Starting today, Kintsugi supports Canadian Goods and Services (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST). After successfully automating U.S. sales tax compliance for more than 1,100 businesses, this marks another significant milestone in our mission to automate tax compliance globally.

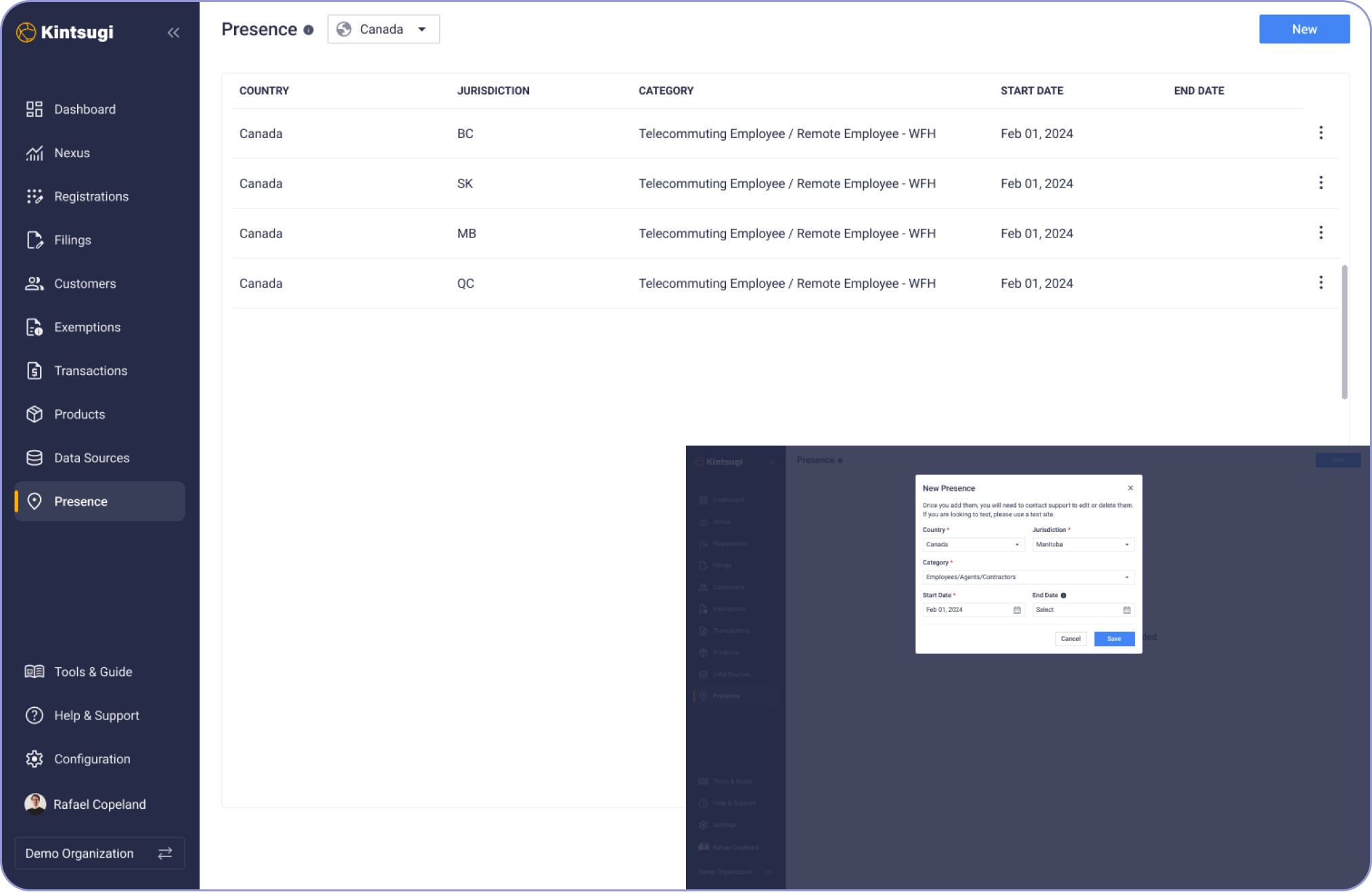

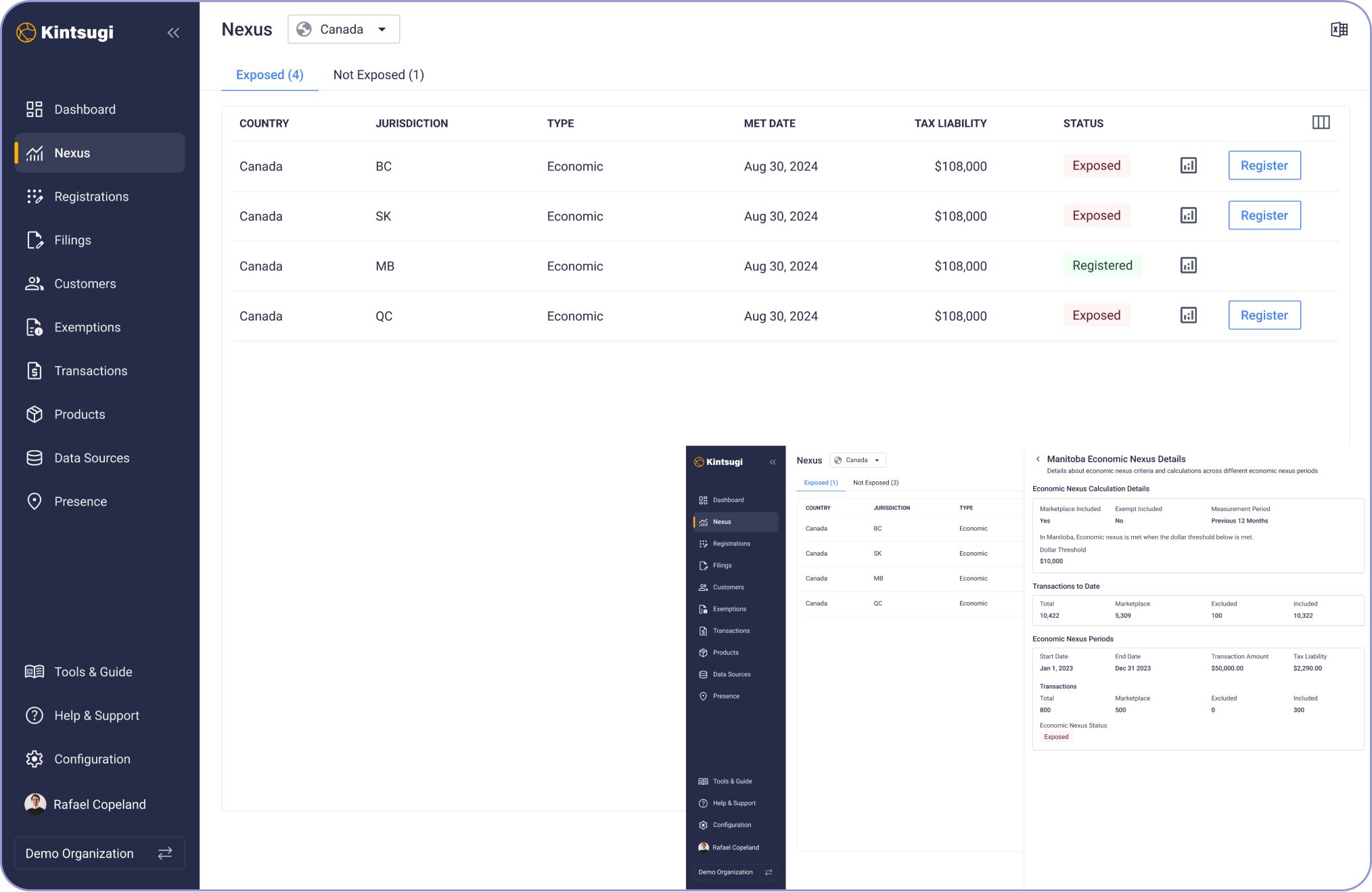

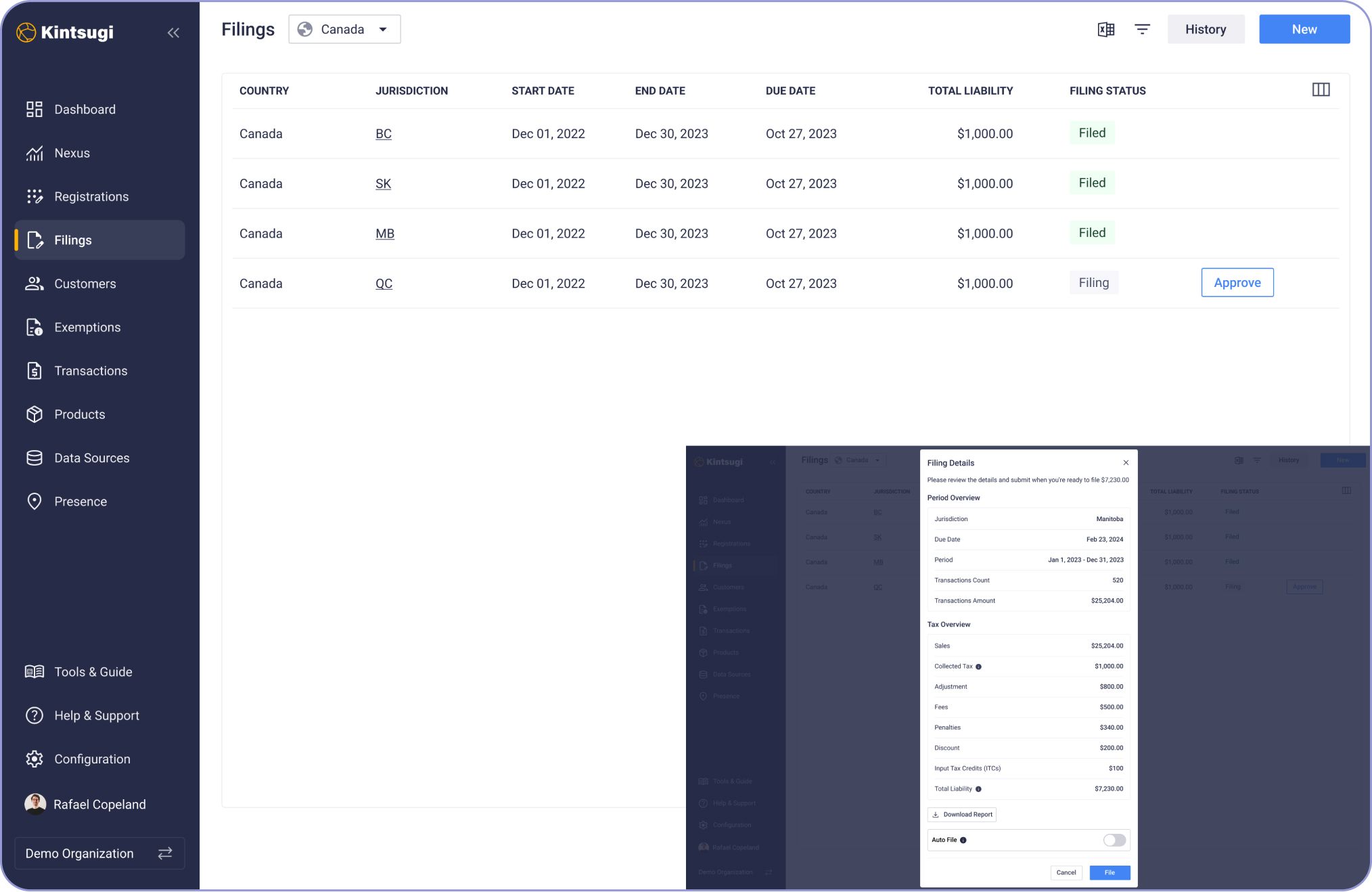

This new functionality will be gradually rolled out to our existing customers and will be publicly available by January 1, 2025. Existing customers can contact support to enable this feature for their organizations. Once enabled, the Kintsugi app will start monitoring nexus for Canadian jurisdictions, allowing you to register and file with just a click.

Looking ahead, we’re excited to announce that European sales tax support will launch by the end of Q1 2025.

Navigating the Complexities of Canadian Sales Tax

