Top Avalara Competitors to Simplify Tax Automation in 2026

09 December

Ready to automate your sales tax?

Sign up for free

Avalara is widely known for automating sales tax calculations and filing. But as tax regulations and compliance requirements are growing more complex, the demand for advanced tax compliance tools are rapidly increasing. Although Avalara has been one of the most recognized names in the tax automation industry for years, it may not always be the best fit for every company.

In this article, we explore some great Avalara alternatives and competitors to help you find the best solution for your business.

About Avalara

Avalara is a legacy tool in the sales tax automation space, used by thousands of businesses worldwide. It simplifies sales tax management by automating tax calculations, filing, compliance, and reporting. It is an enterprise solution built to support high transaction volumes and multiple jurisdictions. Designed to serve a wide range of industries, Avalara offers a mature solution with deep tax coverage.

Key Features

-

Real-time tax calculations for sales tax, VAT, GST, and more based on location, shipping, and jurisdictional rules.

-

Automated product code classification to ensure accurate tax calculations and reduce audit risk.

-

Exemption certificate management to track, validate, and store tax-exemption certificates.

-

Automated return filings and remittance for better tax returns preparation and submission.

-

Pre-built integration ecosystem to connect with ERPs, ecommerce platforms, accounting software, and other applications.

Reasons You’re Probably Looking for an Avalara Alternative

Despite Avalara's established market position, many users are looking for alternatives. Here are some of the reasons that typically push them to consider switching.

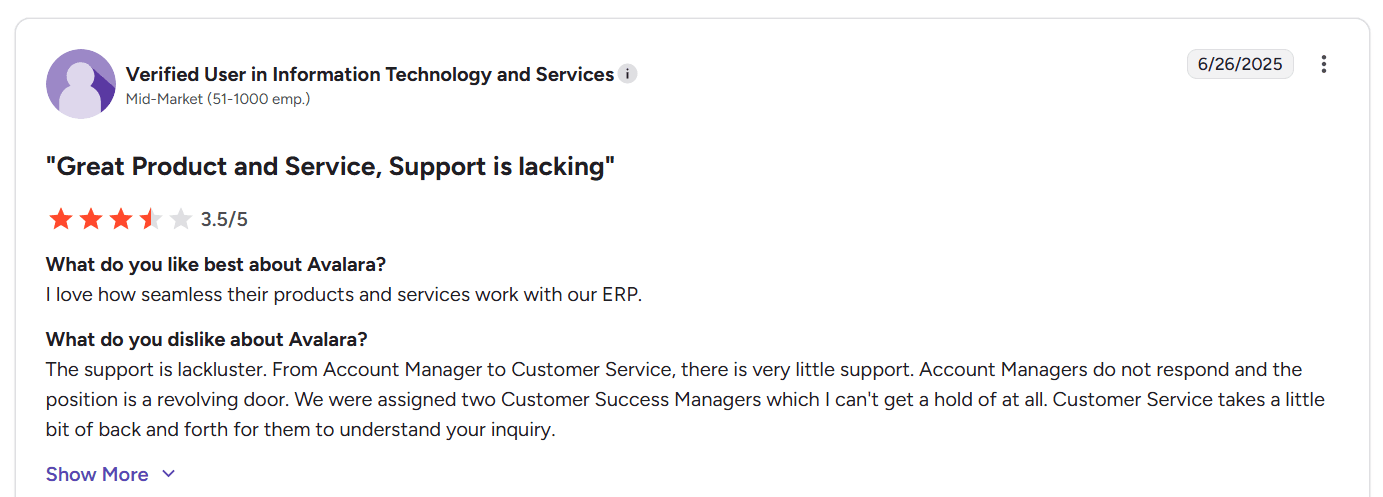

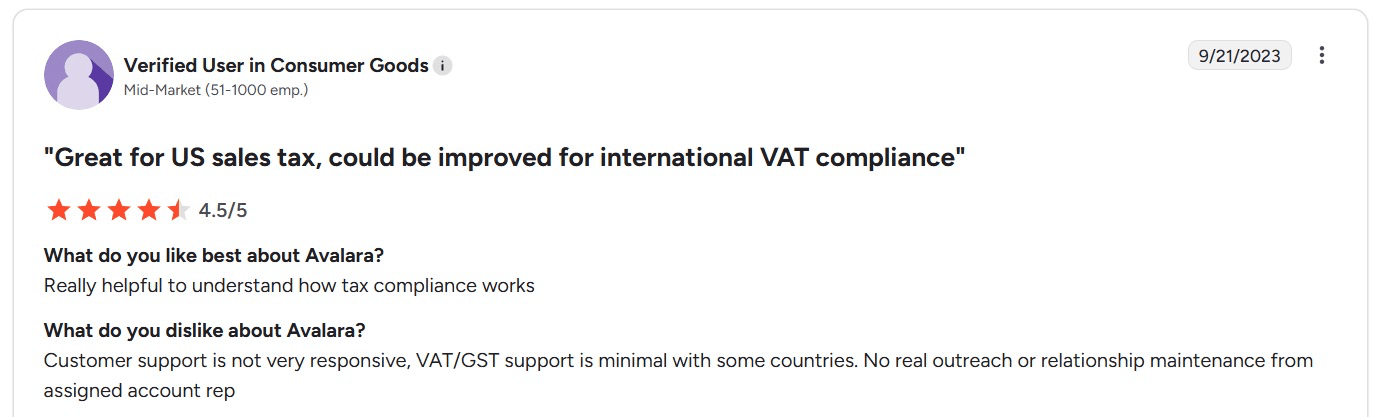

1. Support Issues

One of the most common complaints from unsatisfied Avalara users is regarding its customer support. There have been numerous reviews on G2 that point out its poor customer support. The users do not receive direct answers to their queries, which can be overwhelming considering the field is as complicated as tax compliance.

