As your business grows, so do your sales—and with them, the complexity of managing sales taxes. From calculating rates across jurisdictions to filing returns, staying compliant can quickly become overwhelming, especially during peak sales periods like Black Friday.

While traditional options like tax consulting firms or established software providers such as Avalara and TaxJar might come to mind, there’s a smarter, more modern solution tailored for your needs: Kintsugi.

With the global tax automation market projected to hit $44 billion by 2032, businesses everywhere are embracing software to streamline compliance and free up valuable time. Why? Because automation isn’t just a convenience—it’s a competitive advantage.

In this blog, we’ll explore why Kintsugi stands out from the competition, making sales tax compliance seamless and stress-free. Let’s dive in.

Accurate Tax Calculation

Most companies, big and small, have admitted to having difficulties regarding sales tax compliance because of tax rules and rates that are often subject to change. They find the process complex, so they turn to sales tax agencies for help.

According to Michael Giannettino, Partner, State and Local Tax at RSM US LLP, they had clients who were being overcharged tax on purchases. He acknowledged that automation could help solve the issue.

"By leveraging automation, businesses can mitigate audit risk, enhance accuracy, and streamline the reporting function," Giannettino said.

Yes, sales tax automation makes tax calculations a breeze, but you must be careful when choosing a provider because even established ones like Avalara and TaxJar come short in delivering.

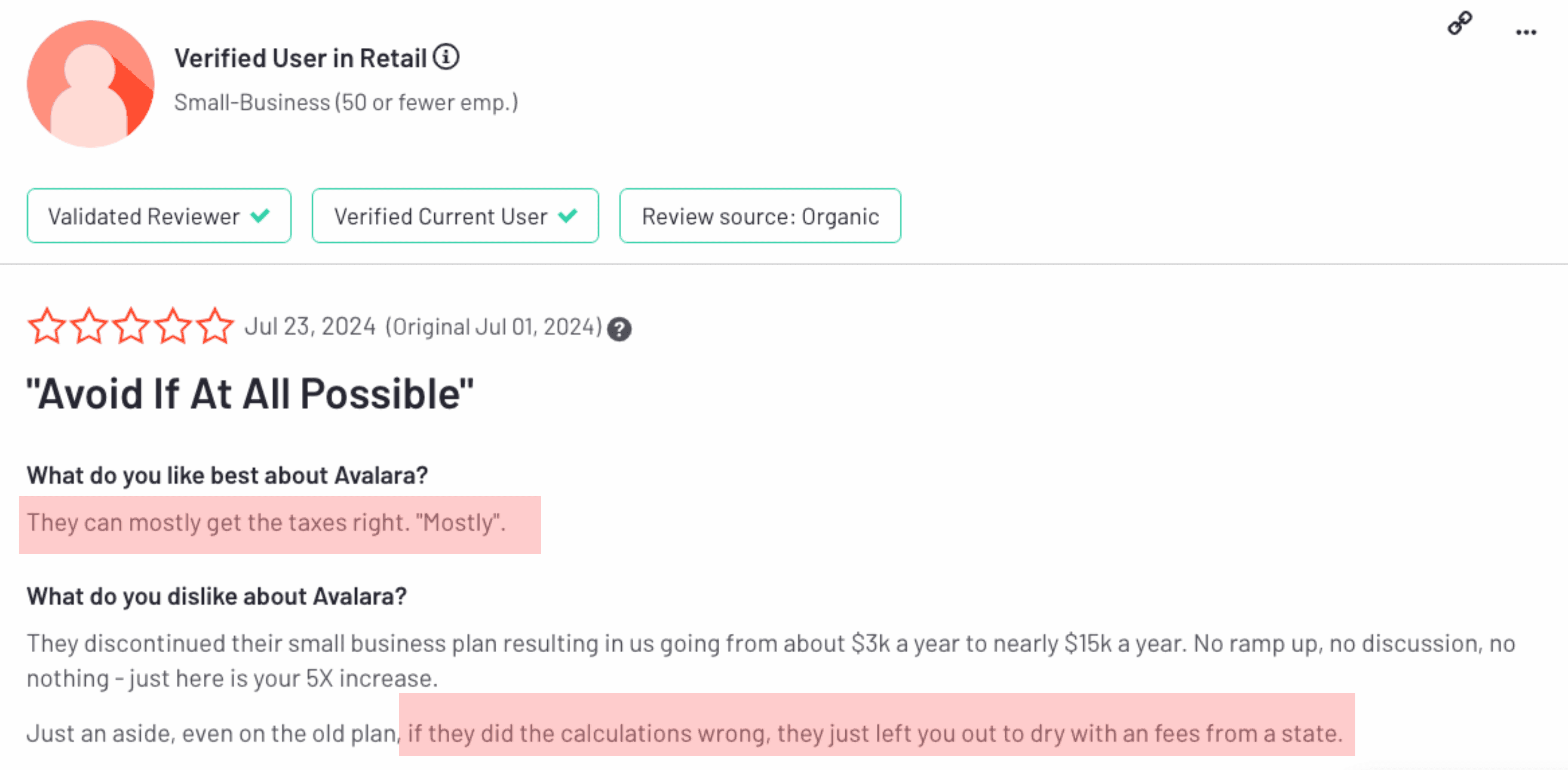

Kintsugi vs Taxjar vs Avalara Avatax-- The latter two, Avalara and TaxJar, received tons of complaints from their users for miscalculated taxes.

One verified Avalara user said, “They can mostly get the taxes right. Mostly,“ suggesting that the tool doesn’t work accurately all the time. Unfortunately, in their case, Avalara reportedly "just left you out to dry with fees from a state.“ after miscalculating the tax.

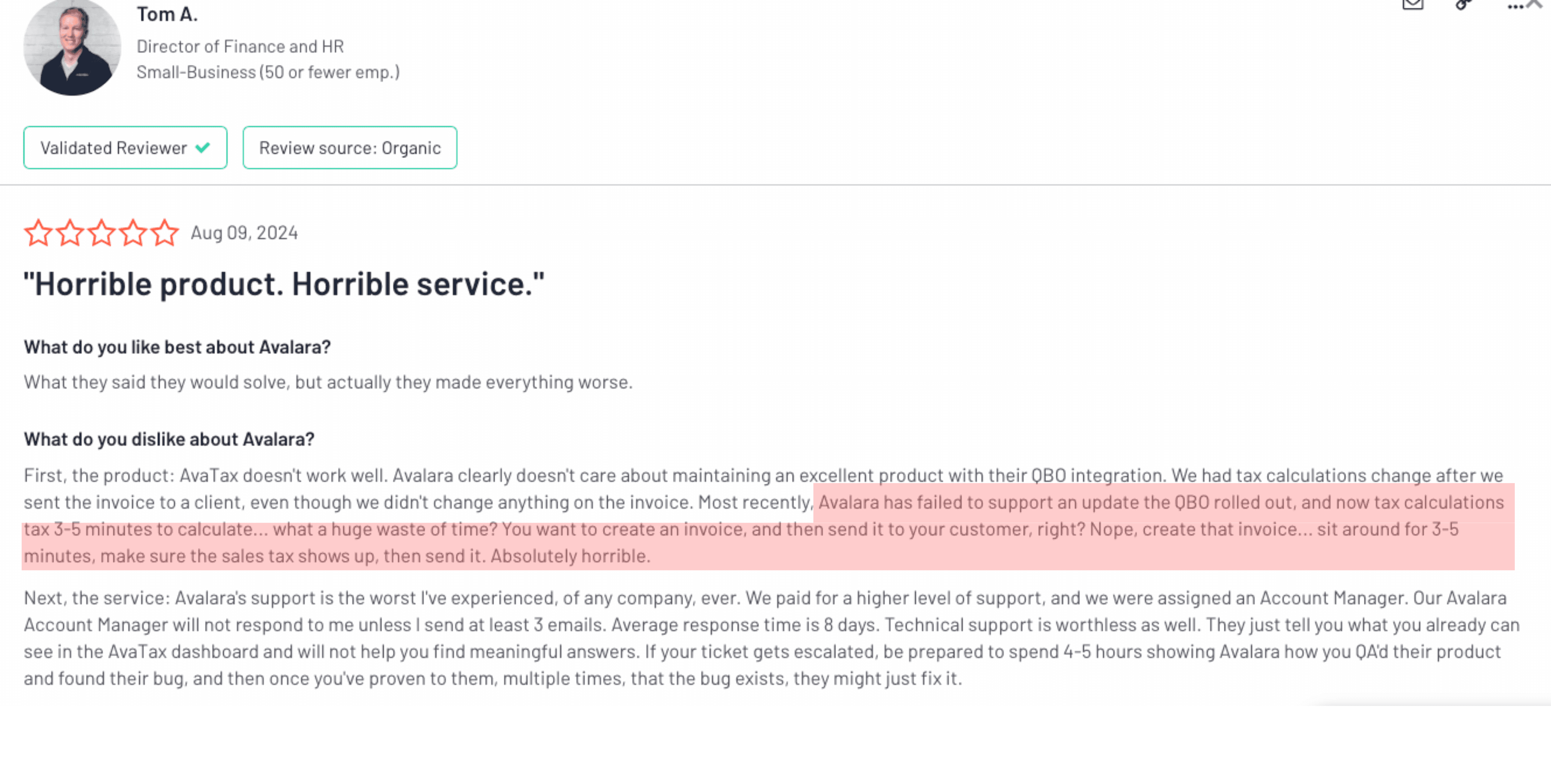

Tom, another Avalara user, said they also encountered the same issue. However, he could not grasp how the tax calculations reportedly changed since they didn’t do anything on their end. “We had tax calculations change after we sent the invoice to a client, even though we didn’t change anything on the invoice,“ he wrote. This suggests that the tax calculation could change without reason.

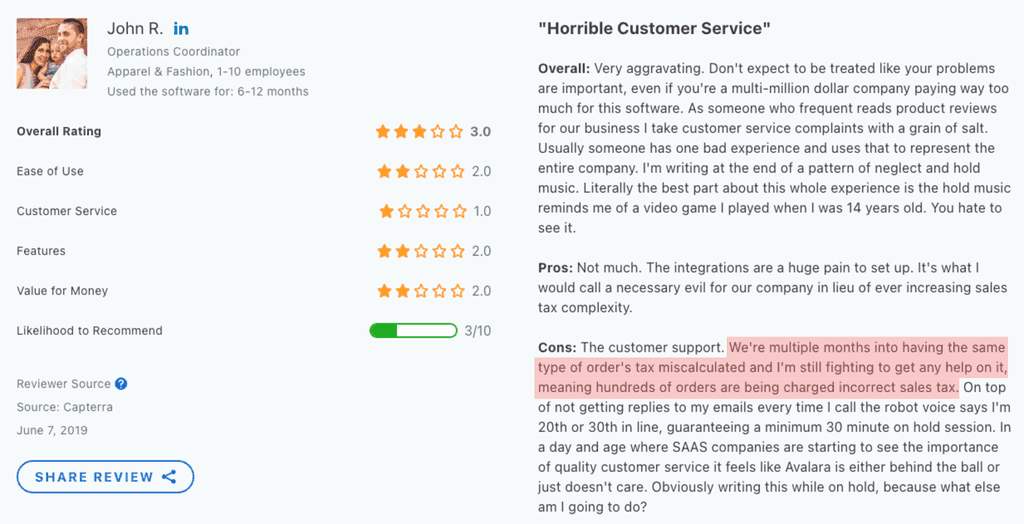

Apparently, tax miscalculation is somewhat of a rampant issue in Avalara. John encountered a similar problem, and it affected “hundreds of orders,“ which was a huge problem. “We’re multiple months into having the same type of order’s tax miscalculated and I’m still fighting to get any help on it, meaning hundreds of orders are being charged incorrect sales tax,“ he wrote.