Canadian sales tax compliance presents unique challenges, combining elements of a federal Goods and Services Tax (GST) with provincial systems like PST, QST, and the harmonized sales tax (HST) .

It incorporates VAT-like mechanisms such as input tax credits (ITCs), enabling businesses to reclaim GST/HST paid on expenses, which adds a layer of administrative complexity. Additionally, the federal economic nexus considers transactions globally, requiring multi-currency support to manage compliance accurately.

These complexities, coupled with unique registration, filing, and compliance requirements, demand a tailored approach to ensure accuracy and efficiency.

At Kintsugi AI, we’ve engineered a comprehensive and unified solution to simplify Canadian tax compliance within the same app. By automating every step—from monitoring nexus to seamless registrations and filings—we empower your business to navigate this challenging system effortlessly, so you can focus on growth.

Are the pricing plans changing?

Our existing pricing structure remains unchanged. Starter plan customers can continue on the same plan until we file for you in 10 jurisdictions, while premium plan customers will retain their current plan with extended support for Canadian VAT and sales tax.

At Kintsugi, we believe in delivering more value without complicating your experience. This commitment drives our pricing approach, ensuring you can seamlessly access expanded capabilities without disruption.

What’s next?

If you’re an existing customer, you can contact our support team to enable this functionality for your organization today. For new customers interested in leveraging Kintsugi for Canadian VAT and sales tax compliance, we encourage you to express your interest early.

This will ensure we can prioritize enabling Canadian support for your organization as soon as it becomes publicly available after January 1, 2025.

This launch is just the beginning of our journey to provide businesses with seamless, global compliance solutions. We’re already working on expanding our capabilities to Europe by Q1 2025, setting the stage for a truly global compliance solution.