November 12, 2024

Essential FAQs for Shopify Businesses Considering Sales Tax Automation

Many Shopify merchants are switching from manual sales tax management to sales tax automation tools. If you have an online store and are considering doing the same but have a ton of questions about how it works, this page is for you.

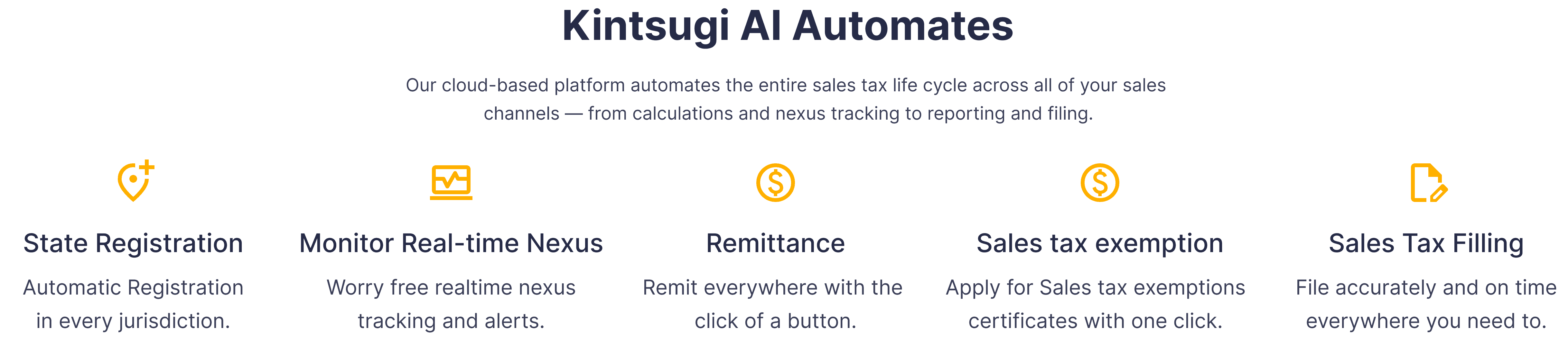

Here are some essential FAQs for Shopify businesses considering sales tax automation platforms like Kintsugi. We’ll answer some of the most common questions and help you understand how automation can simplify your tax compliance strategy and improve your operations.

Top FAQs about Sales Tax Automation

What Is Sales Tax Automation, and Why Do I Need It for My Shopify Store?

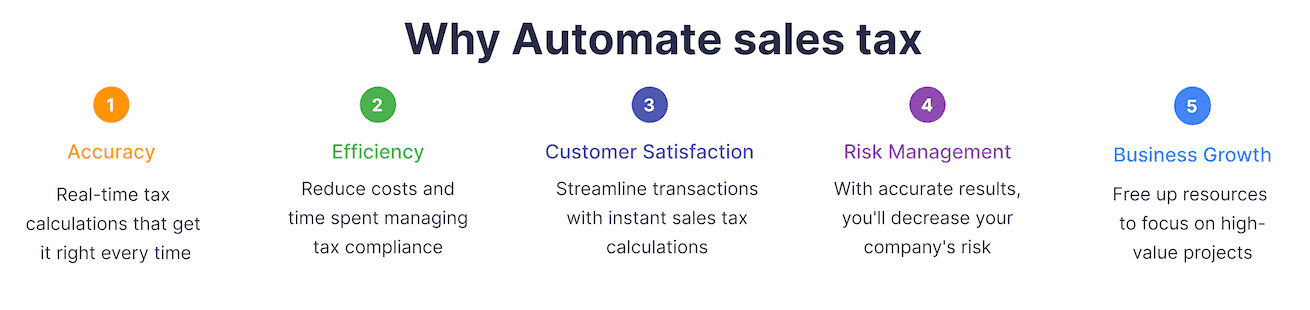

Sales tax automation is a tool that streamlines sales tax compliance by automatically calculating, collecting, and filing sales taxes for your Shopify store. It keeps up-to-date with ever-changing tax rules, eliminates manual errors, and saves time. For Shopify merchants, it simplifies managing tax calculations across multiple states or countries, ensuring compliance while freeing up resources to focus on growth.

