Flywheel: Scaling Product-Led Growth with Kintsugi’s Seamless Sales Tax Compliance

Ready to automate your sales tax?

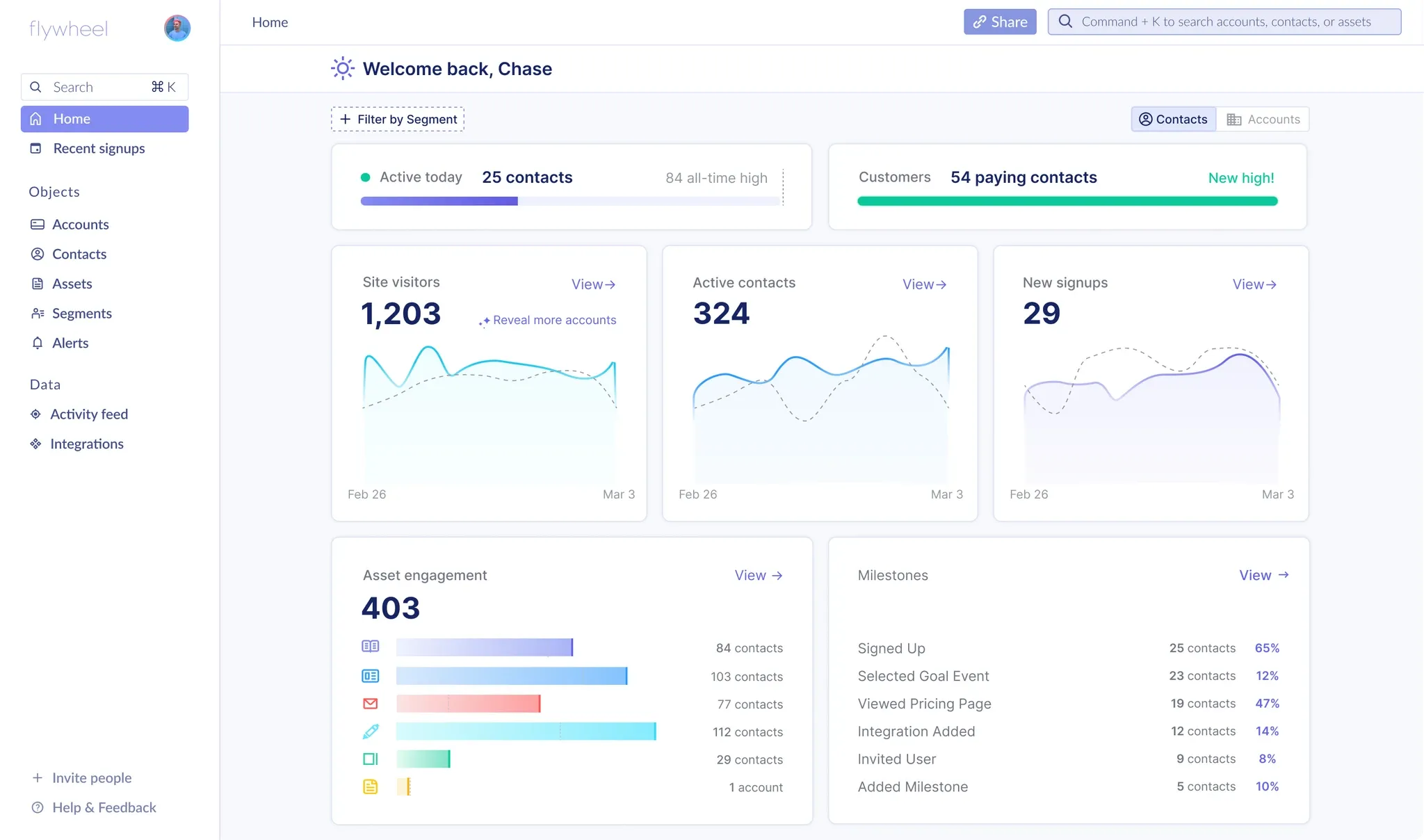

Flywheel, a leading marketing analytics tool founded in 2019, specializes in helping B2B software companies engage, understand, and convert accounts.

Known for its strong Product-Led Growth (PLG) strategy, Flywheel has found itself rapidly expanding into the US market. But as they grew, so did the complexities of managing sales tax compliance across multiple states. Here's how Kintsugi became the essential partner Flywheel needed to navigate their tax challenges and continue scaling effortlessly.

Flywheel’s Challenge: How to Best Manage Their Ballooning Sales Tax Obligations While Also Growing Rapidly

Flywheel’s foray into the US market brought on some immediate challenges requiring immediate attention – namely, figuring out how to manage complicated sales tax regulations for a growing, national customer base.