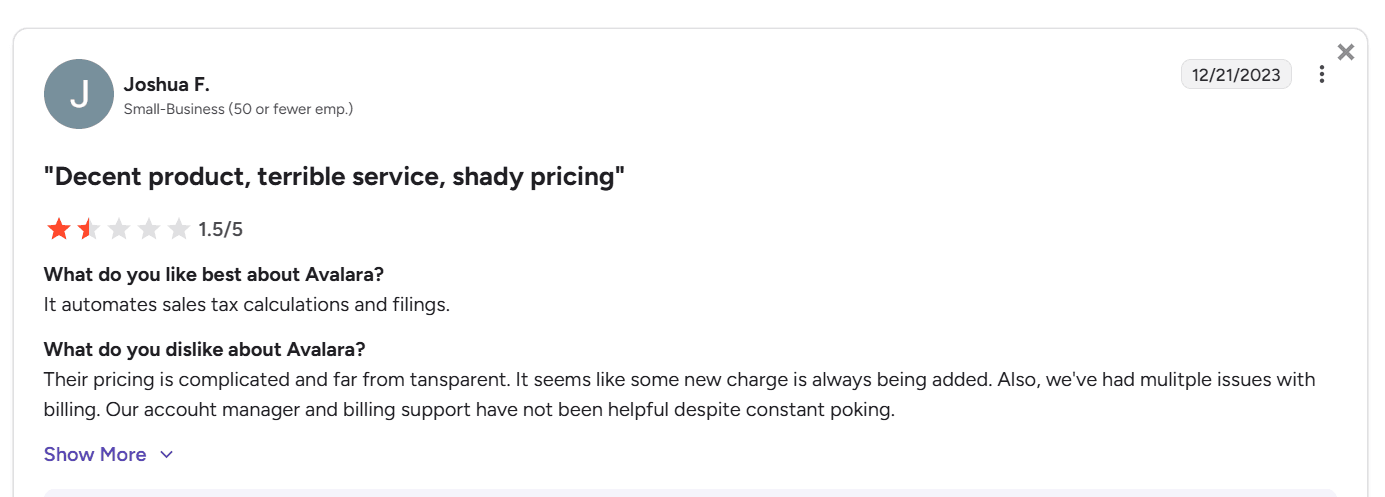

2. Complicated Pricing

Avalara is widely known for its complicated and opaque pricing structures. The pricing includes subscription fees, filing fees, per-transaction costs, and additional charges for API usage and support. Further, the credit system that Avalara uses can be confusing as well. Thus, making it hard to predict total expenses. This can be frustrating for companies trying to manage their budgets.

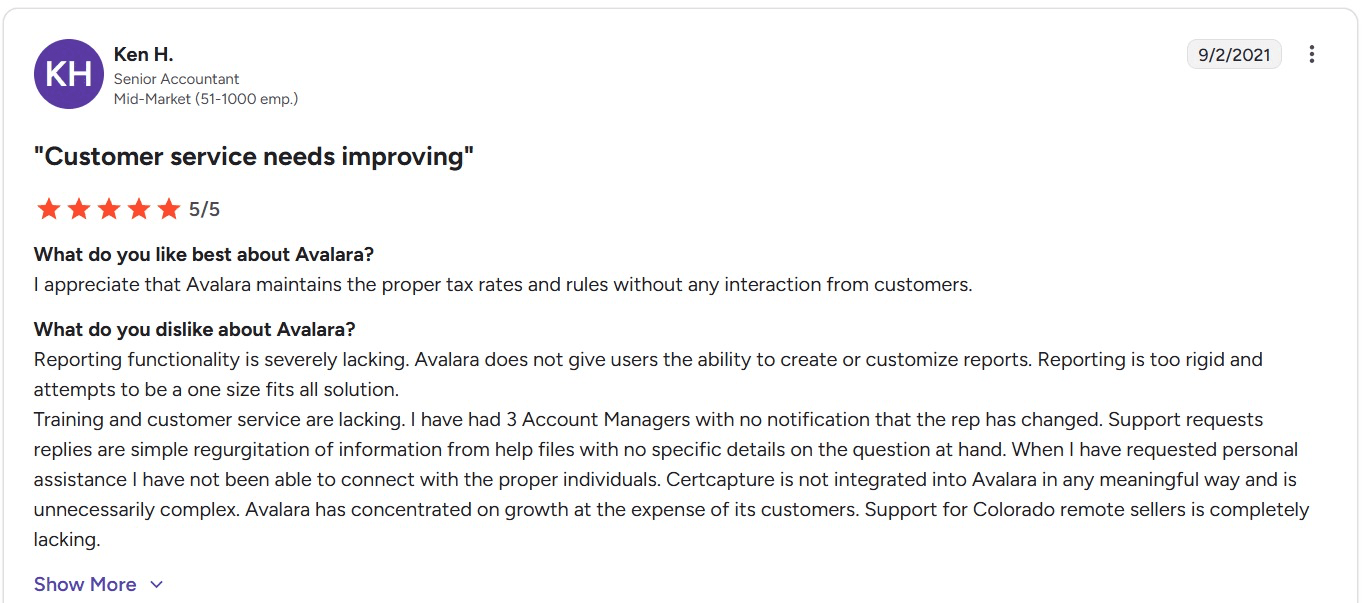

3. Inability to Automate Reports

Avalara’s reporting features are limited in flexibility. Generating custom reports or automating recurring reporting workflows can require manual export, additional tools, or technical workarounds. This increases administrative burden for finance teams and makes compliance tracking less efficient.

4. Limited Global Coverage

While Avalara excels at U.S. sales tax and supports some international tax rules, businesses selling in multiple countries sometimes encounter gaps. Handling VAT, GST, or local digital tax regulations may require additional modules or third-party integrations, complicating global compliance.