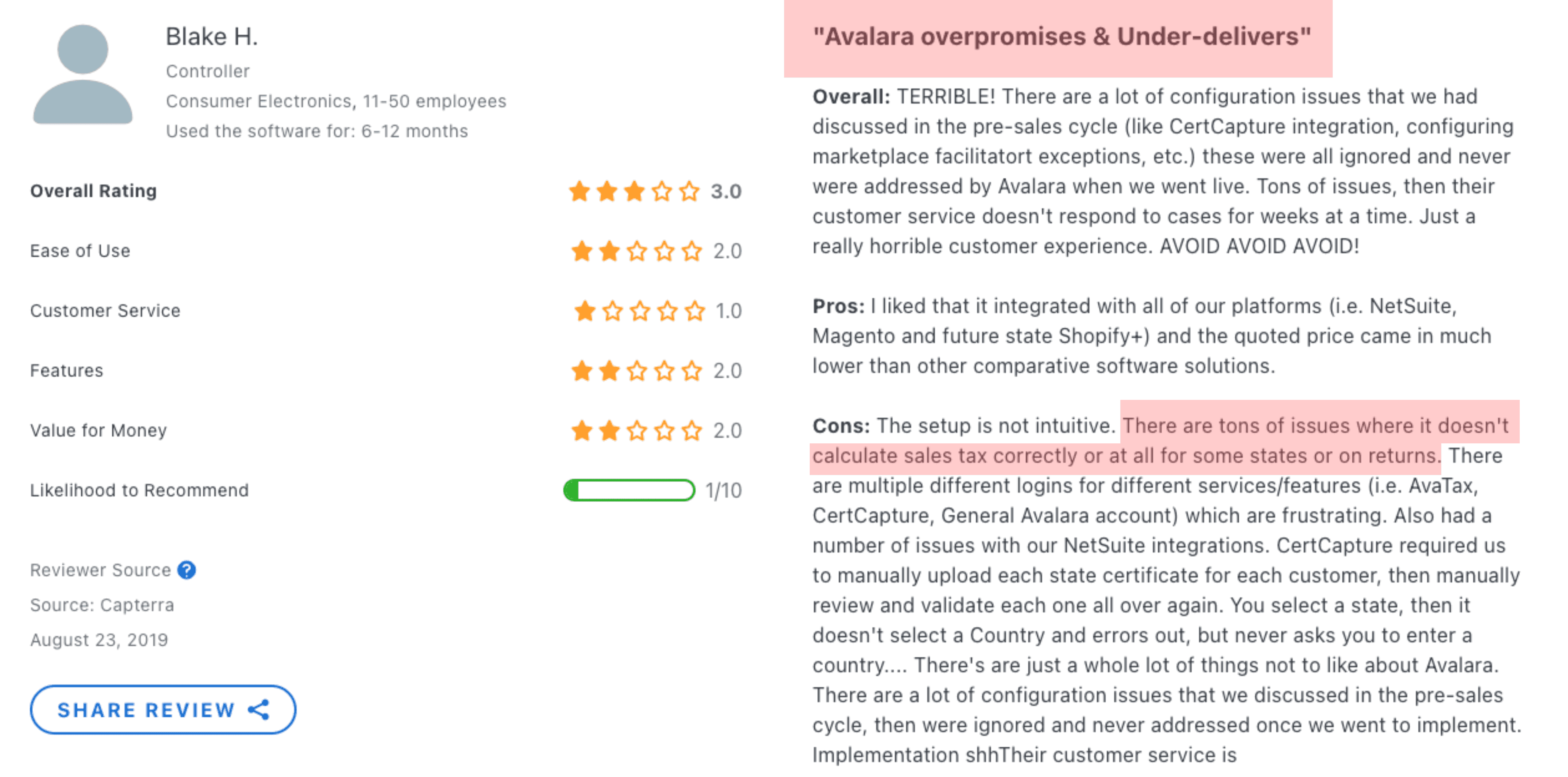

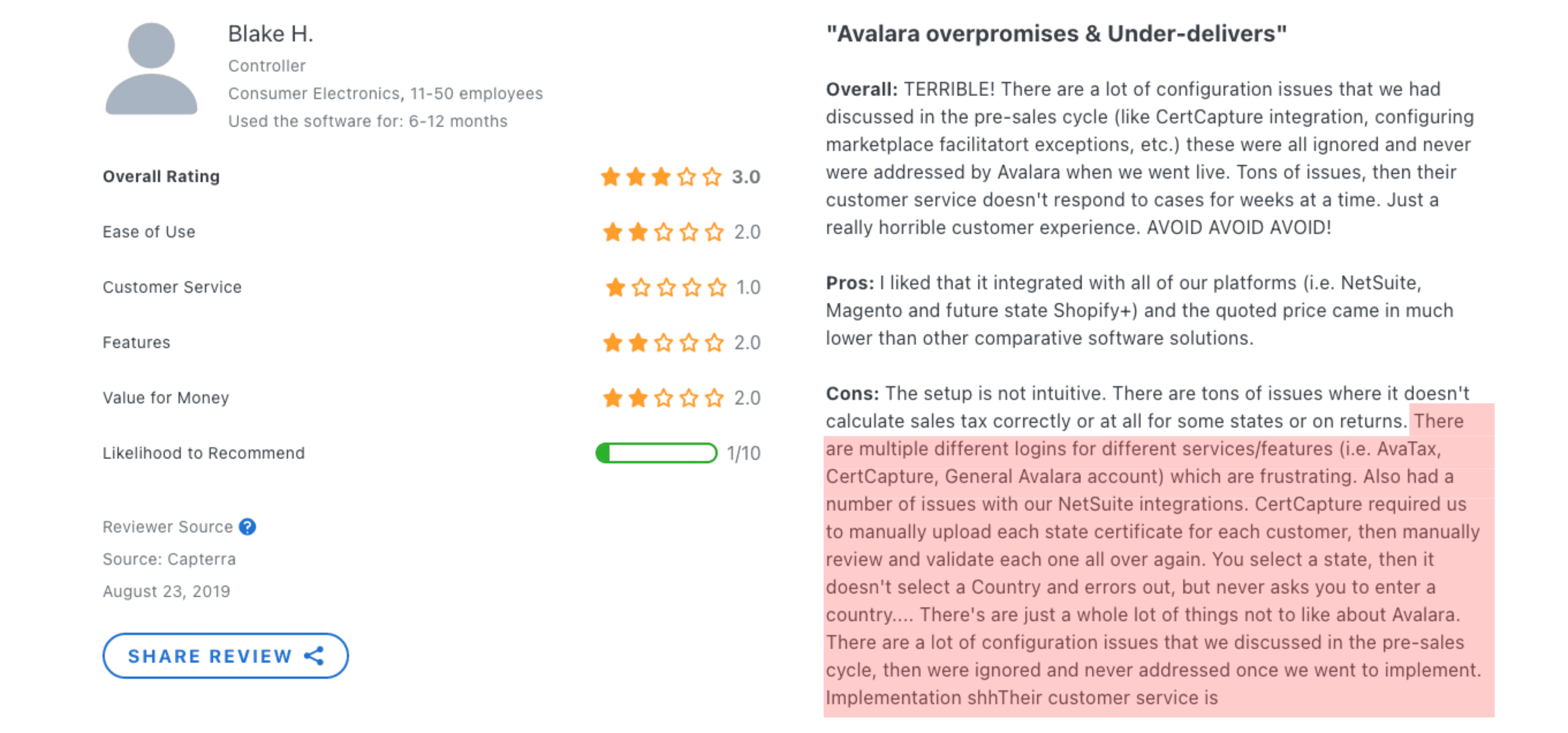

Another unhappy Avalara customer said, “Avalara overpromises & under-delivers,“ The customer has multiple complaints and one of them is inaccurate sales tax computation. “There are tons of issues where it doesn’t calculate tax correctly or at all for some states or on returns,“ Blake H. wrote.

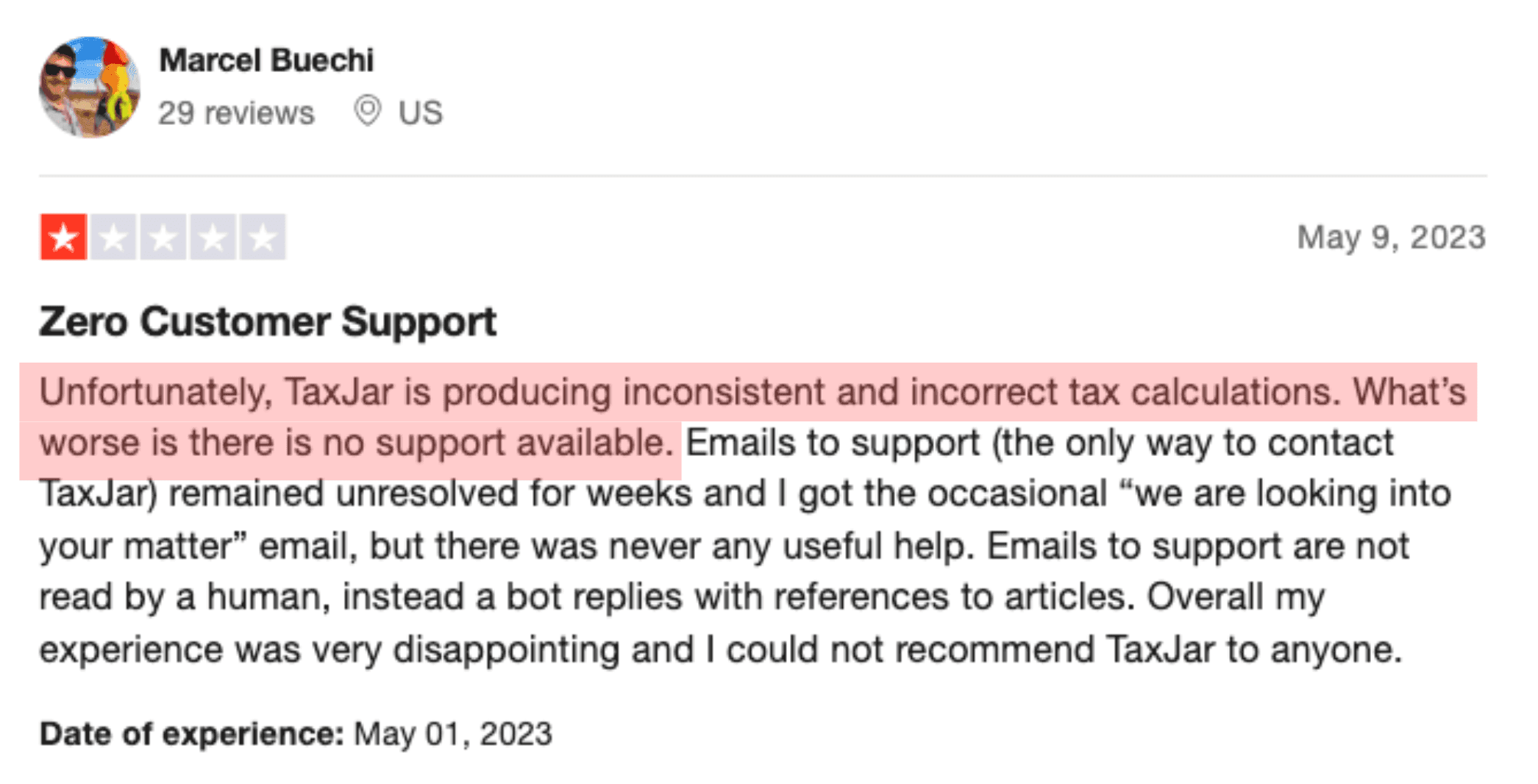

TaxJar customers also experienced similar issues. According to them, they noticed tax miscalculations in their accounts.

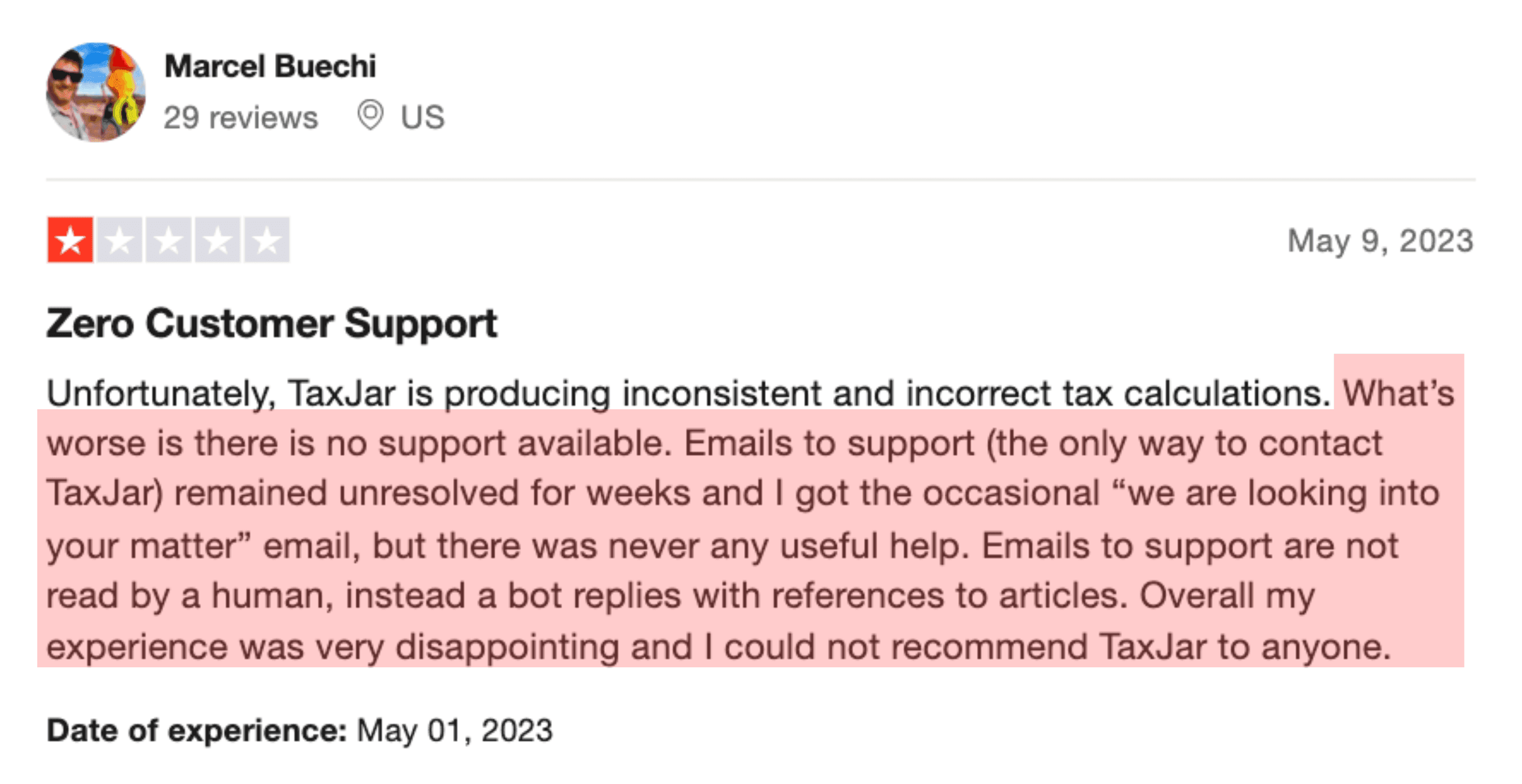

Marcel Buechi encountered tax miscalculations while using TaxJar. To make matters worse, he could only contact customer support via email and they were unresponsive, dragging the issue on for weeks.

“Unfortunately, TaxJar is producing inconsistent and incorrect tax calculations. What’s worse is there is no support available,“ he wrote.

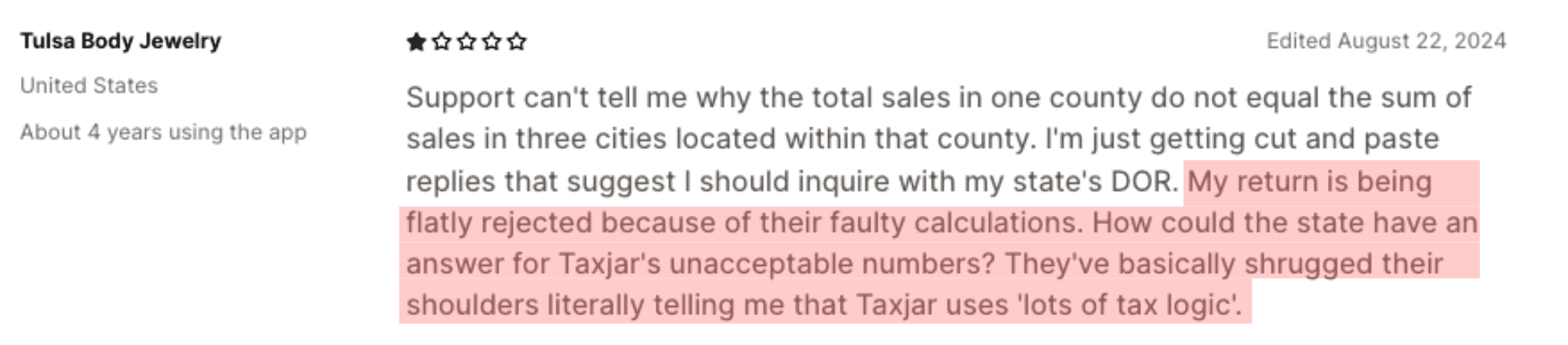

Apparently, this is not an isolated case since another user experienced a similar problem and Taxjar reportedly just “shrugged their shoulders.“ “My return is being flatly rejected because of their faulty calculations. How could the state have an answer for Taxjar’s unacceptable numbers? They’ve basically shrugged their shoulders literally telling me that Taxjar uses ‘lots of tax logic,’“ Tulsa Body Jewelry wrote.