As a SaaS provider, Flywheel was required to register and file taxes in 15 states — a daunting task for their small finance team already stretched thin by the company’s rapid growth. Initially, Flywheel relied on Stripe for payment processing but soon realized that compliance involved much more than simply collecting tax.

"We thought we were covered by just using Stripe, but then we learned we were far from compliant," recalls Chase Wilson, Flywheel's CEO. "We needed a solution fast — something that would take the complexity out of the equation so we could just focus on growing our business."

It was a tough pill to swallow for Flywheel. They realized that properly managing sales tax was not just a compliance issue; it was a significant distraction from Flywheel’s core mission.

"We thought we were covered by just using Stripe, but then we learned we were far from compliant." – Chase Wilson, Flywheel’s CEO

Their internal finance team found themselves overwhelmed by the need to manually manage registrations, filings, and keeping themselves up-to-date on the constantly-shifting landscape of state, county, city, and home-rule sales tax regulations.

Flywheel’s Solution: Using Kintsugi’s Seamless Integrations and Automations to Outsource Sales Tax Compliance Once and For All

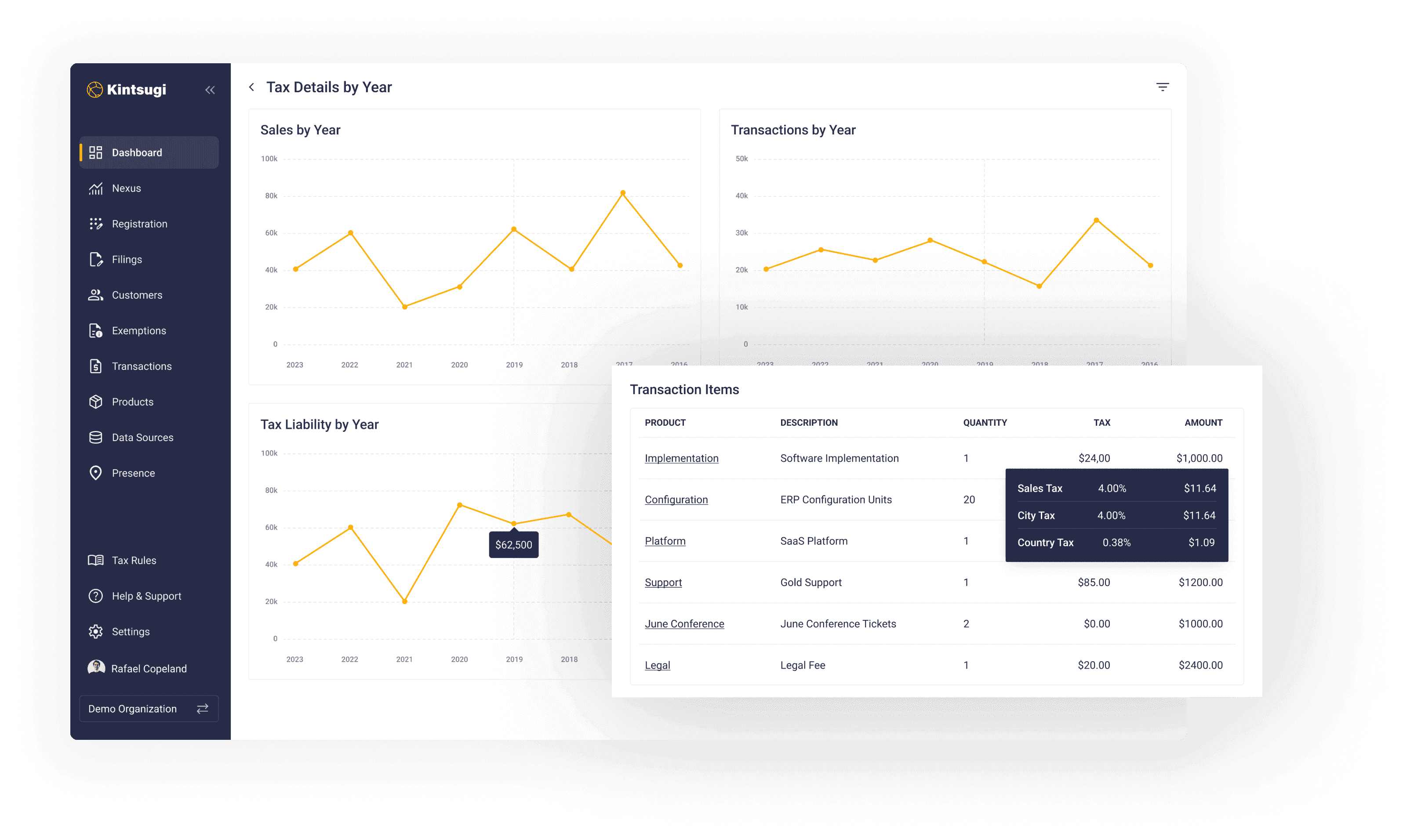

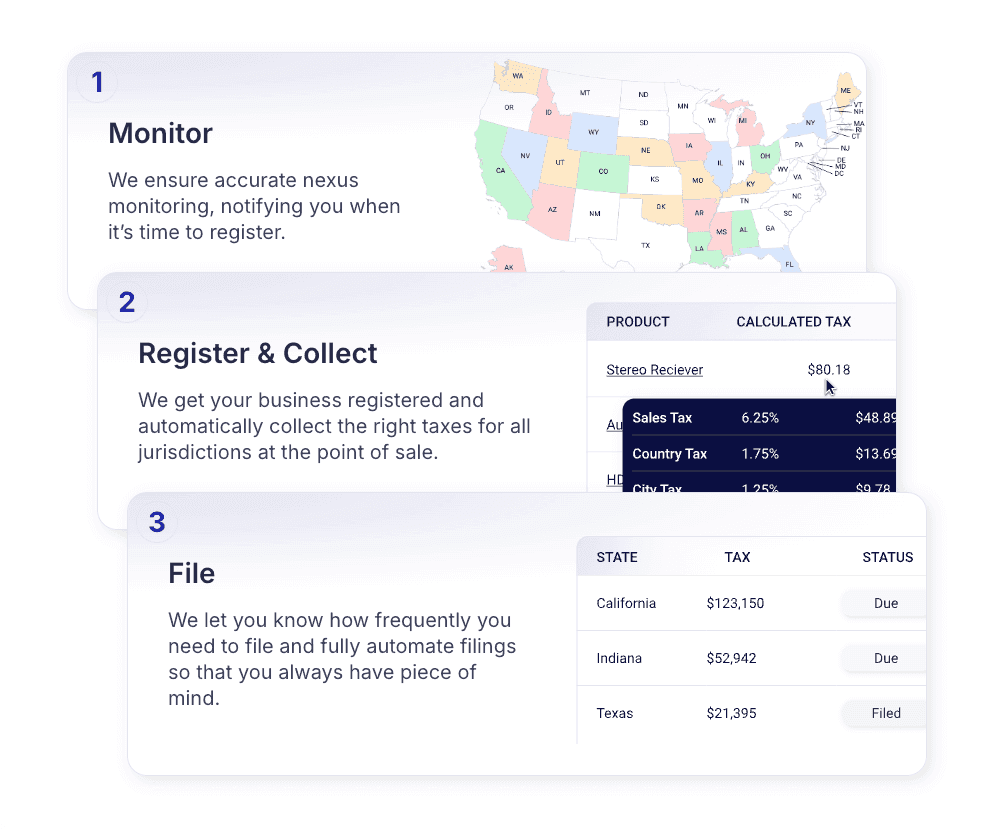

In their search for a better solution, Flywheel turned to Kintsugi, attracted by its prebuilt integration with Stripe and deep expertise in sales tax automation. Within minutes of signing up, Flywheel realized the full scope of their compliance gaps, and Kintsugi’s intuitive platform immediately got to work.

“One of the first steps was setting up business registrations in the 15 states where we had to file,” Chase explains. “Kintsugi walked us through the entire process, making sure we were set up correctly from day one.”

“The automation was a game-changer — it handled everything from tax calculations at the point of sale to monthly filings, all without any manual input from our team.”

For Flywheel, Kintsugi didn’t just offer a tool; they provided a partner.

With their hands-on and customer-centric approach, Kintsugi’s team of certified, in-house sales tax experts guided Flywheel through the particular complexities of their compliance environment, ensuring that every registration was complete and that every filing was “rooftop-level” accurate.

This hands-on, personalized service was exactly what Flywheel needed to satisfy their unique concerns and re-energize their focus on growing their customer base.

Kintsugi’s Impact: Empowering Flywheel’s Growth with Peace of Mind

With Kintsugi handling nearly all of the heavy lifting on sales tax compliance, Flywheel’s team could unblock and redirect their efforts toward what they do best — delivering a stellar product and continuing to drive customer growth.