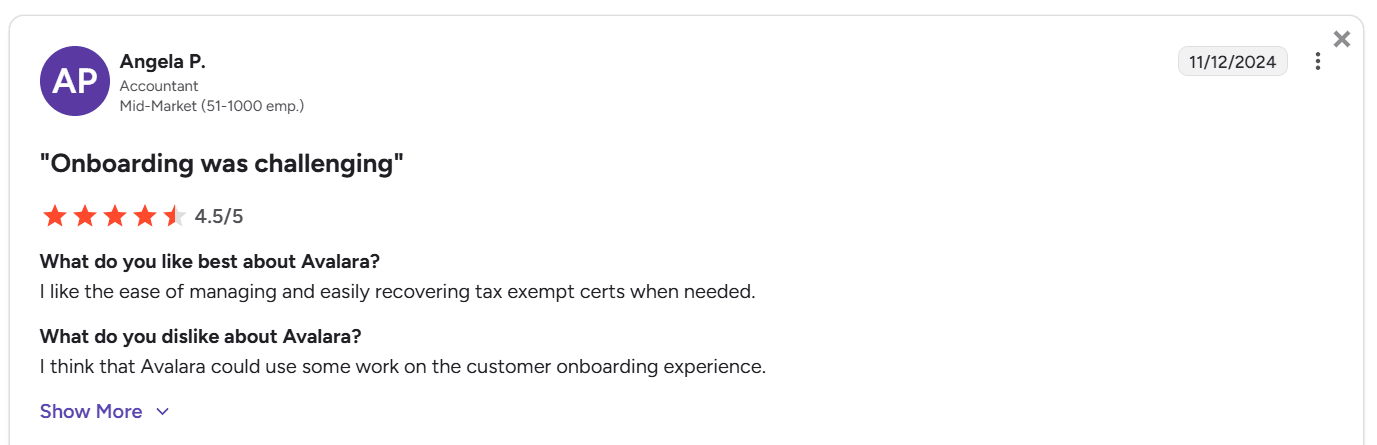

5. Onboarding Experience

Avalara users describe software onboarding as complicated. Instead of simplifying, it adds to their workload. Setting up tax codes, integrating with ERP or ecommerce platforms, and configuring exemption workflows often takes more time and resources than expected. The same goes for product training.

Top 10 Avalara Competitors in 2026

Here are the top Avalara competitors that are worth considering.