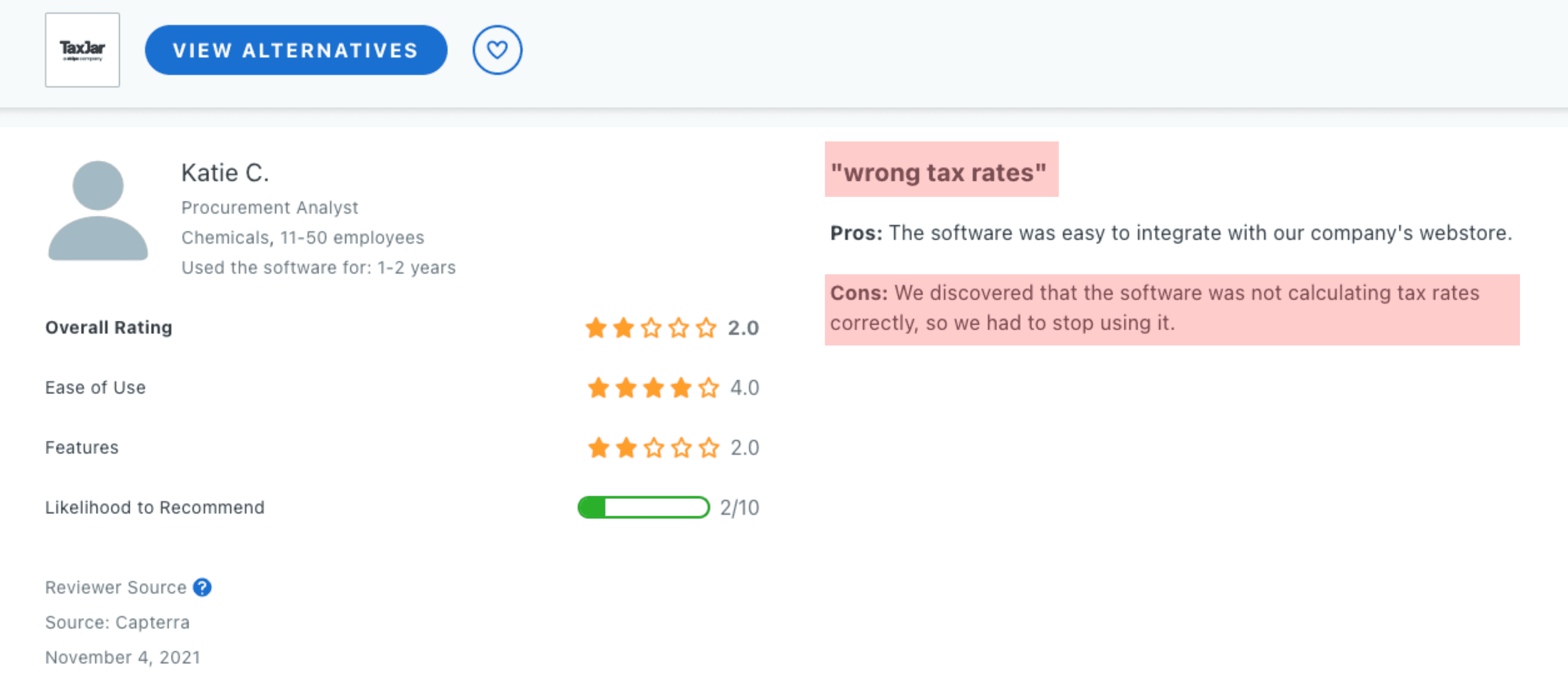

Katie C. had an easy integration experience with TaxJar. However, she encountered another issue – it reportedly had “wrong tax rates.“ “We discovered that the software was not calculating tax rates correctly, so we had to stop using it,“ she wrote.

Meanwhile, Kintsugi customers are happy with our service. They specifically loved how “accurate“ our tool worked and said our platform stood out for them.

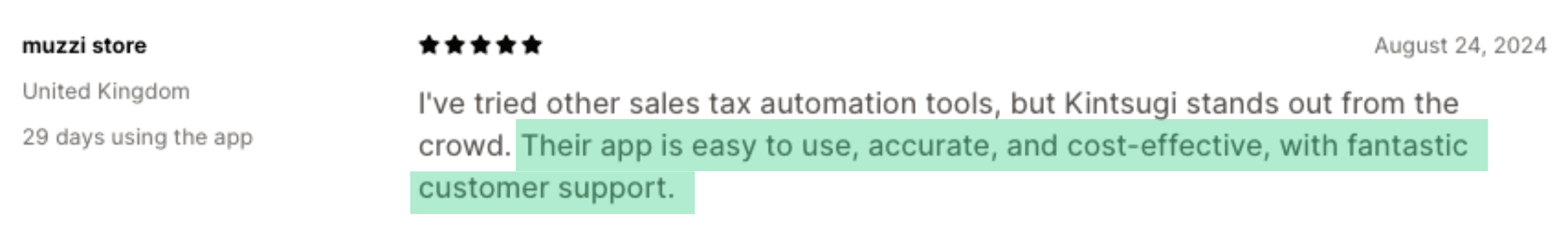

“I’ve tried sales tax automation tools, but Kintsugi stands out from the crowd. Their app is easy to use, accurate, and cost-effective with fantastic customer support,“ Muzzi store wrote.

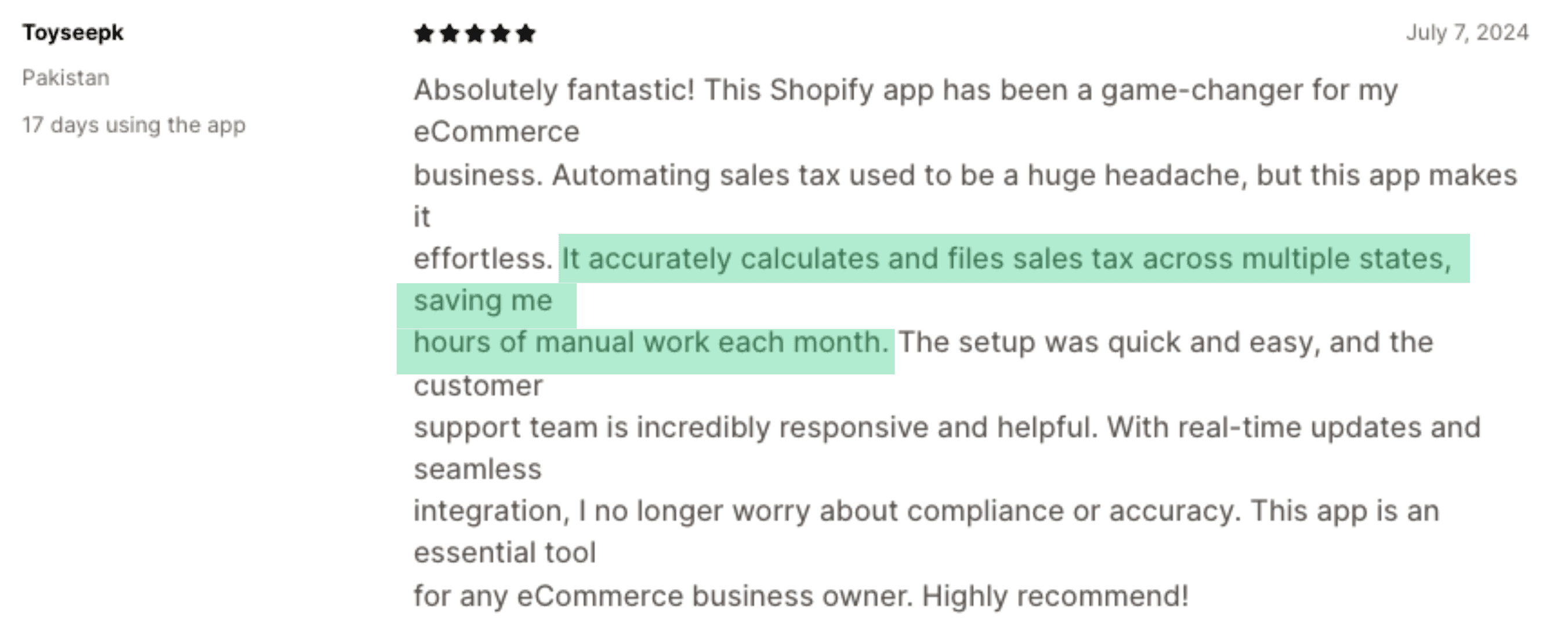

Another shared a similar sentiment, praising our tool’s accuracy. “It accurately calculates and files sales tax across multiple states saving me hours of manual work each month,“ Toyseepk added.

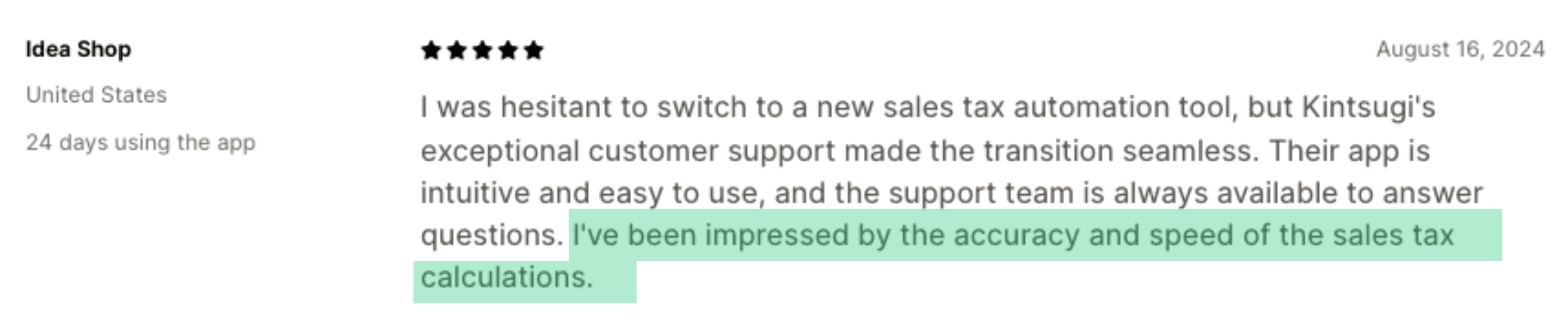

Another customer admitted they were hesitant to switch to Kintsugi but were happy they did because the transition was seamless, thanks to our customer support. They were also impressed with the accuracy of our sales tax computation. “I’ve been impressed by the accuracy and speed of the sales tax calculations,“ Idea Shop wrote.

Clearly, Kintsugi is the smarter choice for sales tax compliance than Avalara and Taxjar.

Customer Support: The Critical Difference

Another significant element that business owners should consider when getting a sales tax automation provider is the quality of customer support they offer. Yes, Avalara and TaxJar both offer 24/7 support, but the question is – do they deliver?

Both companies received countless complaints from unhappy and irate clients who felt that they were left hanging in dire need of assistance. Additionally, some of the concerns they raised took weeks or months to be resolved.

50% of customers are willing to pay extra to receive better customer service, per Salesforce.

Some Avalara customers pay more for better customer support, but they were left disappointed because they didn’t feel the white glove treatment they expected for the extra payment.

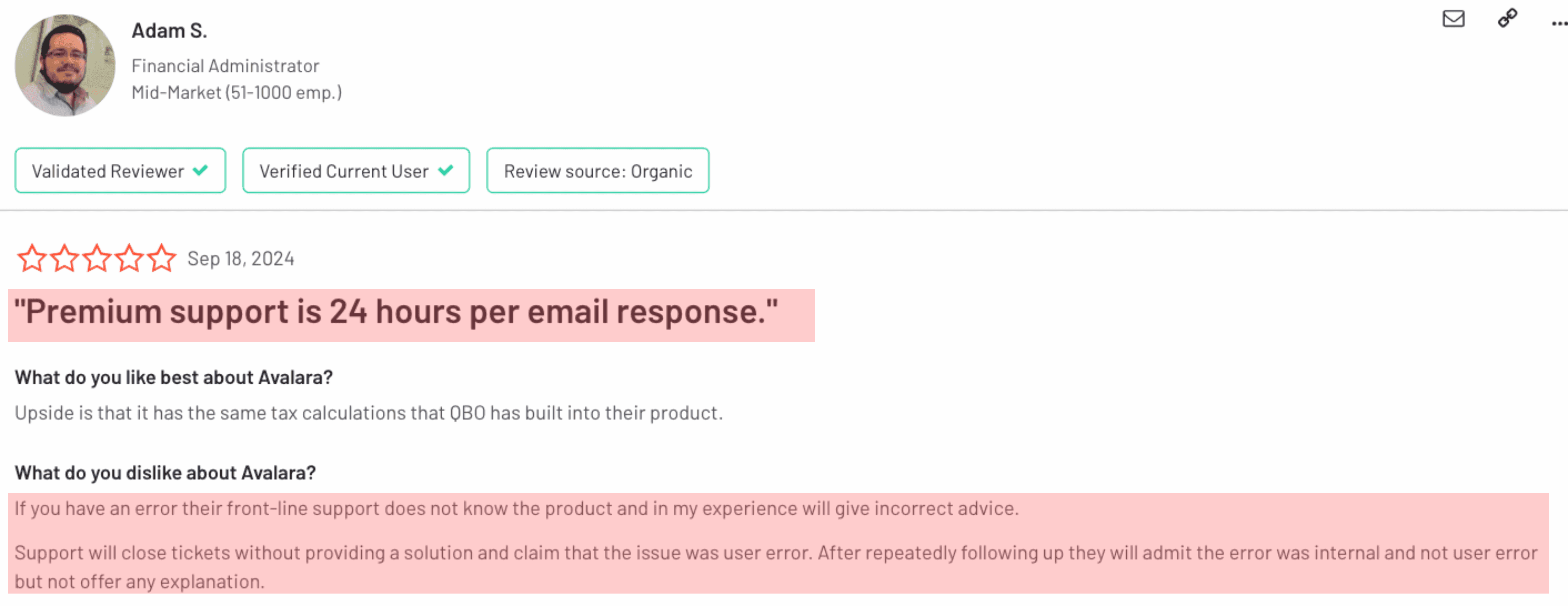

Adam S. said they paid for “premium support.“ However, Avalara’s customer support was not responsive. It reportedly takes 24 hours for them to respond to his emails.