Kintsugi’s automated system meant that the finance team no longer had to worry about missed filings or compliance missteps. Everything was automated, accurate, and easy to manage.

"I can't even imagine how we would have managed compliance manually," Chase reflects. "Kintsugi made it simple. We were able to expand our PLG efforts in the US without constantly looking over our shoulders about sales tax."

Since partnering with Kintsugi, Flywheel has enjoyed seamless tax compliance, freeing up valuable time and resources to focus on scaling their business.

Kintsugi’s one-click integration with Stripe allowed for automatic tax calculations at the point of sale, while Kintsugi’s “Returns” feature ensured timely filings across all of the states they were required to file in. For Flywheel, Kintsugi’s ease of use and reliable automations were not just a convenience — they became a necessity on their way to unlocking sustainable growth.

For Flywheel, Kintsugi’s ease of use and reliable automations were not just a convenience — they became a necessity on their way to unlocking sustainable growth.

Flywheel’s “Lessons Learned”

Customer Growth Enablement Requires a True End-to-End Automation Solution

Kintsugi’s prebuilt integration with Stripe made tax calculations and filings a seamless part of Flywheel’s daily operations. Previously, this was not a fully-automated process for them. As Chase looks toward the future, he sees Kintsugi as a key partner for any further expansions, knowing that whatever challenges lie ahead, they’ve got the right support to keep them compliant and focused on the most important thing – growth.

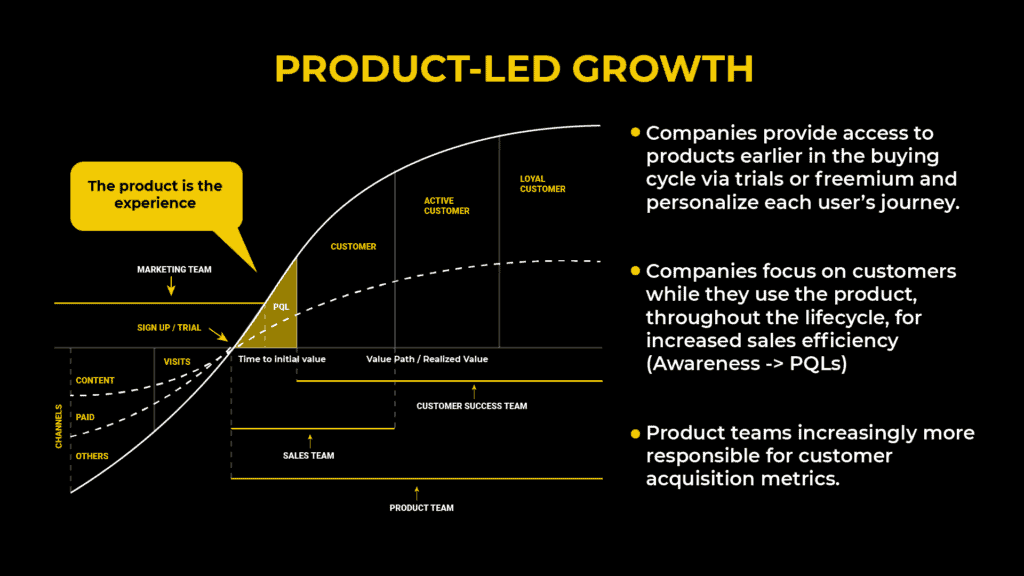

Product-Led Growth in SaaS Works Best When Companies Optimize for Scalability at the Onset

By automating tax compliance, Kintsugi enabled Flywheel to continue expanding their product-led growth in the U.S. market without the added stress of sales tax management. With Kintsugi an evergreen partner by their side, Flywheel is set to continue its impressive growth trajectory, confident that their sales tax compliance is handled by Kintsugi’s trusted experts.

Excellent Customer Service Is Not a Nice-to-Have – It’s a Necessity

Kintsugi’s dedicated in-house sales tax experts provided ongoing support for all sorts of thorny questions, ensuring Flywheel’s sales tax compliance was always on track. If they ever had notices to take care of, Kintsugi was not only there to answer any questions, but also to assuage any anxieties and take care of it quickly and expertly – and in just a few clicks.

For more information on Flywheel, visit their website here.

About Kintsugi

Based in San Francisco and founded in 2022, Kintsugi is dedicated to taking the stress out of sales tax compliance. Our platform automates the entire process, delivering high performance, reliability, and flexibility as your business scales.

Kintsugi is secure, encrypted, GDPR-compliant, and SOC 2 Type II certified, adhering to the highest standards for security, availability, processing integrity, confidentiality, and privacy.

Learn more about Kintsugi’s platform and integrations here.