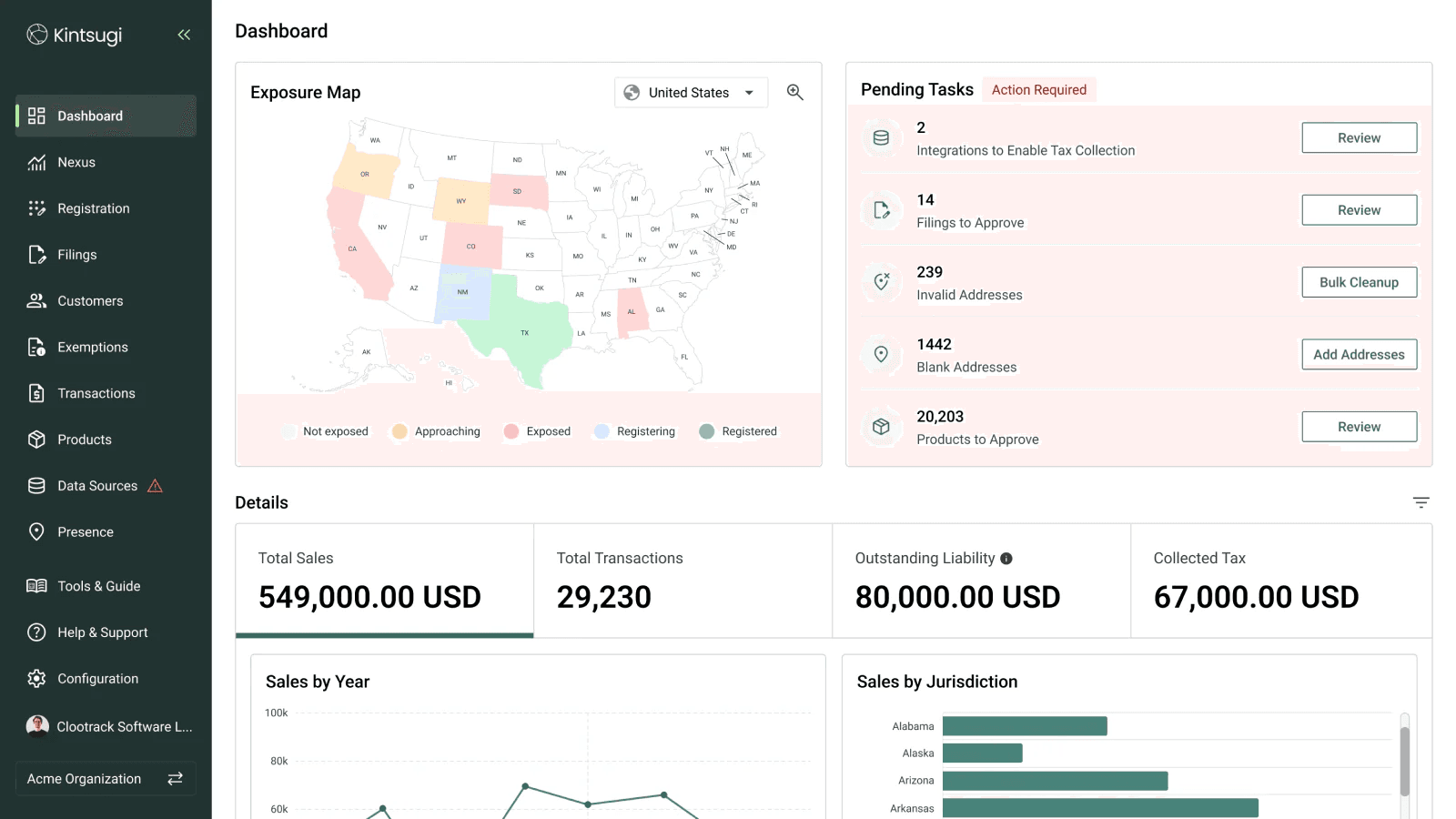

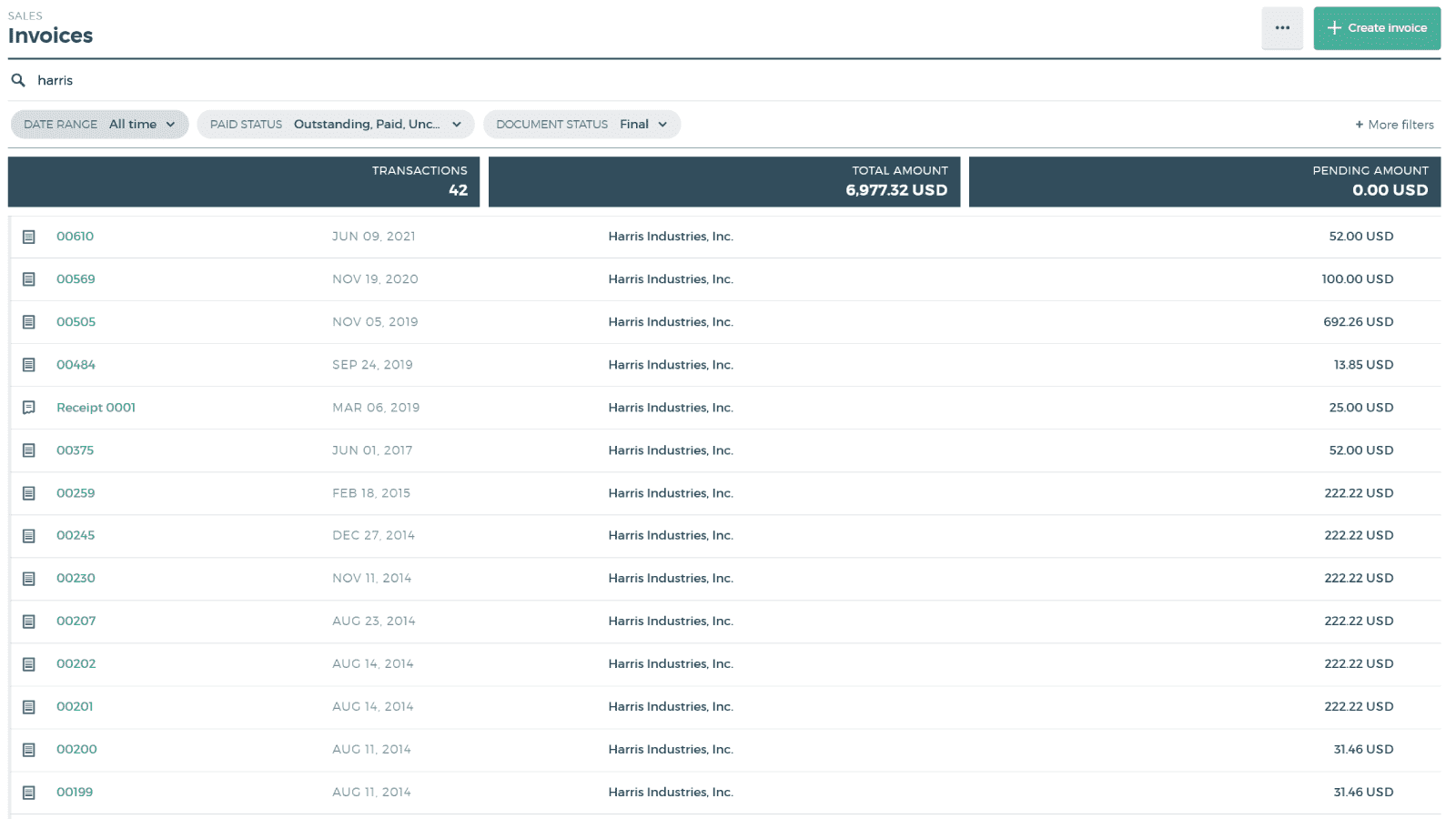

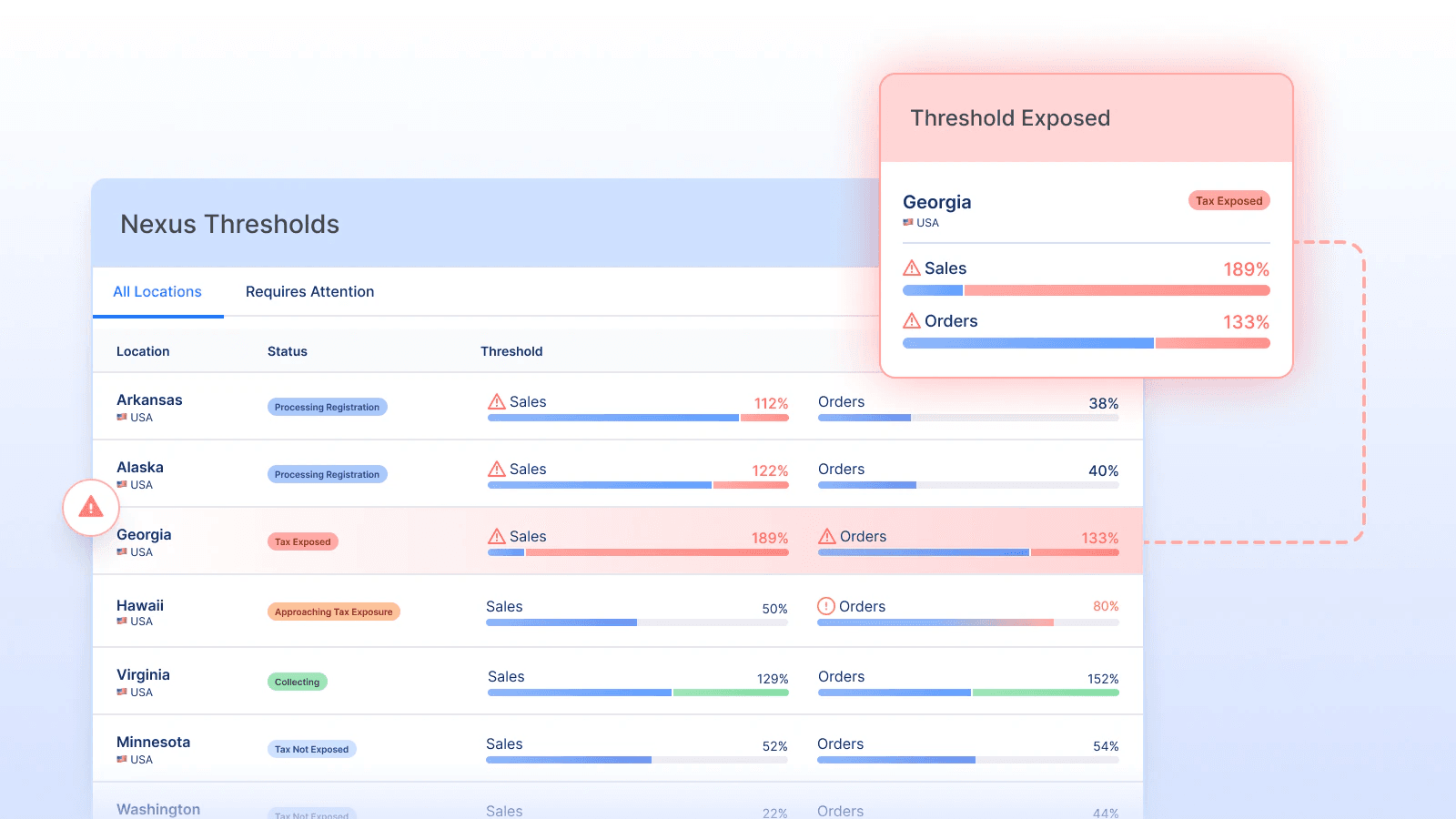

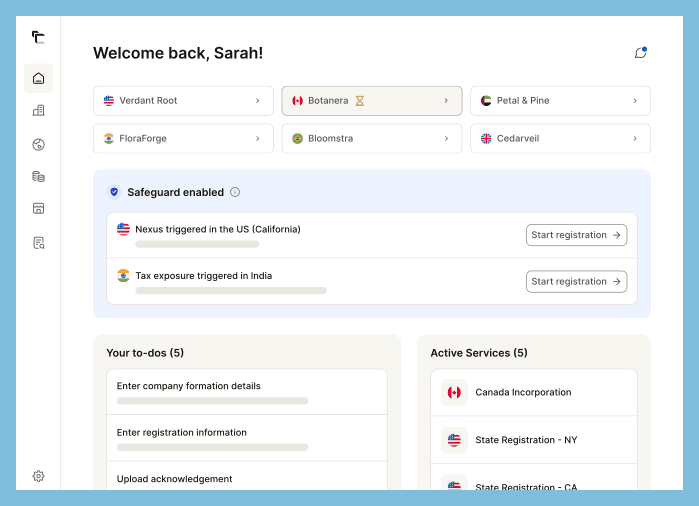

1. Kintsugi

Kintsugi is the best Avalara alternative that offers a modern tax automation solution for digital businesses, SaaS platforms, and ecommerce businesses. It offers an end-to-end solution that manages everything from sales tax calculations to automated filings.

Unlike Avalara, Kintsugi combines AI-driven automation with human tax expert support and onboarding, allowing founders to get compliant fast, and focus their time back on growing the business.

Since it is designed for subscription, usage-based, and cross-border digital transactions, this Avalara alternative fits naturally into modern product and billing workflows. It focuses on handling the unique tax challenges of SaaS products, subscription plans, and digital transactions without the overhead of a full enterprise tax system. For example, mid-cycle subscription changes, cancellations, and more.

It is everything Avalara promised but without the complexity or exorbitant pricing. Thus, making it one of the best alternatives to Avalara.

Key Features

-

Automates nexus threshold tracking and sends exposure alerts in real time.

-

Offers advanced machine-learning-driven tax rule updates and product classification.

-

Provides a virtual mailbox for managing notices from tax authorities.

-

Provides Kintsugi Sheets to sync tax and transactions data from Kintsugi directly into Google Sheets for generating custom reports.

Kintsugi vs Avalara

Kintsugi is built with digital-first companies in mind. It offers a more flexible tax automation solution compared to Avalara’s broad enterprise platform. Its API-driven design allows you to integrate tax logic exactly where it is needed without the stress of Avalara’s extensive configuration.

