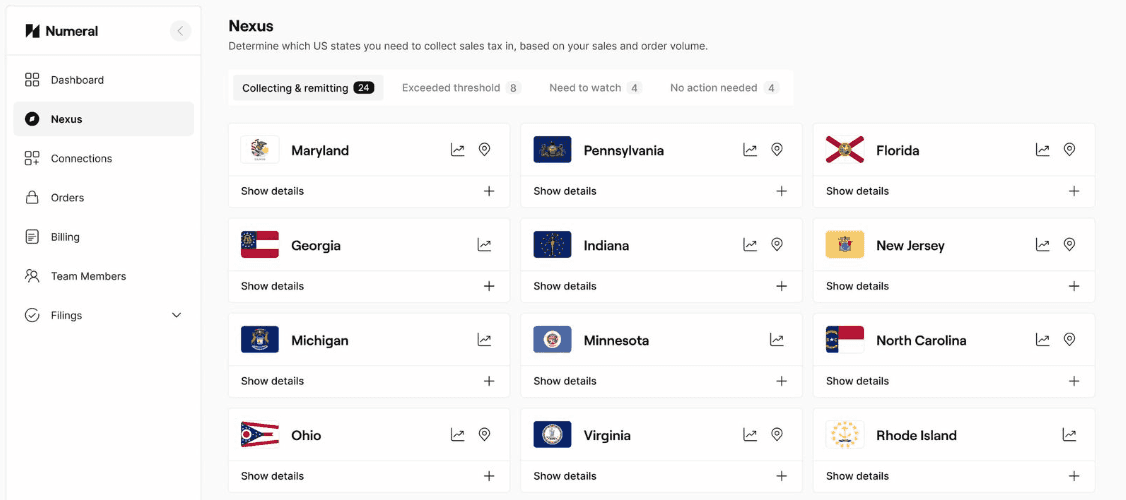

Numeral

Numeral provides clear, data-rich visibility into tax liabilities, allowing ecommerce businesses to make informed decisions. Its tax engine automates calculations and returns, enabling you to maintain sales tax compliance effortlessly while refining your strategies with accurate insights.

Ideal for: Data-driven merchants looking for enhanced reporting and insights

Integrations: Numeral integrates easily with ecommerce platforms and payment solutions.

Pricing: Numeral's pricing is straightforward. It charges a flat fee per filing for each state at $75. It also charges a one-time registration fee for each state at $150.

Get Started: To get started with Numeral, you can sign up or book a demo with their sales tax experts

Final Thoughts

In an evolving ecommerce environment, selecting the right ecommerce sales tax software is crucial to remaining compliant and efficient. From established giants like Avalara and TaxJar—both recognized for their accuracy and global coverage—to specialized solutions tailored to SaaS models or digital goods, there’s a tax engine designed for every need. By focusing on integrations, understanding pricing models, and leveraging platforms built for scalability, you can streamline sales tax compliance and maintain the accuracy you need.

With the right ecommerce sales tax software in place, you’ll be well-equipped to meet changing tax laws and handle shifting tax rates, all while keeping your sights on innovation and growth. And as you fine-tune your approach, remember that Avalara, TaxJar, Kintsugi and the rest of the tools mentioned above are there to support your ecommerce journey to meet the demands of today’s dynamic marketplace.