“If you have an error, their front-line support does not know the product and, in my experience, will give incorrect advice. Support will close tickets without providing a solution and claim that the issue was [1] user error. After repeatedly following up they will admit the error was internal and not user error, but not offer any explanation,“ he wrote.

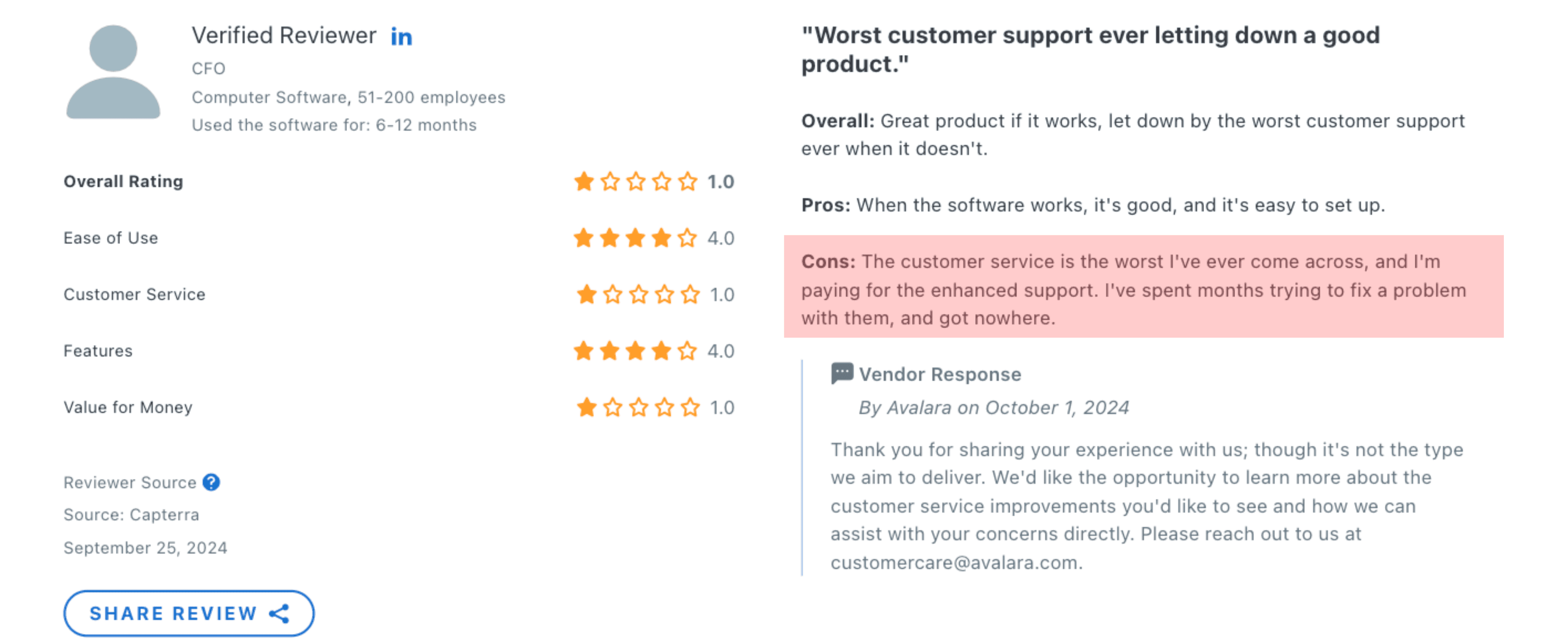

It turns out that many of Avalara’s customers have issues with its customer support, and many of them called it the “worst“ they have come across despite paying extra for the “enhanced support,“ which they don’t enjoy.

“The customer service is the worst I’ve ever come across, and I’m paying for the enhanced support. I’ve spent months trying to fix a problem with them, and got nowhere,“ another wrote.

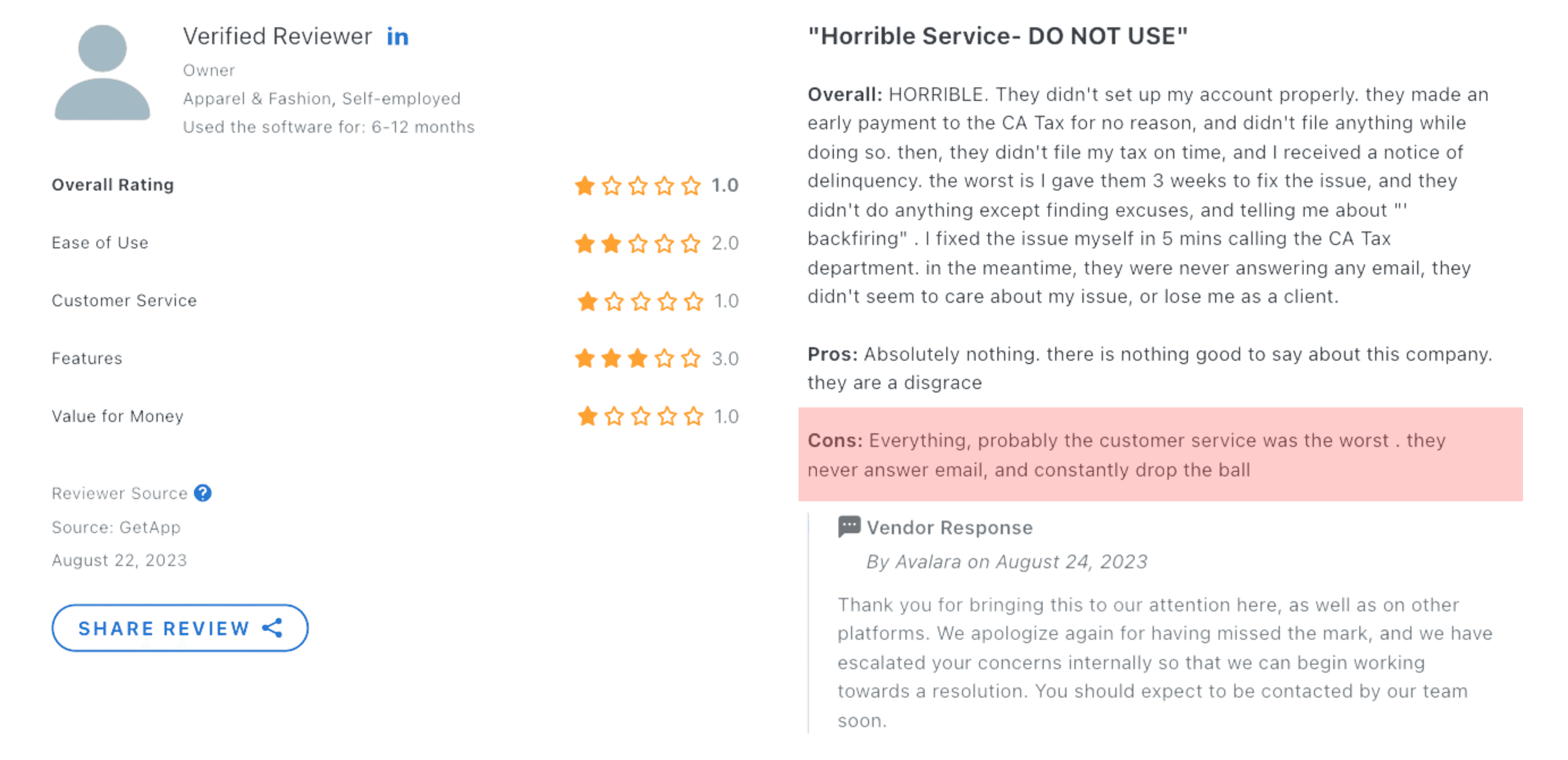

A different Avalara customer said they received a “Horrible Service“ and warned others not to use the platform. Among their biggest issue with Avalara was its customer support.

“Everything, probably the customer service was the worst. They never answer email and constantly drop the ball,“ the owner of Apparel & Fashion wrote.

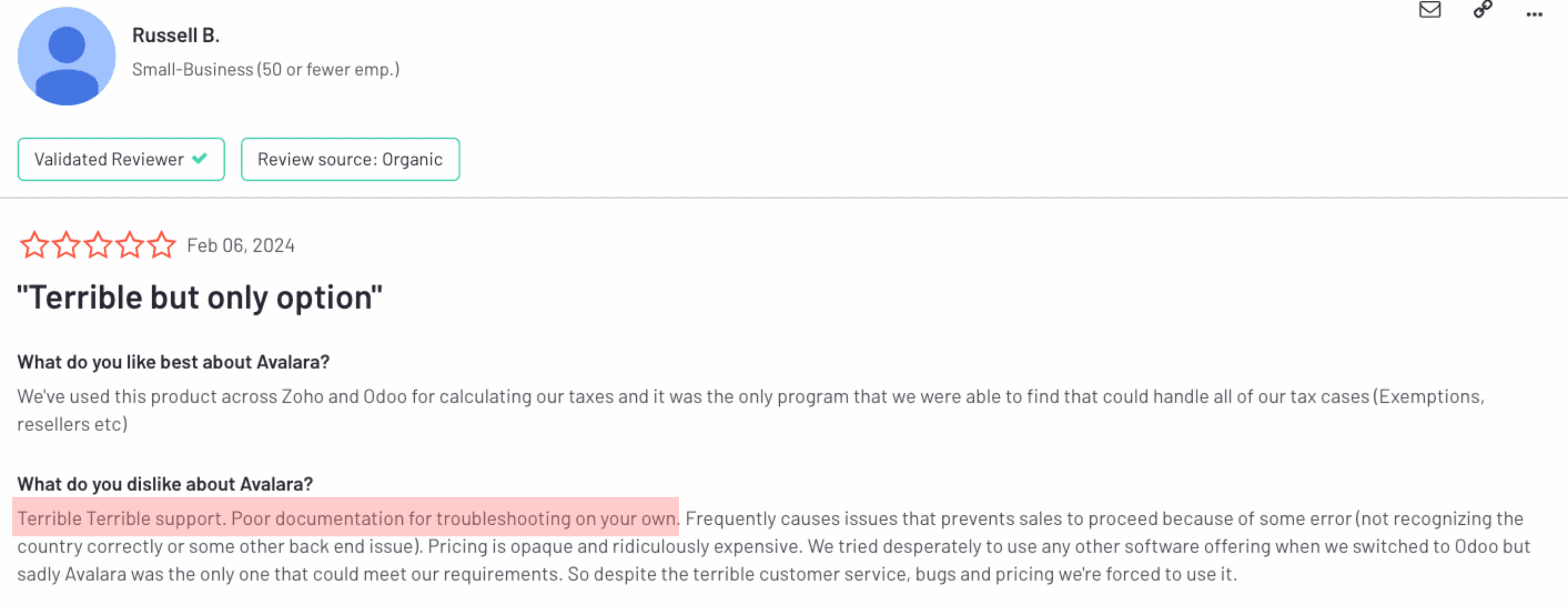

Another said Avalara was “terrible,“ but it was their only option because they felt that Avalara was the only one that could handle all of their tax cases. Aside from the poor support, there was reportedly “poor documentation“ too.

“Terrible. Terrible support. Poor documentation for troubleshooting on your own,“ Russell B, a small business owner, wrote.

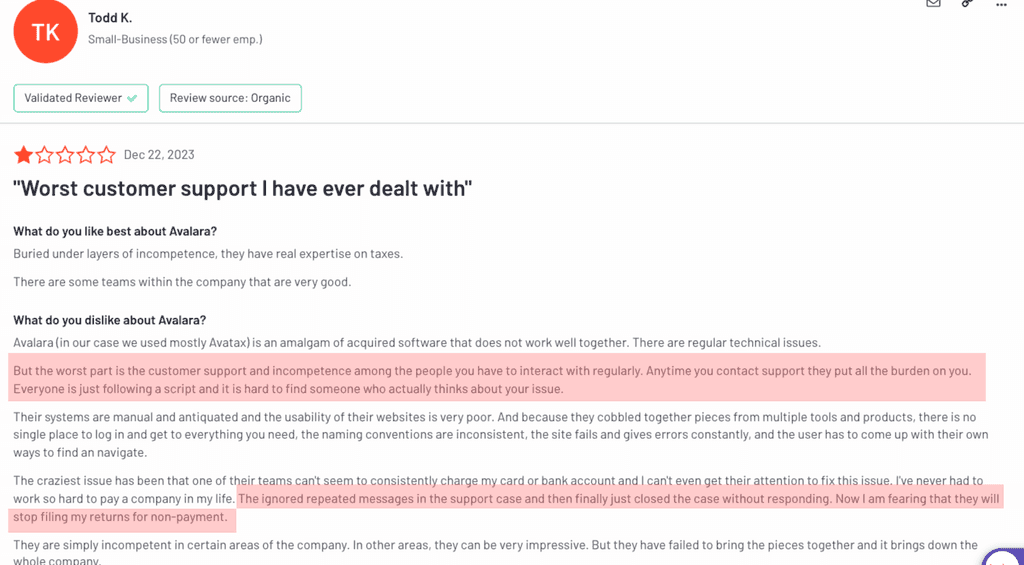

Todd K. said they experienced tons of technical issues using Avalara. However, for him, the worst part was its customer support, which could have been more helpful.

“But the worst part is the customer support and incompetence among the people you have to interact with regularly. Anytime you contact support they put all the burden on you. Everyone is just following a script and it is hard to find someone who actually thinks about your issue,“ Todd wrote.

TaxJar also received similar complaints from its users regarding poor customer support. The only available support was via email and it reportedly takes days for them to get a response.

“What’s worse [is that] there is no support available. Emails to support (the only way to contact TaxJar) remained unresolved for weeks and I got the occasional 'we are looking into your matter' email, but there was never any useful help,“ Marcel Buechi wrote. According to him, he had a “very disappointing“experience with TaxJar and could not recommend it.