Kintsugi delivers all the essential tax automation capabilities you would expect from Avalara. But, it wraps them in a simpler, more modern system with several innovative features designed specifically for digital-first businesses. You can read more about how Kintsugi compares with Avalara in this detailed article - Kintsugi vs Avalara.

Turn sales tax from a recurring nightmare into a recurring automation

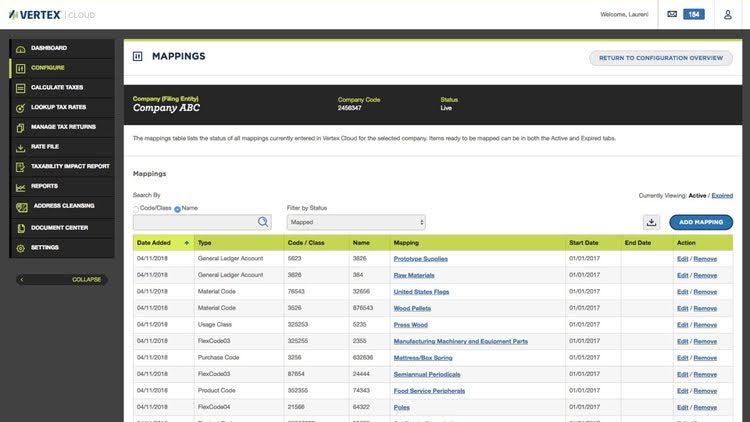

2. Vertex

The next solution in this list of Avalara competitors is the legacy tool, Vertex. This enterprise-level tax automation platform simplifies complex sales management and tax compliance. With the help of its AI-powered engine, it can generate highly detailed reports, transaction logs, and audit trails for your financial documentation.

The next solution in this list of Avalara competitors is the legacy tool, Vertex. This enterprise-level tax automation platform simplifies complex sales management and tax compliance. With the help of its AI-powered engine, it can generate highly detailed reports, transaction logs, and audit trails for your financial documentation.

Key Features

-

Offers a smart global tax calculation and reporting engine.

-

Files return to the appropriate jurisdictions automatically.

-

Supports integration with legacy ERP systems. For example, SAP and Oracle.

Vertex vs Avalara

Vertex offers a more enterprise-focused solution when compared to Avalara. Its powerful integrations with large ERP solutions make it a preferred choice among multinational companies with highly complex tax requirements. Vertex also offers far more control and customization options than Avalara.