How Does Sales Tax Automation Help Me Stay Compliant With Tax Laws?

Sales tax automation platforms calculate the correct sales tax rates for each transaction based on the customer's location and regulatory updates. They handle complex tax rules and exemptions while minimizing errors, ensuring compliance across all applicable jurisdictions.

Which Is Better: Shopify’s Built-In Tax Service Provider, Sovos, or Kintsugi?

Shopify integrates with Sovos, a well-established sales tax automation provider, for calculating and remitting taxes. However, some users report limited integrations and high costs.

Kintsugi, on the other hand, offers a better alternative with seamless Shopify tax platform capabilities, excellent support, and flexible pricing with no annual commitments. Many merchants give Kintsugi five-star ratings for its reliable sales tax compliance and robust features.

EB Upgrade from spreadsheets to strategy with our survival guide \ Download PDF \ https://trykintsugi.com/resource/ecom-sales-tax-survival-guide

Why Should I Switch to Sales Tax Automation Instead of Managing Taxes Manually?

Manual tax management is time-consuming, error-prone, and inefficient, particularly for businesses operating on an ecommerce platform like Shopify. Automation reduces errors, eliminates penalties from missed deadlines, and ensures accurate sales tax calculation across jurisdictions. Automation is a scalable solution for growing businesses, offering seamless Shopify sales tax automation features.

Can Sales Tax Automation Handle Both U.S. and International Taxes?

Yes, most sales tax automation software can handle both U.S. and international tax calculations. Platforms like Kintsugi ensure compliance globally, helping Shopify merchants simplify operations across borders.

Is Sales Tax Automation Only for Large Businesses, or Can It Help Smaller Shopify Stores, Too?

Sales tax automation benefits companies of all sizes. Even smaller stores can ensure efficient tax compliance with automation tools, making it a cost-effective, scalable solution for growing Shopify merchants.

How Do I Know If My Business Is Ready for Sales Tax Automation?

If you’re struggling to keep up with economic nexus thresholds, multiple jurisdictions, or complex sales tax rules, then your business is ready for automation. It saves time, minimizes errors, and ensures compliance.

Will Sales Tax Automation Work With My Shopify Store's Existing Setup?

Yes, most sales tax automation tools seamlessly integrate with Shopify, requiring minimal adjustments. Kintsugi’s Shopify sales tax automation solution features no-code integration, ensuring a smooth and fast setup process.

How Will Automation Impact My Current Accounting or Bookkeeping Processes?

Automation tools integrate with accounting software like QuickBooks and NetSuite, simplifying tax reporting and reconciliation. This reduces manual effort and ensures accurate sales tax reports across your systems.