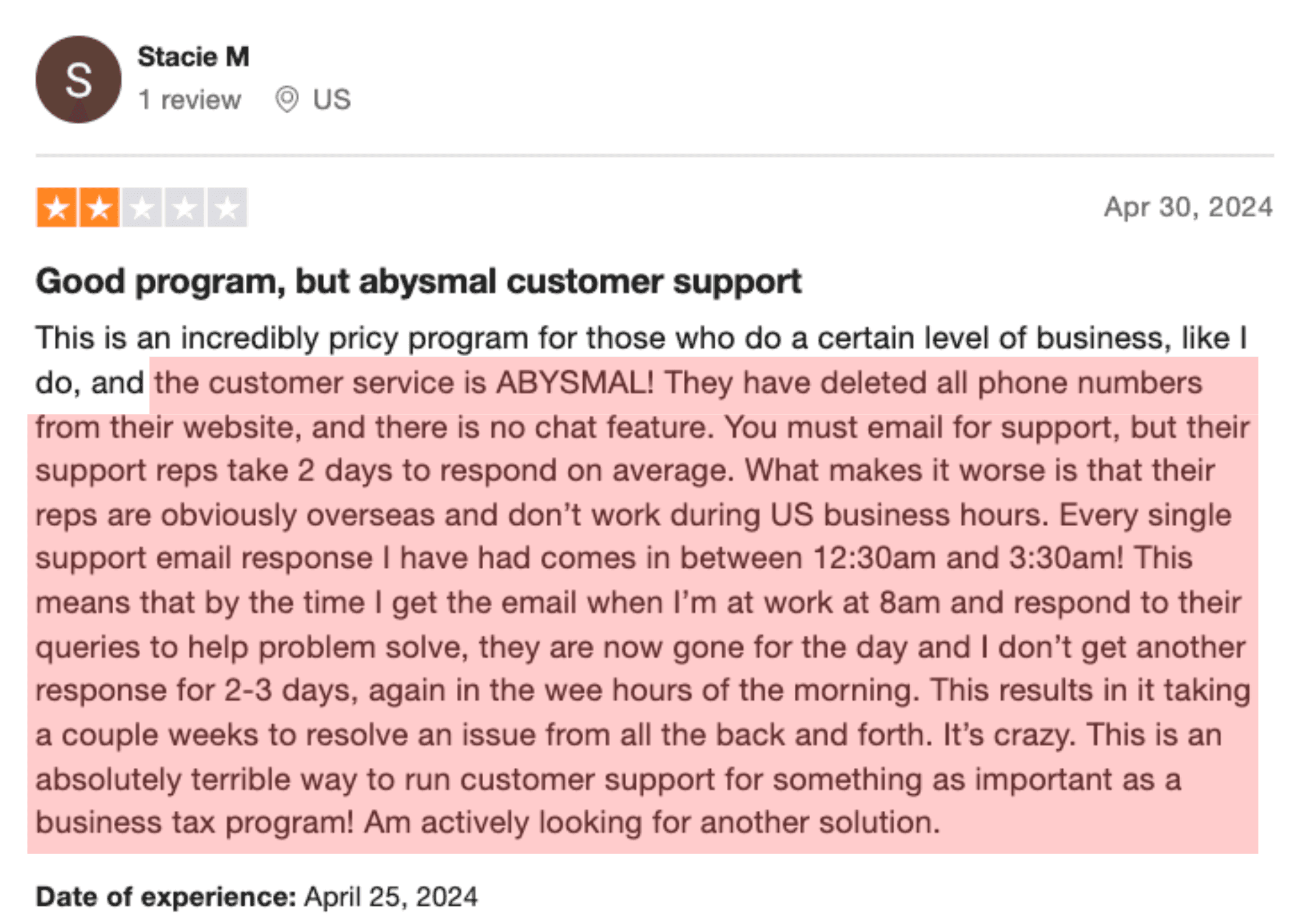

TaxJar’s poor customer service was experienced by many users. Stacie M. said, “the customer service is ABYSMAL!“ There was no other way to reach TaxJar for assistance other than email, as they offered no chat support. However, the support reps would only respond to her emails after two days and she suspected that they lived overseas due to the timing of their response.

“Every single support email response I have had comes in between 12:30 am and 3:30 am! This means that by the time I get the email when I’m at work at 8 am and respond to their queries to help problem solve, they are now gone for the day and I don’t get another response for 2-3 days, again in the wee hours of the morning. This results in it taking a couple of weeks to resolve an issue from all the back and forth,” Stacie wrote. “It’s crazy. This is an absolutely terrible way to run customer support for something as important as business tax program!“

We all know how important customer service is—especially when tax deadlines are breathing down your neck. So, we agree with Stacie that there is no room for poor customer service, especially in important issues like tax cases.

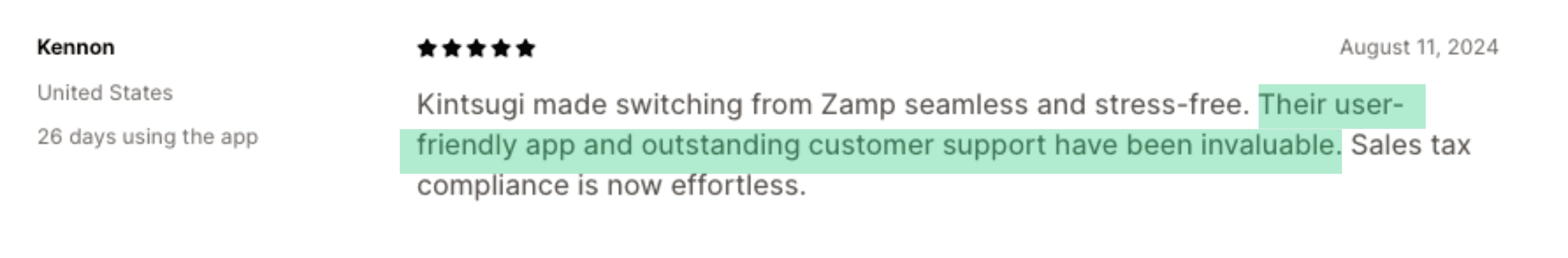

Kintsugi stands out in this area. With our 24/7 support, you can conveniently reach us for any assistance and we will connect you with a tax expert or our helpful and knowledgeable support staff in minutes. Kintsugi values your time, and our customers can attest to that.

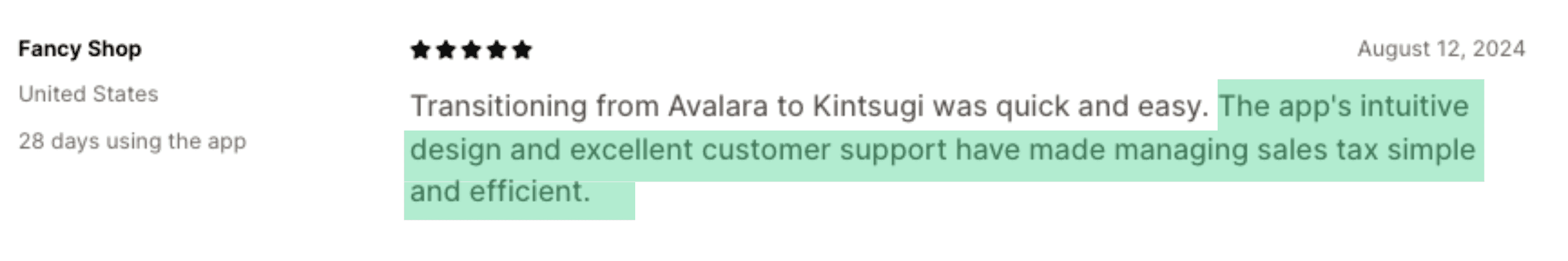

Another user switched from Avalara to Kintsugi and experienced the same seamless transition, saying it was “quick and easy.“ “The app’s intuitive design and excellent customer support have made managing sales tax simple and efficient,“ Fancy Shop wrote.

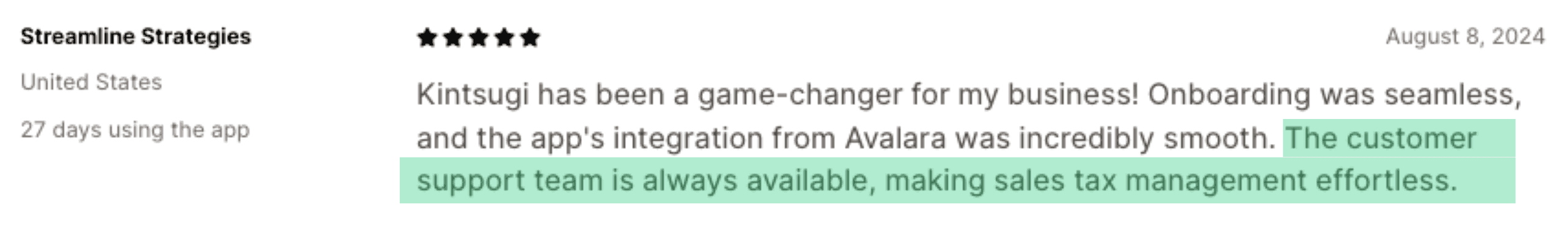

Another Avalara user did the same and was impressed by Kintsugi’s “seamless“ onboarding, app integrations and customer support. “The customer support team is always available, making sales tax management effortless,“ Streamline Strategies said about their Kintsugi experience.

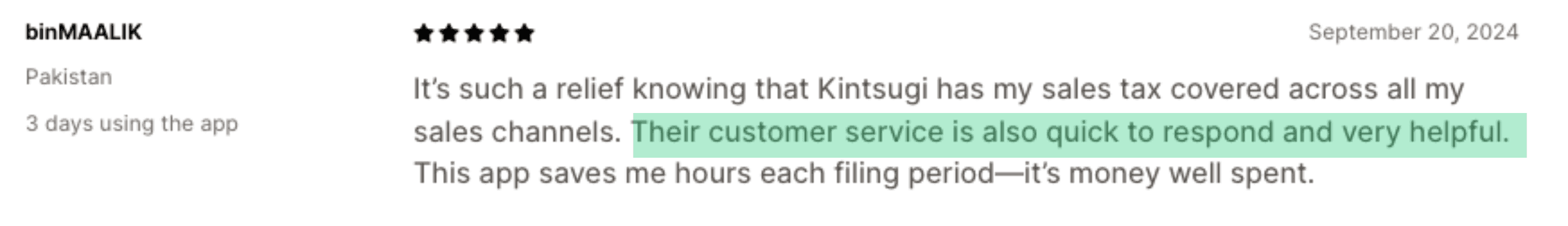

Unlike Avalara and TaxJar’s non-responsive customer support, Kinstugi’s support is available all the time and very responsive. “Their customer service is also quick to respond and very helpful. This app saves me hours each filing period – it’s money well spent,“ binMAALIK wrote.

Our customer support is not just available and responsive, they also know what they are doing. “Their support staff is both knowledgeable and helpful. A+ service!“ another Kintsugi client said.

Kintsugi values your time and money, so we make sure to deliver.

Forty percent (40%)of small businesses struggle with tax compliance because of complicated software and lack of support, according to IRS Reports.

Ease of Use and Integration

According to The State of Mobile Enterprise Collaboration, 97% of business owners prioritize ease of use over mobile application security, comprehensive features and training. However, Avalara and TaxJar users encountered several issues from onboarding to integration.

One user said they encountered several issues after “Avalara has failed to support an update the QBO rolled out“ and it reportedly takes too much time to calculate tax. “Now tax calculations [takes] 3-5 minutes to calculate…what a huge waste of time? You want to create an invoice and then send it to your customer, right? Nope, create that invoice…sit around for 3-5 minutes, make sure the sales tax shows up, then send it. Absolutely horrible,“ Tom wrote.

Meanwhile, Blake struggled with Avalara’s lack of internal integrations. According to him, “There are multiple different logins for different services/features (i.e. AvaTax, CertCapture, General Avalara account), which are frustrating.“

Additionally, they also encountered some problems when integrating 3rd party apps like NetSuite. “Also had a number of issues with our NetSuite Integrations. CertCapture required us to manually upload each state certificate for each customer, then manually review and validate each one all over again,“ he added. Blake paid a huge price for Avalara’s service, but he felt that he still had to do a lot of things – which is too much for what is supposed to be an automation system.

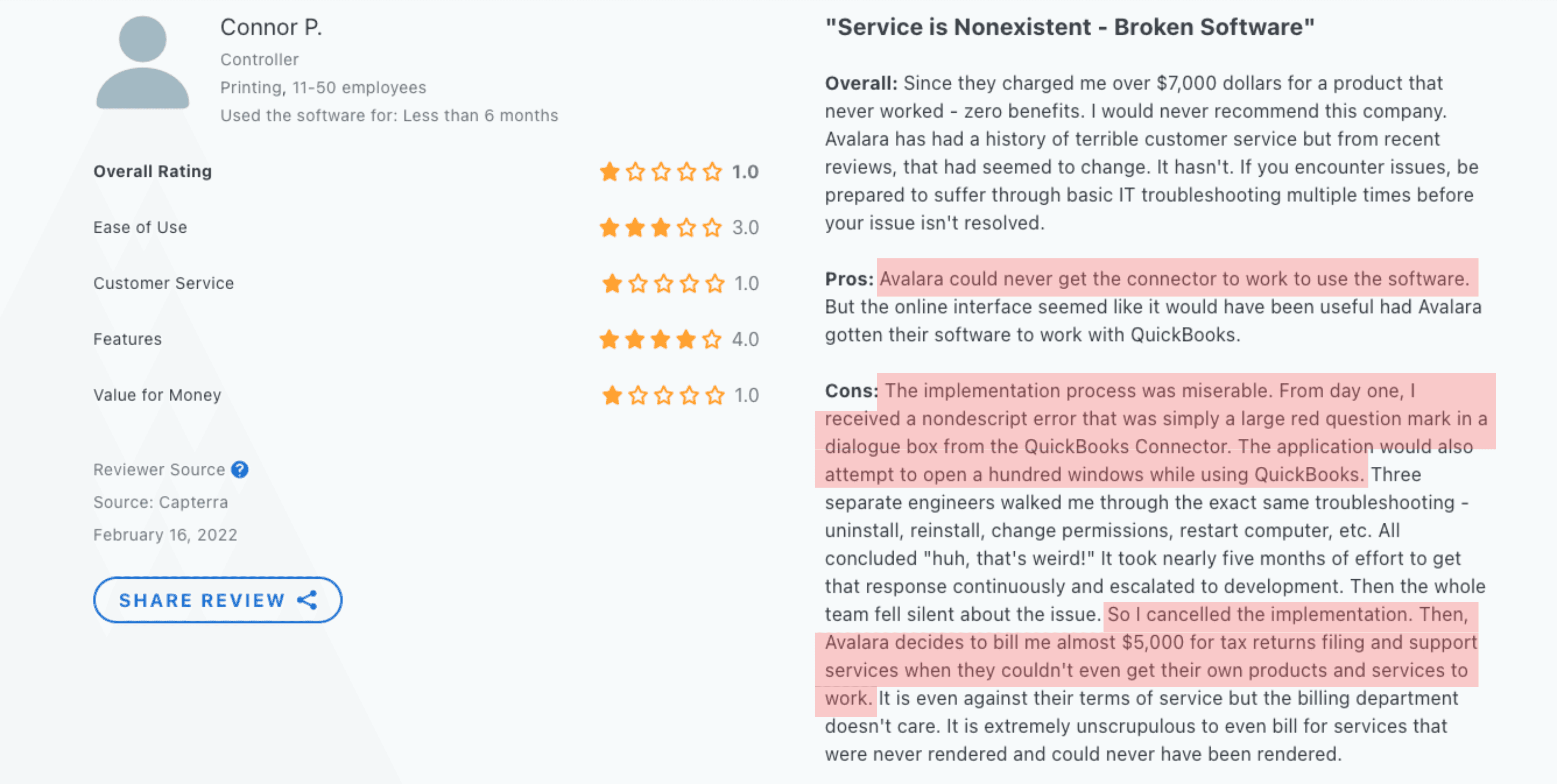

Connor P. also struggled with Avalara, particularly with QBO integration. “Avalara could never get the connector to work to use the software,“ he said.