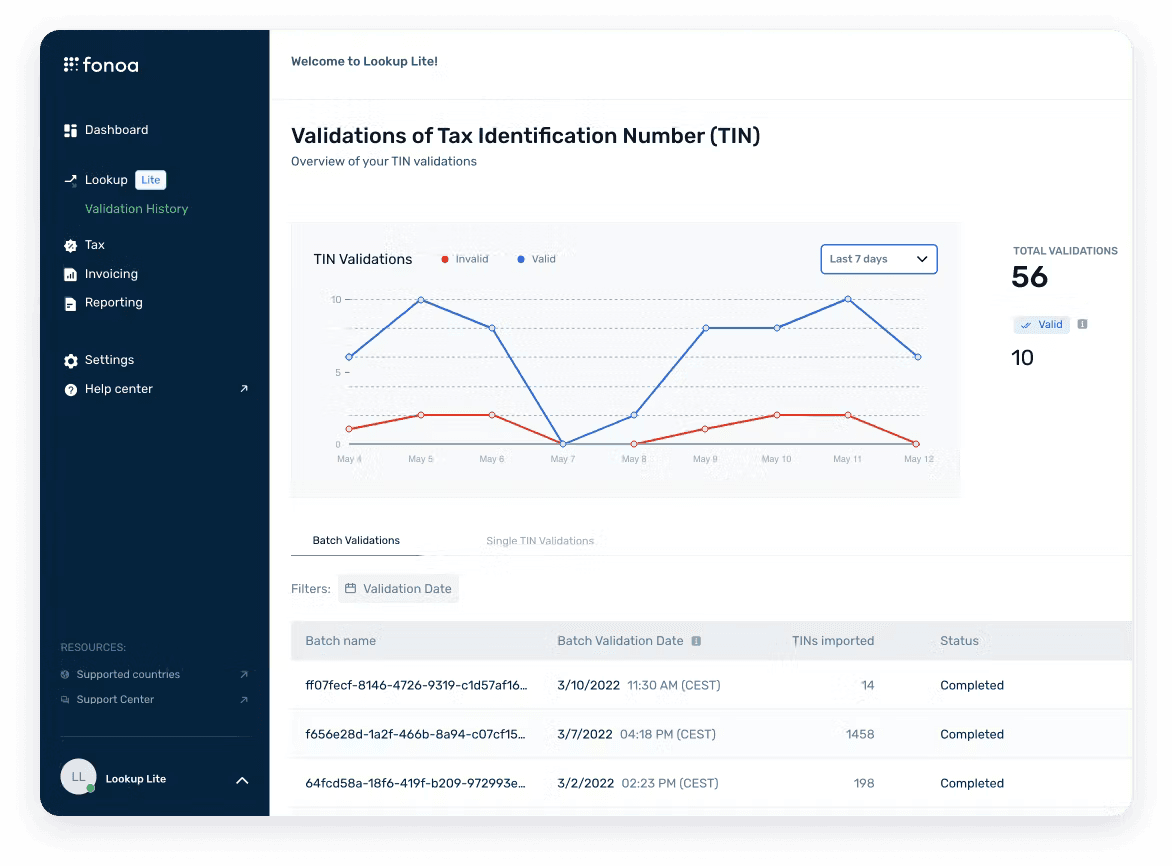

3. Fonoa

Fonoa is the next among Avalara alternatives that you may consider if you are a digital-first organization. It is designed to simplify global tax automation with its VAT, GST, and sales tax capabilities. It also supports global compliance by making the management of complex international tax requirements much easier.

Key Features

-

Offers a suite of tax automation products for global tax calculations.

-

Automates tax-ID verification process to reduce errors.

-

Offers automated reporting and compliance workflows.

Fonoa vs Avalara

Fonoa is purpose-built for digital-first businesses like SaaS, marketplaces, and ecommerce companies. Unlike Avalara, it focuses heavily on global tax automation. Hence, it is an ideal choice for companies dealing with cross-border digital transactions.