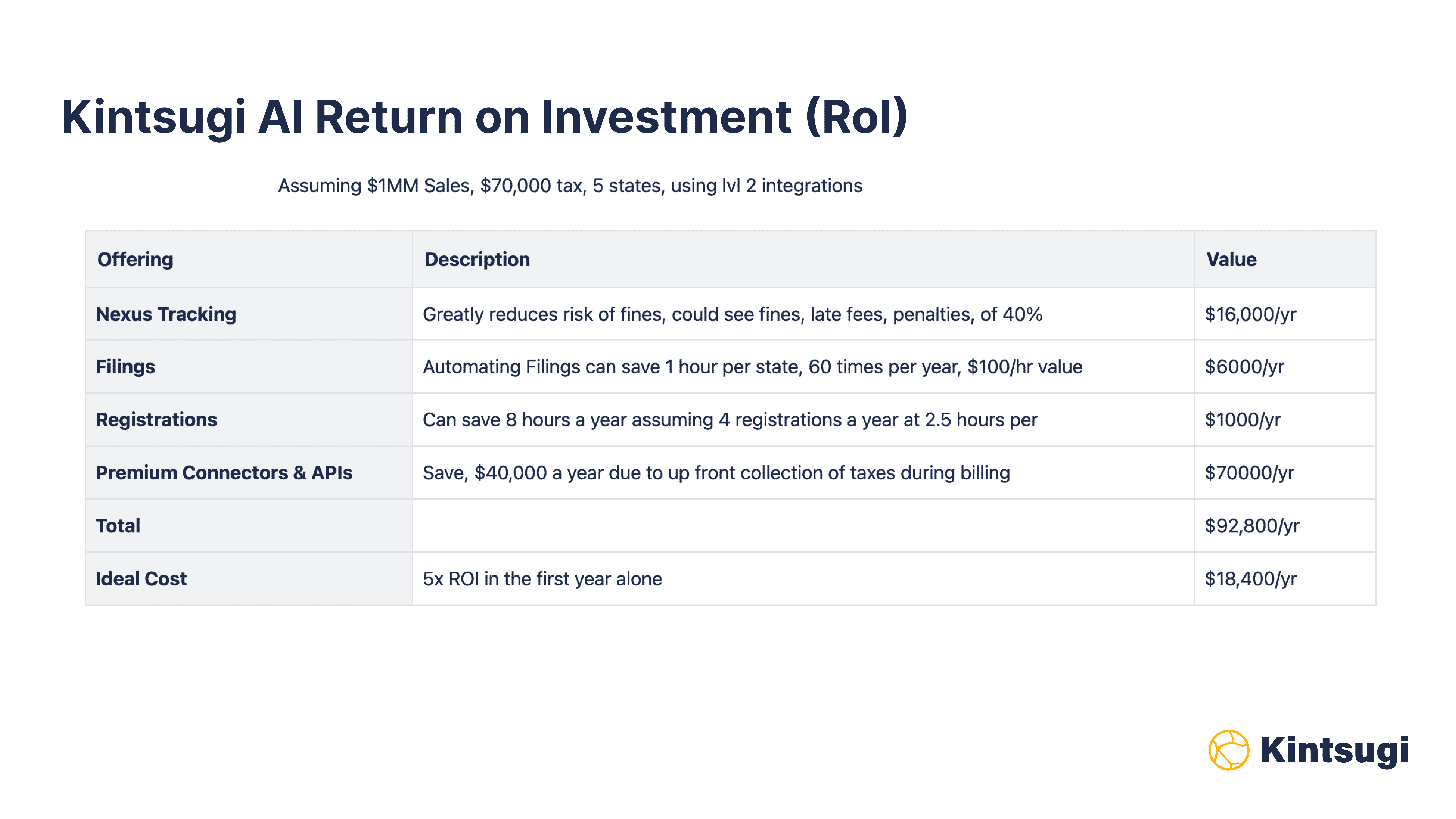

How Much Does Sales Tax Automation Cost, and Is It Worth the Investment?