“The implementation was miserable,“ he added. ”From day one, I received a nondescription error that was simply a large red question mark in a dialogue box from the Quickbooks Connector. The application would also attempt to open a hundred windows while using Quickbooks.”

Connor eventually decided to cancel the service, but to his disappointment, Avalara billed him nearly $5,000 when “they couldn’t even get their own products and services to work.“

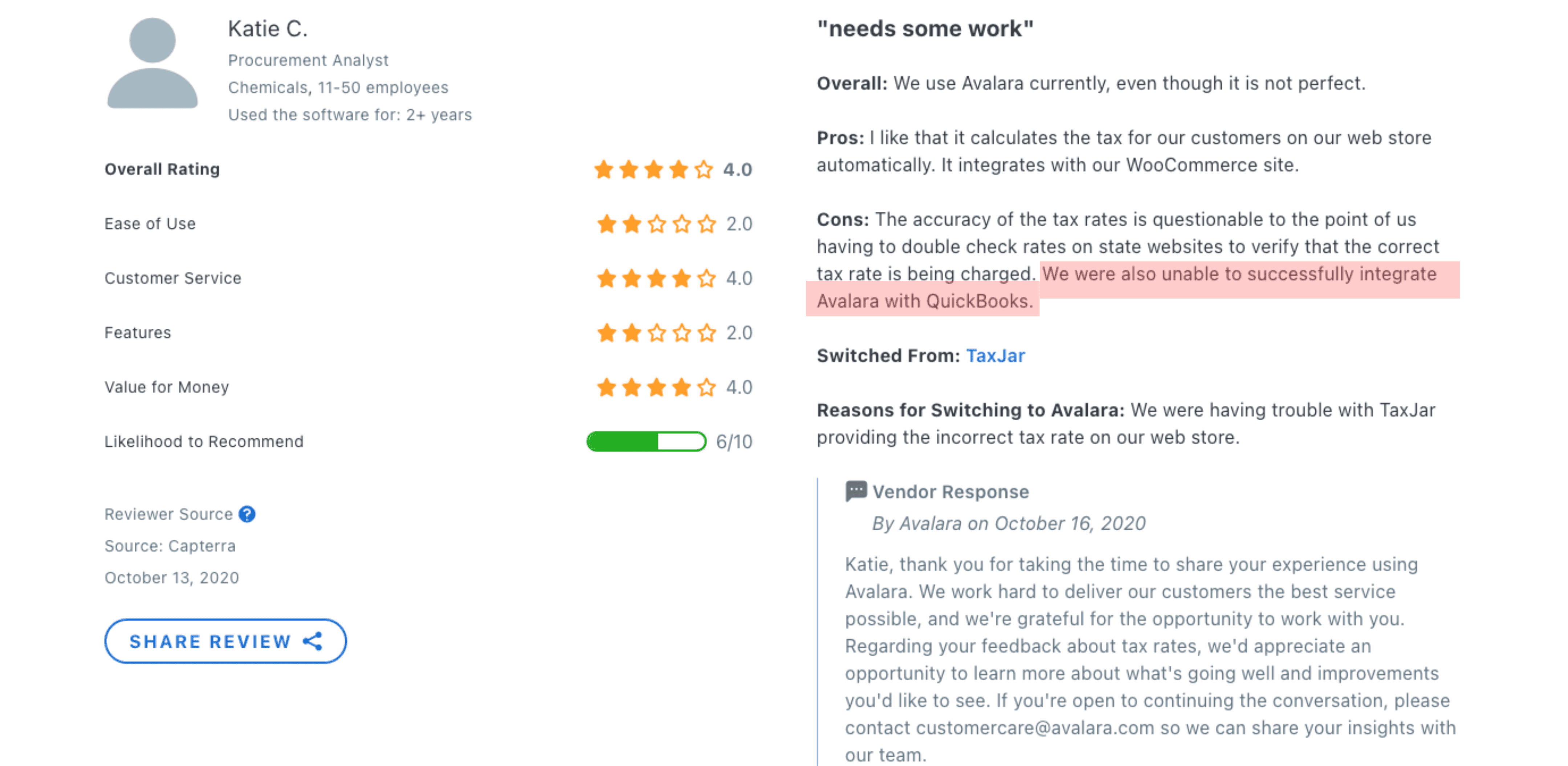

Meanwhile, Katie C.'s experience was similar to the others. She also encountered problems with QuickBooks integration. “We were also unable to successfully integrate Avalara with QuickBooks,“ she wrote.

Unfortunately, TaxJar's customers experienced similar problems. Some do not find the app user-friendly, and others have reported bugs in the system and issues with integration.

Ryan R. decided to use TaxJar for sales tax compliance. However, the platform was too complex for him to use, so he canceled the subscription.

“I did not think TaxJar was very user friendly,“ Ryan wrote. “It was hard to understand how to make things work for my business. Whenever I tried to set it up, I just became more frustrated. I finally gave up and cancelled my subscription.“

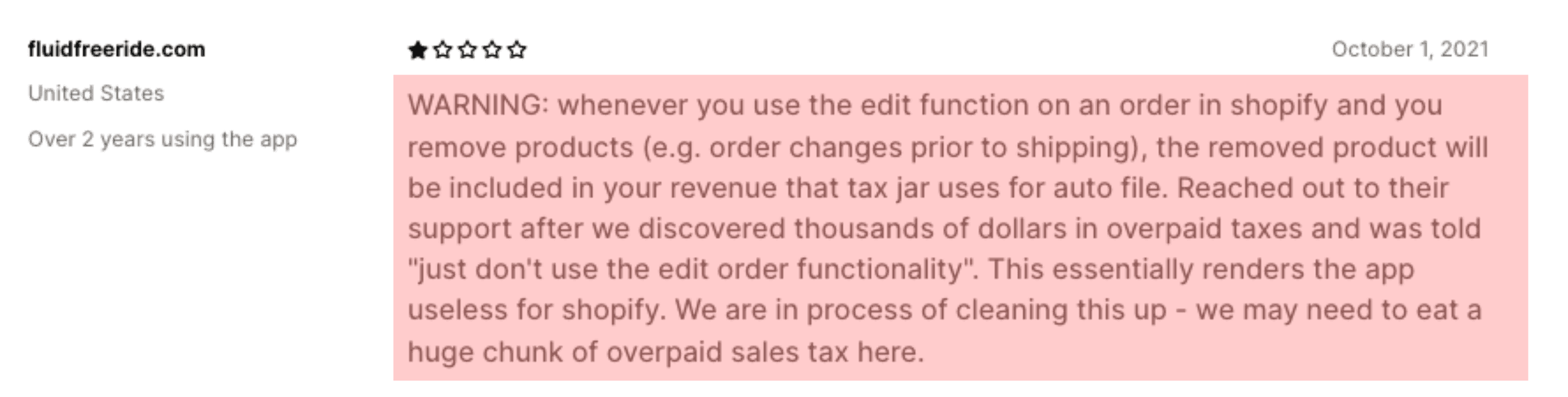

Another user said that they encountered some problems with TaxJar's “edit function,“ which reportedly “renders the app useless for Shopify.“

“Whenever you use the edit function on an order in Shopify and you remove products (e.g. order changes prior to shipping), the removed product will be included in your revenue that TaxJar uses for auto file. Reached out to their support after we discovered thousands of dollars in overpaid taxes and was told ‘just don’t use the edit order functionality,'“ the customer wrote. “This essentially renders the app useless for Shopify.“

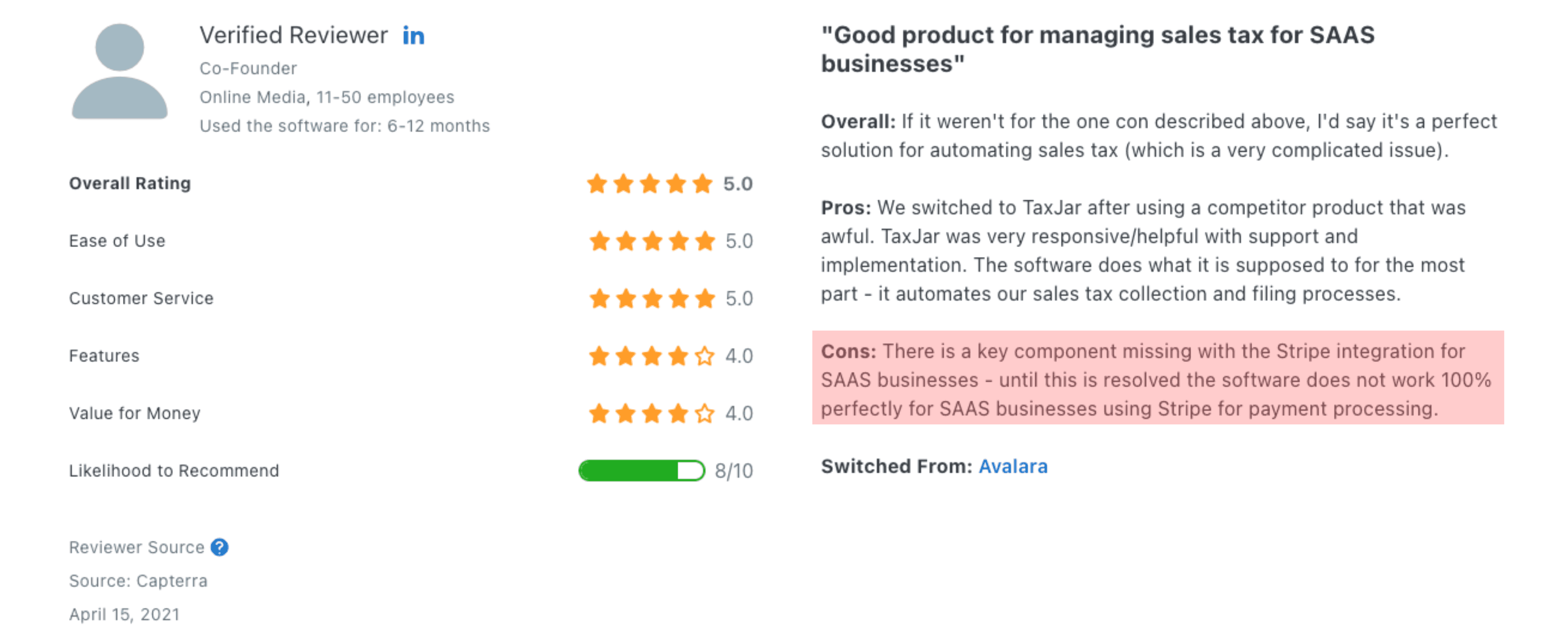

A different TaxJar user, who switched from Avalara, said the product was “good” for SAAS businesses. However, they encountered issues with Stripe integration.

“There is a key component missing with the Stripe integration for SAAS businesses - until this is resolved, the software does not work 100% perfectly for SAAS businesses using Stripe for payment processing,“ the user wrote.

Kintsugi's goal is to make your sales tax compliance a breeze and we want you to feel the convenience every step of the way from onboarding to integration. "With our no-code integration, you can easily plug your existing ERP, HR, and e-commerce into our platform."

We understand that to help save your precious time, our platform must be user-friendly and you should not spend hours or days learning it. And we are proud to say that our customers are feeling it. Some of our new customers just switched from other providers like Avalara and TaxJar.

“Setup is quick and straightforward, and once done, the sales tax filing is all automated. It easily integrated with my Shopify store,“ one satisfied customer wrote. “Thank you, Kintsugi!“

Another user switched to Kintsugi from Numeral and they were happy with their choice. “The app is user-friendly,“ the user wrote.

A former TaxJar customer also switched to Kintsugi and the experience was smooth and seamless. “Kintsugi’s onboarding process made transitioning from TaxJar effortless,“ while pointing out how “incredibly user-friendly“ our app is.

Another Kintsugi client previously used Avalara and they experienced the same stress-free transition. “Onboarding was seamless and the app’s integration from Avalara was incredibly smooth,“ Streamline Strategies wrote.

Pricing Transparency: Kintsugi vs. TaxJar vs. Avalara

Another major thing that makes Kintsugi stand out from Avalara and TaxJar is its pricing. We make sure that you get the value of your money and will not subject you to hidden charges or unwanted upgrades, which our competitors do.