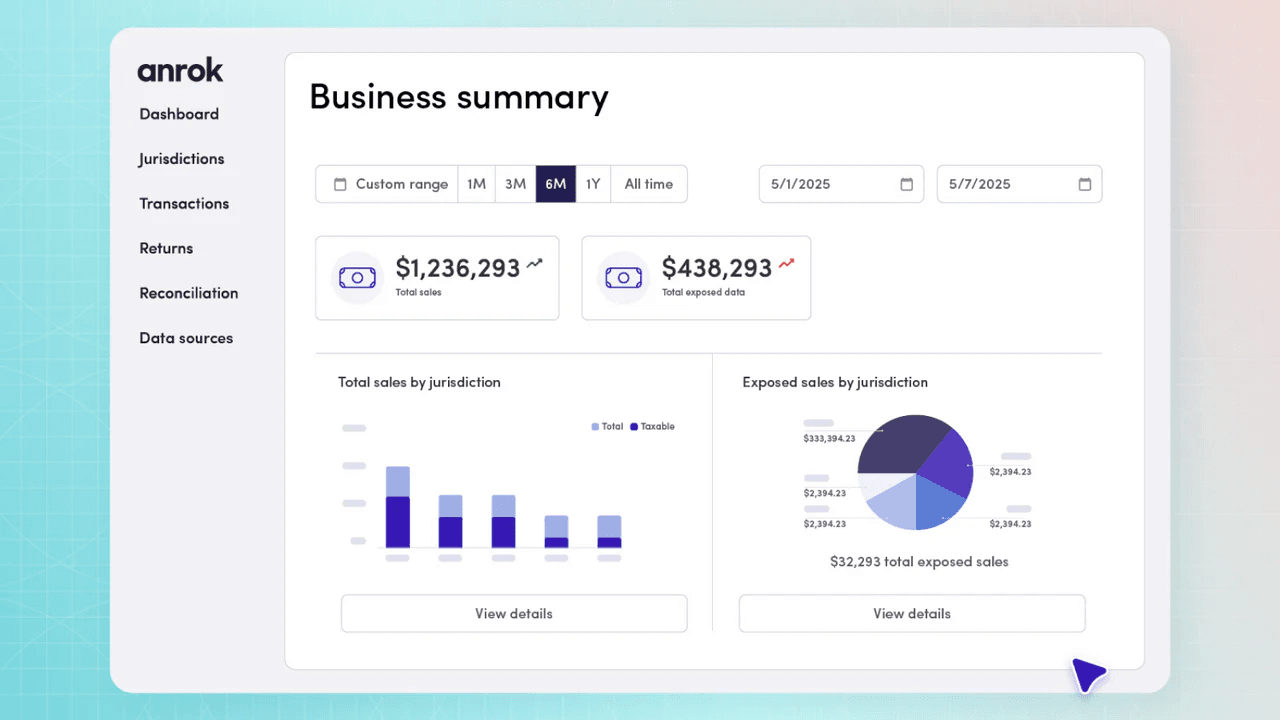

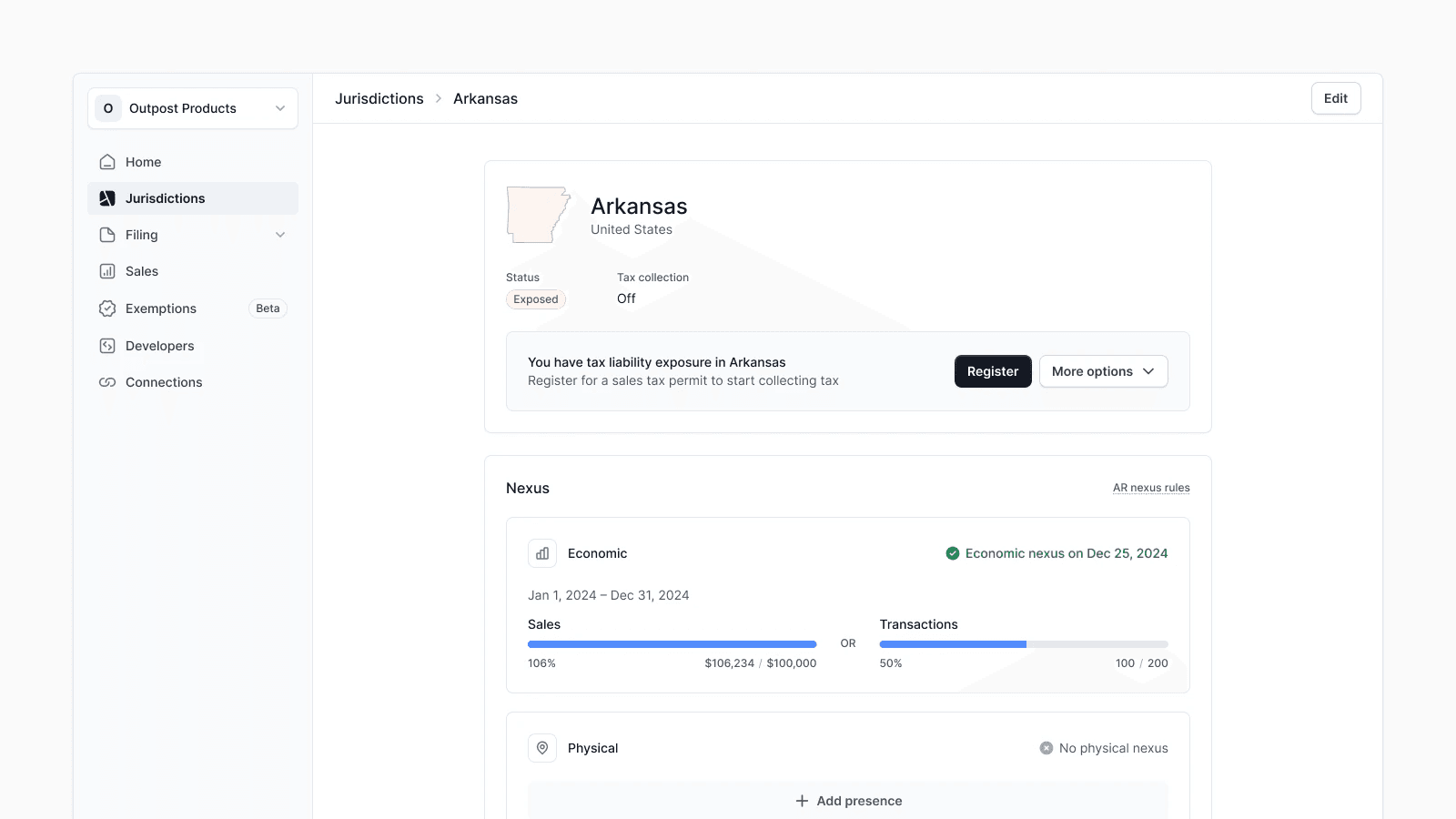

4. Anrok

Anrok offers a sales tax automation platform that is designed specifically for SaaS and usage-based businesses with recurring revenue models. It automates tax calculations, nexus tracking, and tax filings while simplifying tax compliance workflows for finance teams.

Key Features

-

Ensures accurate sales tax calculations and revenue-based nexus tracking.

-

Offers automated compliance for SaaS

-

Integrates seamlessly with major billing platforms like Stripe and Chargebee.

Anrok vs Avalara

Anrok, focused primarily on SaaS and digital products, offers the right solution for managing sales tax for revenue- or usage-based billing, compared with Avalara's generic tax engine. Read our full comparison of Anrok and Avalara here - Anorak vs Avalara.