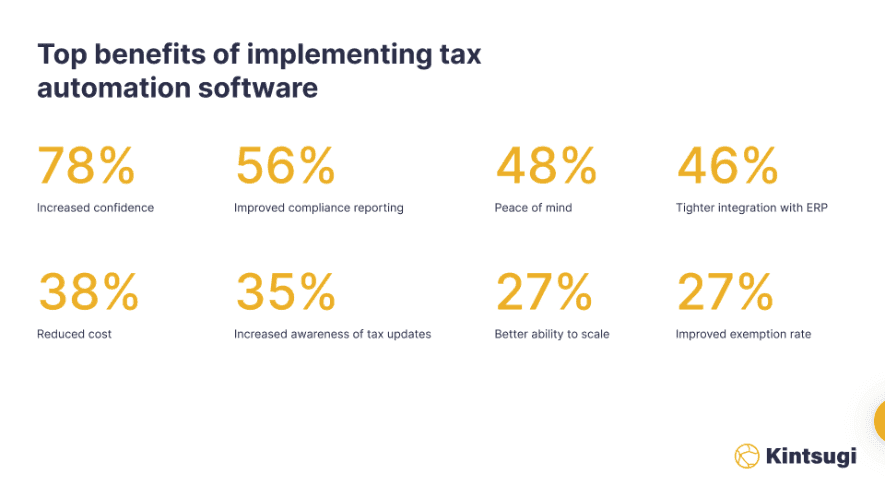

The cost depends on the provider and your needs. However, the benefits—avoiding penalties, improving efficiency, and ensuring compliance—make automation a worthwhile investment. With automated solutions like Kintsugi, Shopify merchants often experience significant ROI by saving on penalties and labor.

How Much Time Will I Save by Using Sales Tax Automation?

Automation eliminates manual sales tax calculations, reporting, and filings. Many Shopify merchants save over 20 hours per month, allowing them to focus on growing their business instead of managing sales tax compliance.

Can Sales Tax Automation Help Me When I’m Behind on My Sales Tax Filings?

Yes, automation tools identify outstanding obligations and efficiently prepare back filings. They simplify catching up on missed tax filings while minimizing penalties.

Will Sales Tax Automation Slow Down My Store’s Checkout Process?

Modern tools like Kintsugi are optimized for speed and sales tax calculation efficiency, ensuring seamless checkout experiences for Shopify customers.

Can Sales Tax Automation Help Me With Multi-Channel Sales?

Yes. Sales tax automation integrates with other ecommerce platforms like Amazon, eBay, and Etsy. For example, Kintsugi enables unified management of sales tax compliance across Shopify and other sales channels.

Is It Difficult to Set Up Sales Tax Automation for My Shopify Store?

No, the setup is straightforward. Tools like Kintsugi offer step-by-step onboarding with no-code integration, allowing you to start automating tax filings in minutes.

How Long Does It Take to Set Up Kintsugi for My Shopify Store?

With its intuitive design, Kintsugi takes just 30 seconds to set up and 30 minutes to run the first batch of tax data, making it one of the fastest Shopify sales tax automation tools.

How Does Sales Tax Automation Handle Tax-Exempt Customers or Products?

Automation tools validate tax-exempt certificates and apply tax rules accurately to ensure compliant processing of tax-exempt transactions.

What Kind of Ongoing Support Is Available If I Encounter Issues With Sales Tax Automation?

Kintsugi provides 24/7 Slack support, live chat, and email assistance to ensure smooth operations. Reliable support is essential for Shopify merchants who are navigating complex sales tax compliance.

What Happens If I Decide to Stop Using Sales Tax Automation?

Automation tools like Kintsugi ensure you retain access to your tax reports and data for smooth transitions. Kintsugi also offers flexible, no-contract pricing to suit Shopify merchants.

What’s the ROI for Using Kintsugi—Will It Save Me More Time and Money Than Manual Tax Management?

Kintsugi ensures accurate sales tax calculations, filing, and compliance while saving significant time and reducing the risk of penalties. The ROI varies based on business size, but many Shopify merchants report saving hours each month and achieving peace of mind.

Why Should I Choose Kintsugi Over Other Sales Tax Automation Providers?

Kintsugi offers unmatched Shopify tax platform capabilities, including seamless integrations, accurate sales tax calculation, real-time updates, and exceptional support. It simplifies managing economic nexus, state registrations, remittances, and filing. With Kintsugi, Shopify merchants enjoy automated tax compliance and a user-friendly experience.

Is There a Free Trial or Demo Available to Test Kintsugi?

Yes, Kintsugi offers a Starter Kit with free features, a free trial, and a free nexus study. Book a demo to explore how Kintsugi can transform your Shopify tax compliance processes.

For those who are planning to get Kintsugi, book a demo now or sign up for free.