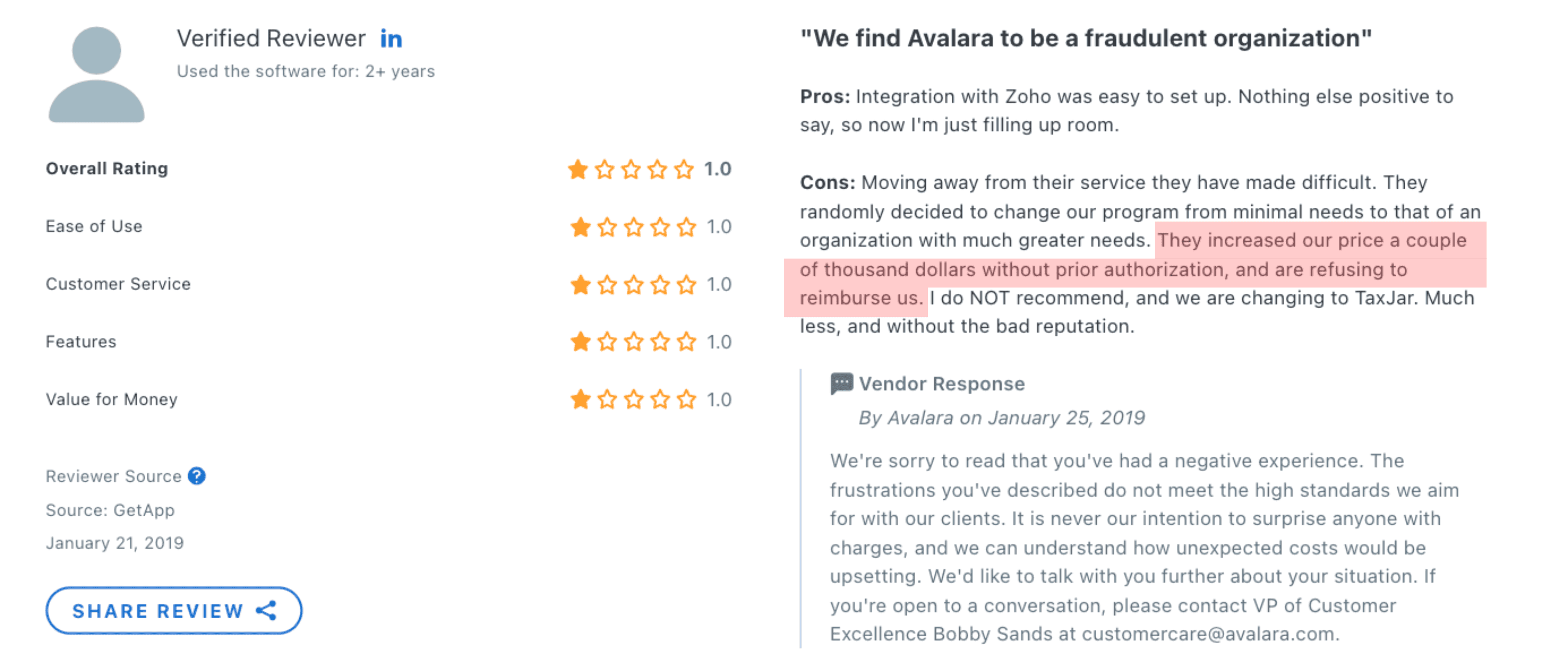

There are various complaints about Avalara’s pricing from its customers. One said their account was upgraded without their approval and they were not notified about it.

“They randomly decided to change our program from minimal needs to that of an organization with much greater needs. They increased our price a couple of thousand dollars without prior authorization and are refusing to reimburse us,“ one customer said.

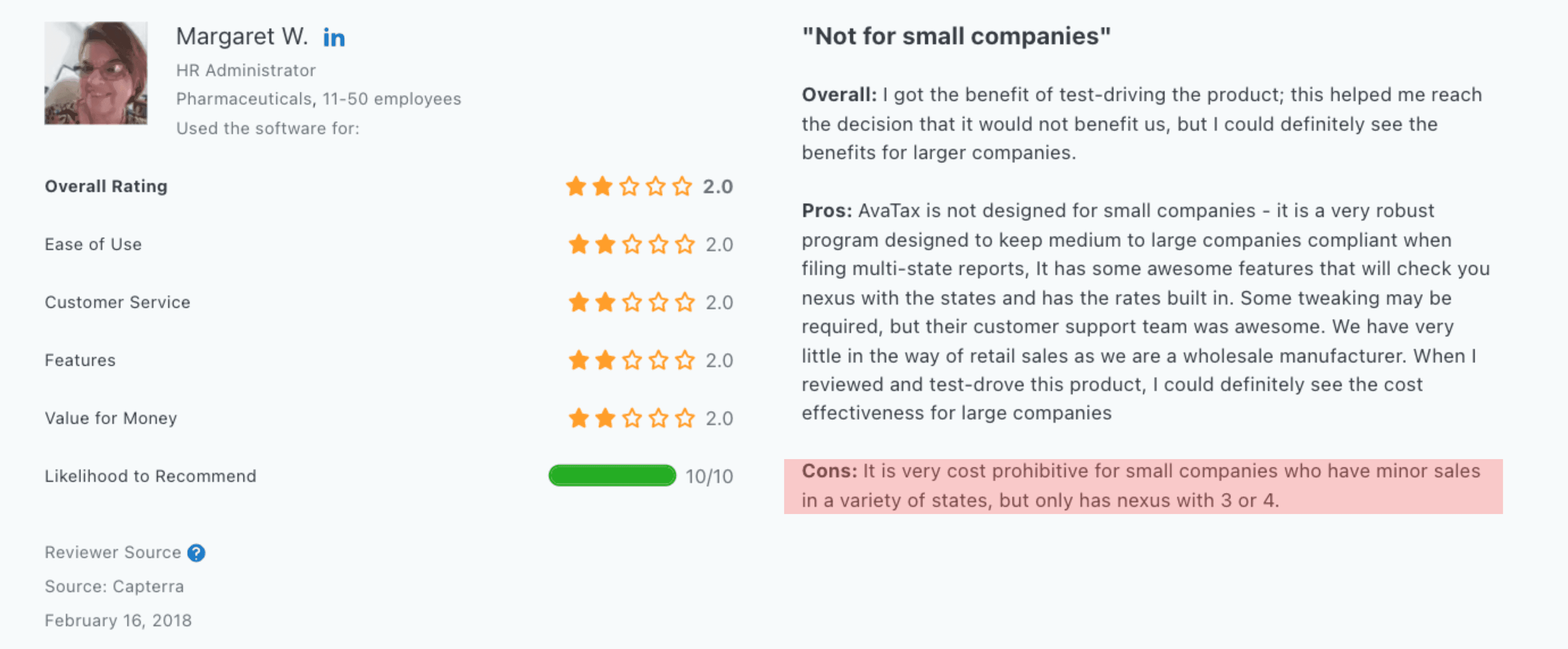

Another said that Avalara is “not for small companies“ because they are too expensive. “It is very cost prohibitive for small companies who have minor sales in a variety of states, but only has nexus with 3 or 4,“ Margaret W. said.

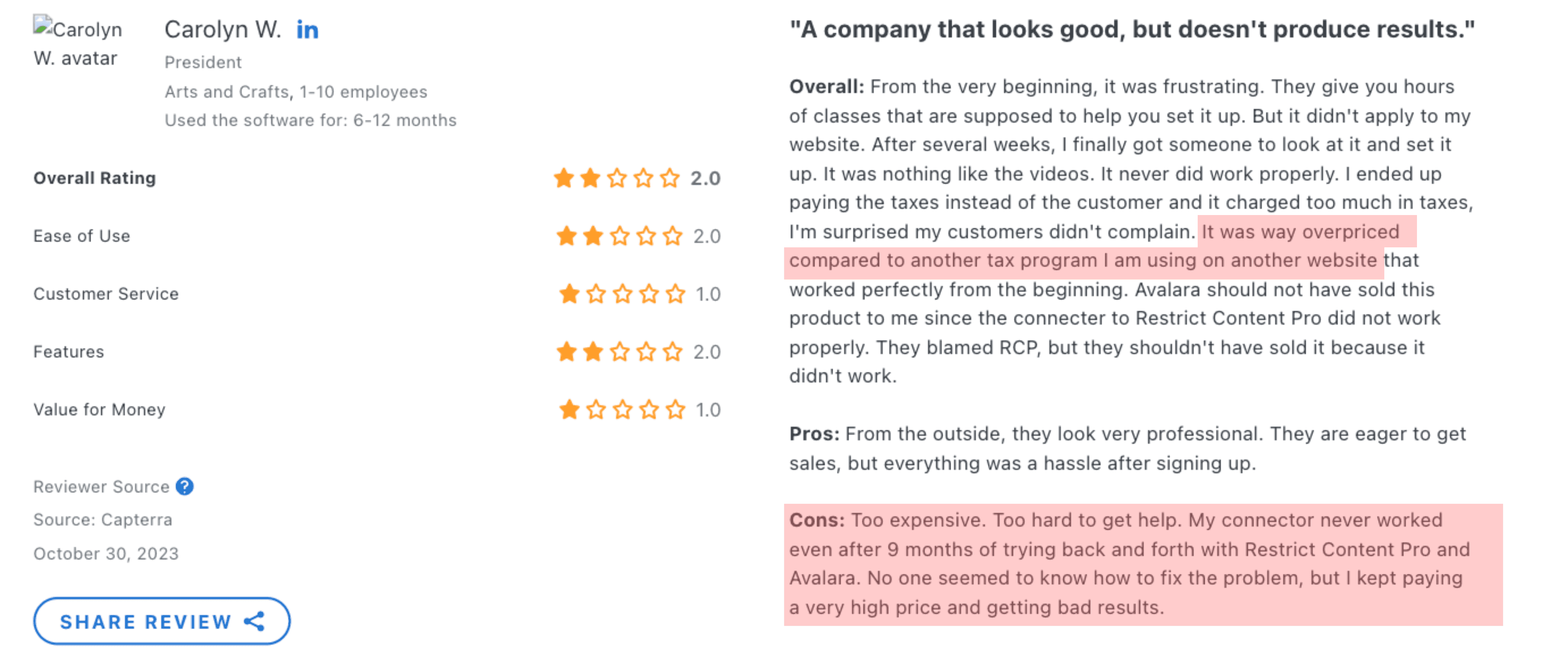

Carolyn W was another unhappy Avalara customer who believed she didn’t get the value of her money after getting the Avalara software. “It was very overpriced compared to another tax program I am using on another website,“ she wrote. Carolyn said she encountered problems using the “too expensive” sales tax software and it was “too hard get help.“ “No ,one seemed to know how to fix the problem, but I kept paying a very high price and getting bad results,“ she added.

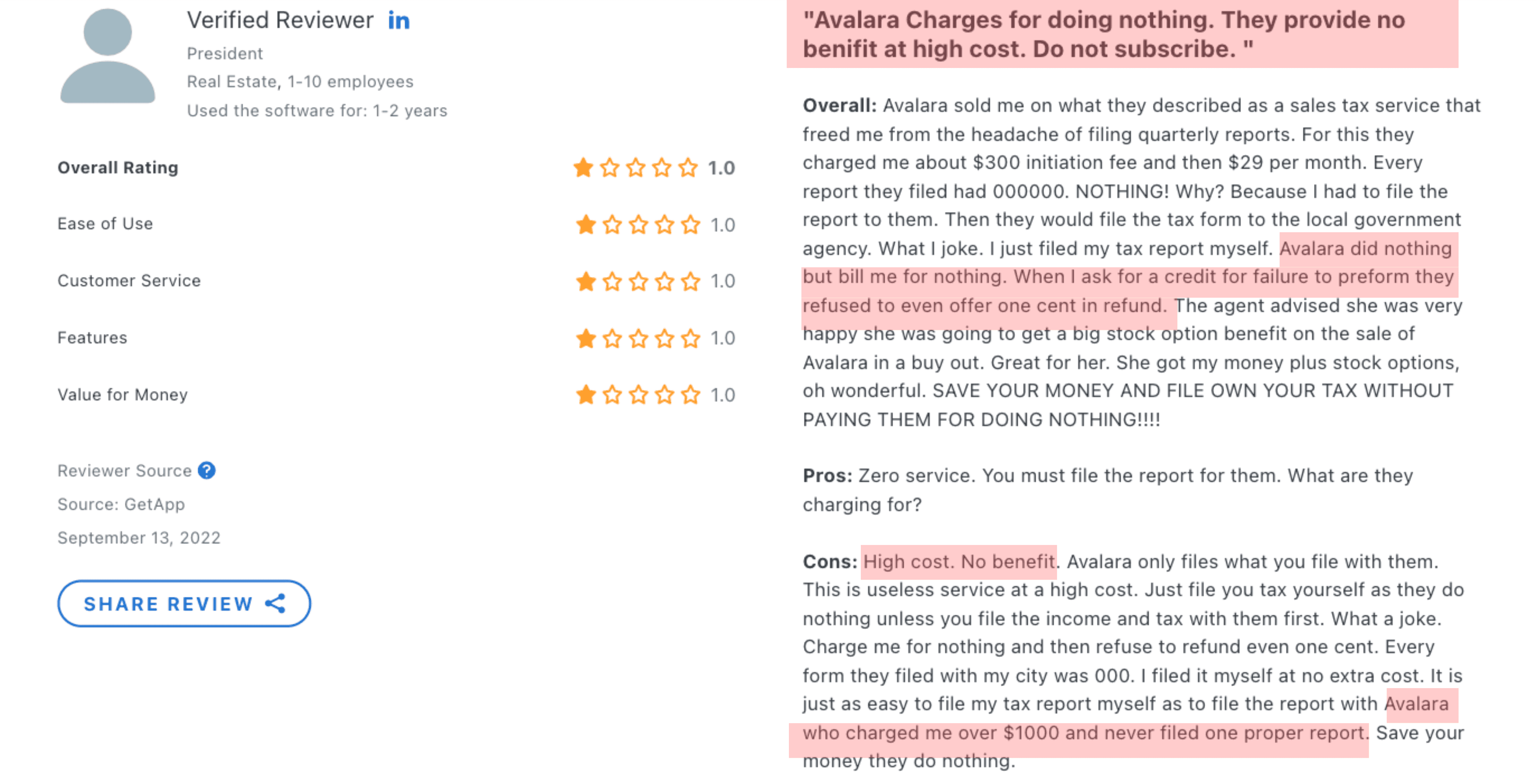

Meanwhile, another user said they paid Avalara for doing nothing and even refused to refund the payment. The customer was charged $300 initiation fee and $29 per month, but Avalara reportedly did not do anything because they filed the tax themselves. “High cost. No benefit,“ the customer wrote. “It is just as easy to file my tax report myself as to file the report with Avalara, who charged me over $1000 and never filed one proper report,“ the Avalara client said.

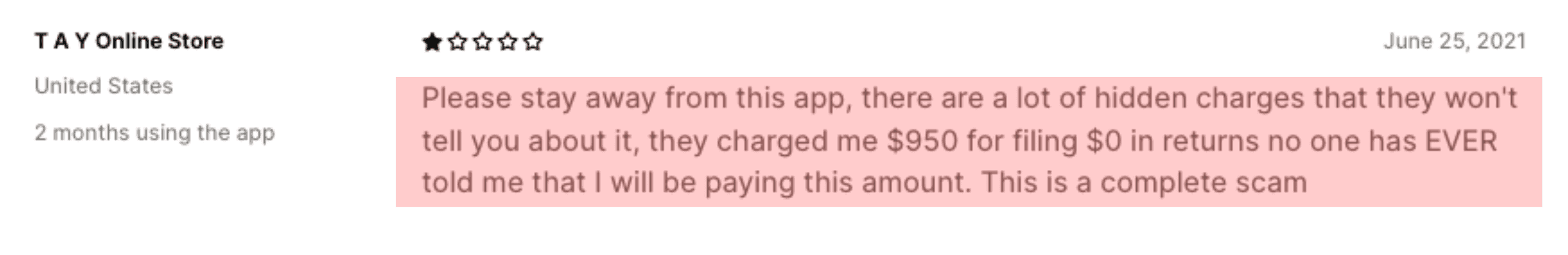

Many customers were also not happy with the way TaxJar charged them. Some said they wanted to cancel but could not reach out the customer support and were continuously charged. Several also felt that TaxJar sales tax software was a "scam" for not being transparent with the pricing and unreasonably charging them.

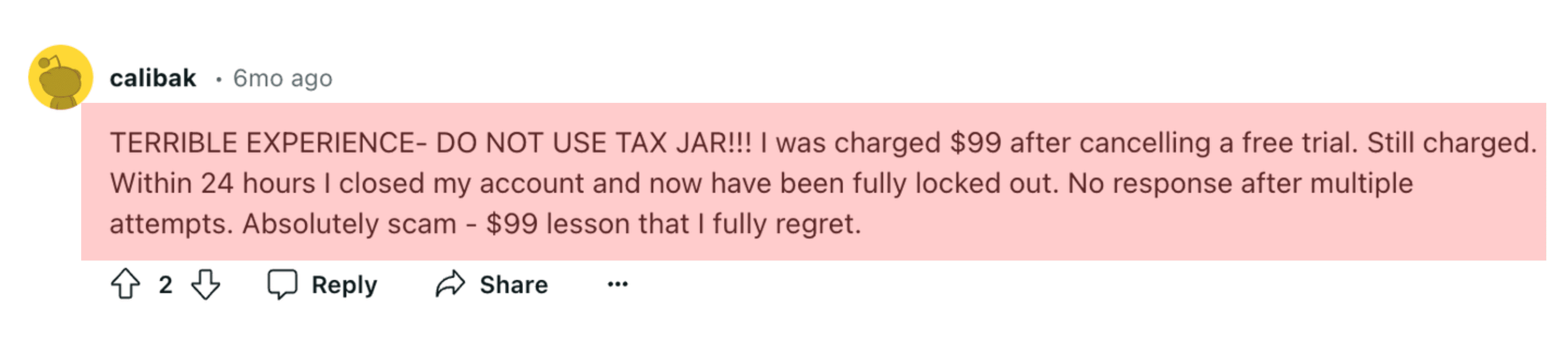

“TERRIBLE EXPERIENCE - DO NOT USE TAX JAR!!! I was charged $99 after cancelling a free trial. Still charged, within 24 hours I closed my account and now have been fully locked out. No response after multiple attempts. Absolutely scam - $99 lesson that I fully regret,“ one wrote.

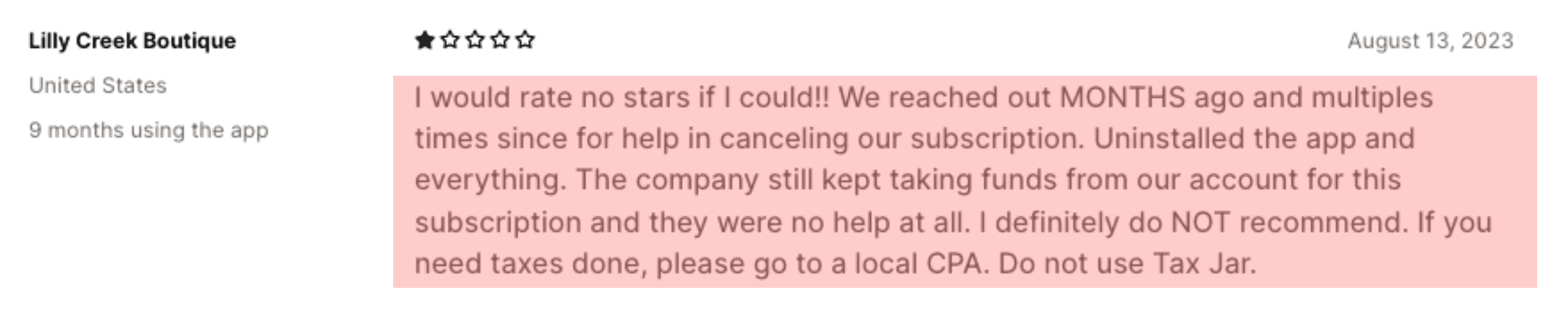

Lilly Creek Boutique said they attempted to reach out to TaxJar several times for "months" to cancel their subscription, but they were no help. Instead, TaxJar reportedly charged them continuously.

"I would rate no stars if I could!! We reached out MONTHS ago and multiple times since for help in canceling our subscription. Uninstalled the app and everything. The company still kept taking funds from our account for this subscription, and they were [of] no help at all," Lilly Creek Boutique wrote.

Another TaxJar user urged other business owners to consider other automation sales tax providers because of the unexpected charges they incurred. “Please stay away from this app, there are a lot of hidden charges that they won’t tell you about it.“

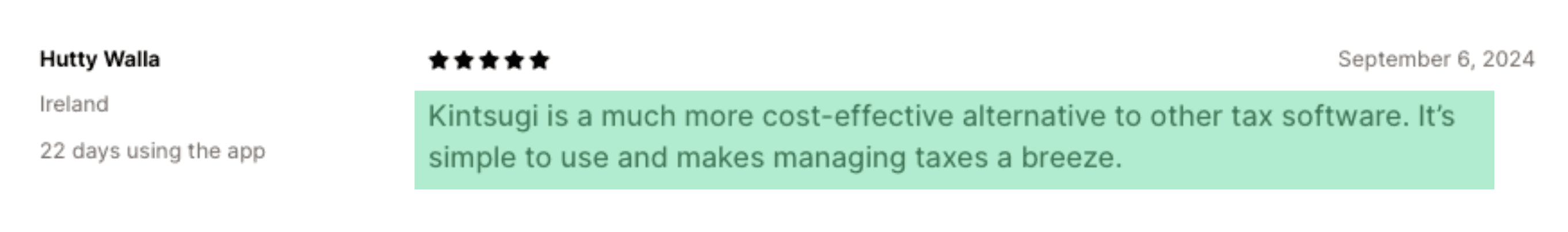

On the other hand, Kintsugi customers are happy with their experience with us, and we receive no complaints about pricing, unhidden charges, or unwanted upgrades. We offer transparent pricing and tons of free services, including a free plan, free nexus monitoring, free address validation, and free advanced CSV importing. So, anyone can use Kintsugi for free.

More features are available in the Premium plan, including multi-country support, error insurance, and voluntary disclosure agreements (VDAs). For VDAs, customers must work with our sales department to discuss the scope.

Plus, we do not require credit cards or long-term contracts. With our pay-as-you-go service, you will not be subjected to any unnecessary charges. You can pay us every month, but only when we file or register you.

With Kintsugi you enjoy flexible pricing with no annual commitments. View Kintsugi plans and pricing.

“Kintsugi is a much more cost-effective alternative to other tax software. It’s simple to use and makes managing taxes a breeze,“ Hutty Walla wrote.

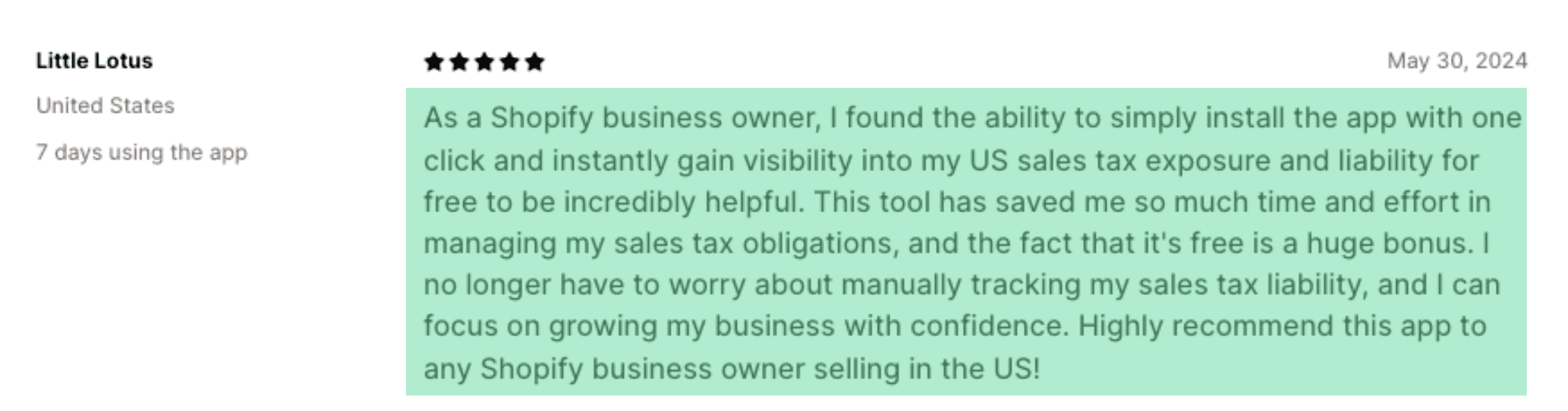

Another user enjoyed Kintsugi’s free services. “As a Shopify business owner, I found the ability to simply install the app with one click and instantly gain visibility into my US sales tax exposure and liability for free to be incredibly helpful,” Little Lotus wrote.

“This tool has saved me so much time and effort in managing my sales tax obligations, and the fact that it’s free is a huge bonus. I no longer have to worry about manually tracking my sales tax liability, and I can focus on growing my business with confidence. Highly recommend this app to any Shopify business owner selling in the US!“

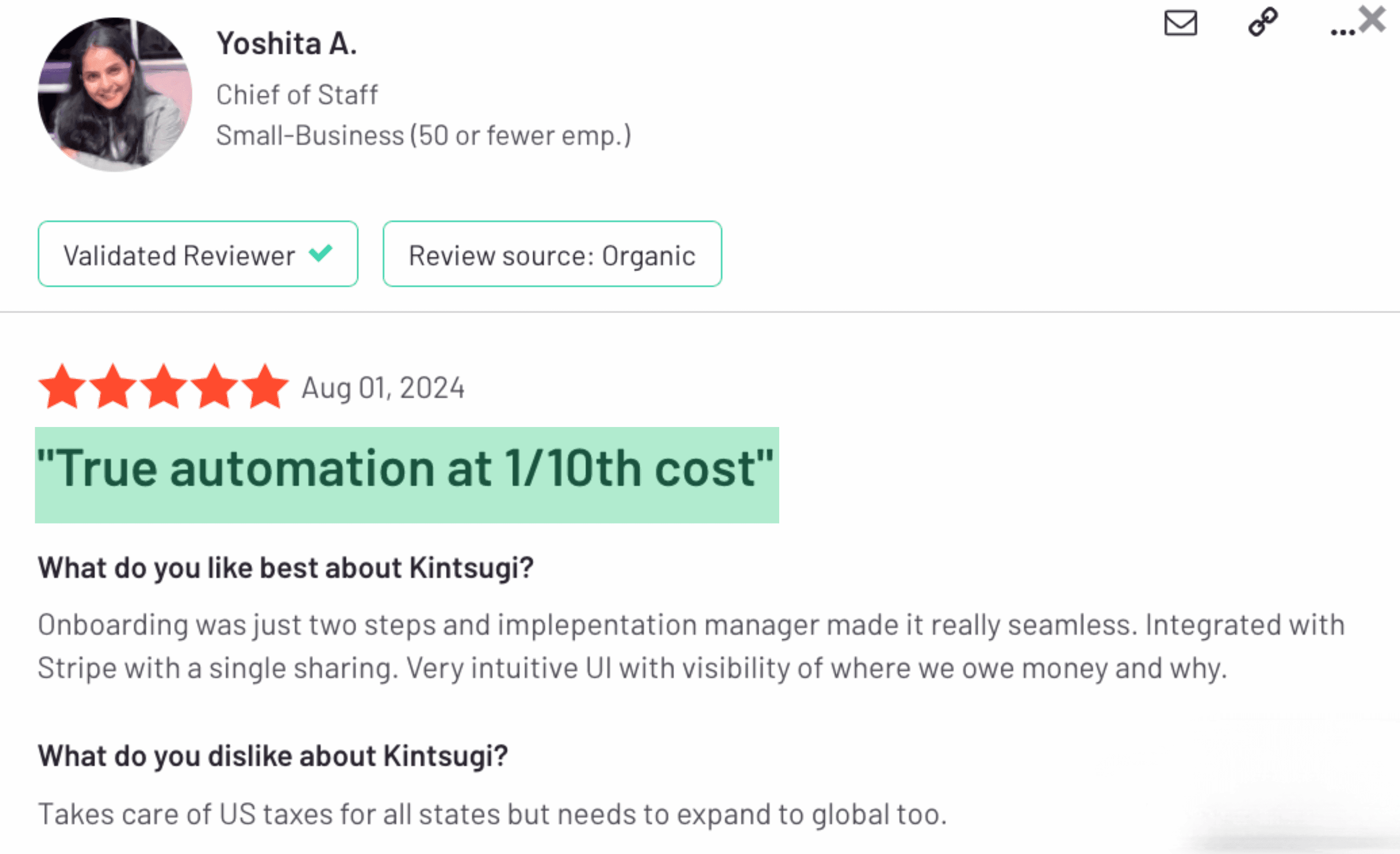

Meanwhile, Yoshita A. was very satisfied with our pricing. In fact, she felt that our service was very affordable compared to other sales tax automation providers.

“True automation at 1/10 cost,” she wrote.

Final Verdict: Is TaxJar or Avalara Better Than Kintsugi Sales Tax Software

Although TaxJar and Avalara are popular sales tax software for automating tax filing and tax returns, they are not necessarily the best option. If your business sells enough to reach the sales tax nexus and want a different experience, you should consider other sales tax software solutions like Kintsugi.

Overall, Kintsugi is the best sales tax automation provider among the three. With Kintsugi, you will enjoy automatic registration in every jurisdiction, free real-time nexus tracking and alerts, convenient remittance, one-click sales tax exemption application, and accurate and timely sales tax filing.

Even if Kintsugi is new in the market, those who switch to our platform were happy they did. Kintsugi delivers accurate tax calculations, has responsive and knowledgeable customer support, no-code integrations, and transparent pricing. Rest assured that there will be no hidden fees or surprising charges. We are proud to say that we only have 5-star reviews on Shopify. So, book a demo now or sign up for free.