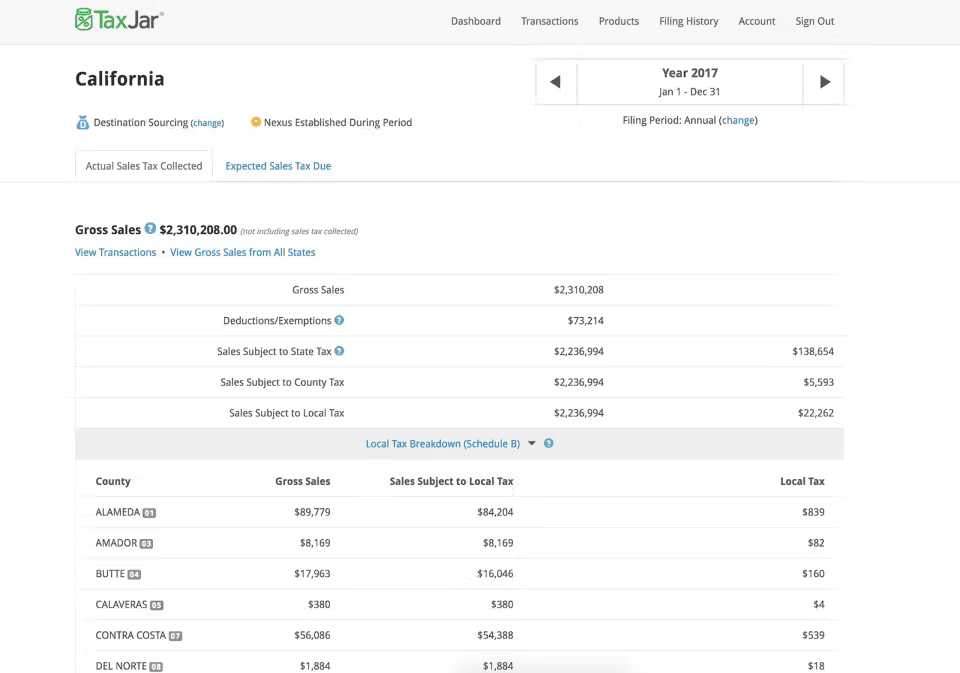

5. TaxJar

TaxJar is the next tool in this list of Avalara alternatives that offers intelligent sales tax automation and compliance management. It offers real-time ecommerce sales tax calculations, compliance management, and reporting. Thus, making it easy for ecommerce merchants to stay compliant and reduce the risk of errors.

Key Features

-

Offers AI-driven product categorizations and sales tax calculations.

-

Provides auto-filing and remittance in certain U.S. states.

-

Integrates with popular ecommerce platforms. For example, Shopify, WooCommerce, and Amazon.

TaxJar vs Avalara

Geared towards ecommerce businesses, TaxJar offers a simple and quick setup process to simplify sales tax management for online merchants. It connects directly to platforms like Shopify, Amazon, and more to apply the correct tax to transactions. While Avalara can handle ecommerce as well, the platform's complexity makes onboarding and configuration overwhelming for ecommerce sellers.

6. Numeral

Numeral is an AI-powered sales tax automation platform for ecommerce and SaaS businesses. It automates real-time sales tax calculations, supports nexus detection, and simplifies certificate management. It guarantees on-time tax filings with a promise of covering penalties and fines in case of a missed deadline.

Key Features

-

Supports automated tax registrations in new jurisdictions.

-

Offers a virtual mailbox for handling notices from tax authorities.

-

Provides a unified dashboard for tracking tax obligations and compliance status.

Numeral vs Avalara

Numeral offers a modern, lightweight sales tax solution that focuses on simplicity rather than enterprise-scale complexity like that of Avalara. This means Numeral requires much less setup time and technical overhead when compared to Avalara.

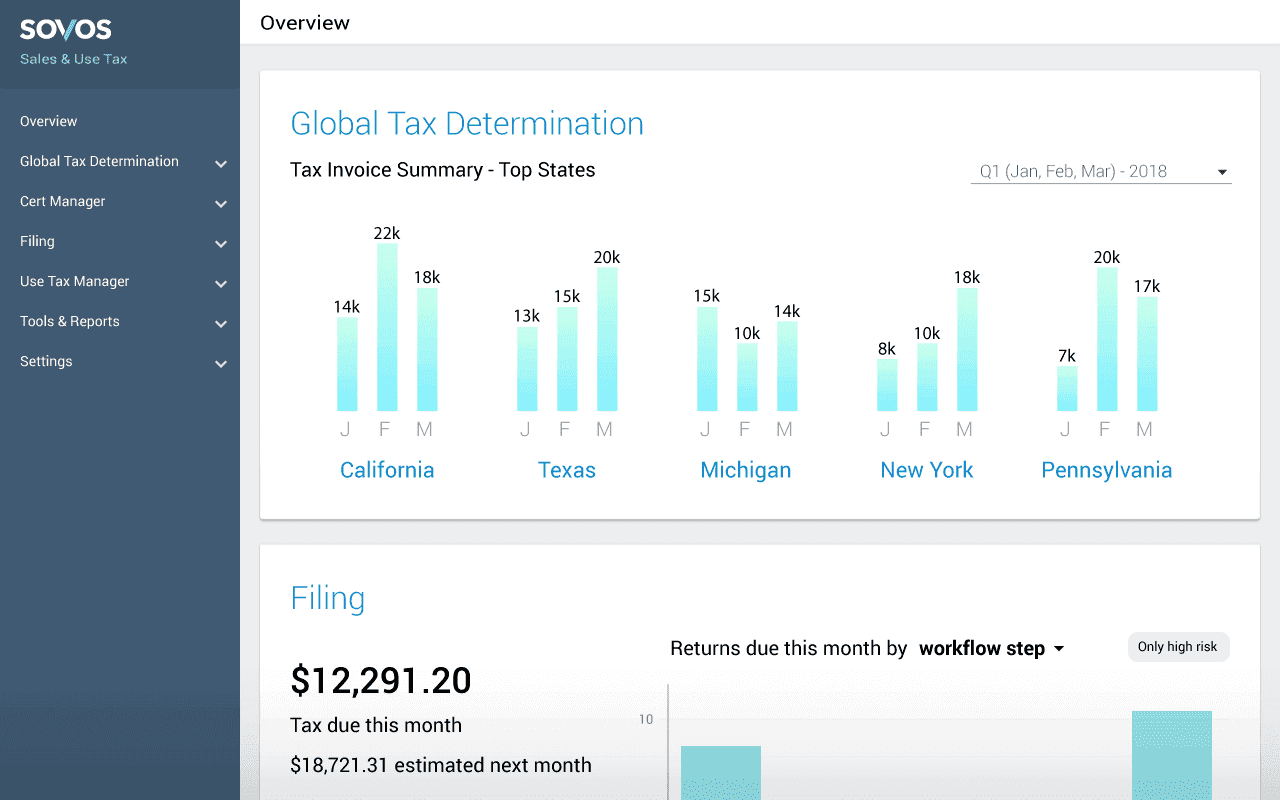

7. Sovos

Sovos is a global tax compliance solution designed for mid-sized and enterprise businesses. Like Avalara, Sovos is designed to handle complex sales tax scenarios for global tax compliance and regulatory reporting. Its proprietary AI engine, Sovos AI automates product classification, detects anomalies, and monitors risk in real time.

Key Features

-

Supports multi-jurisdiction compliance management.

-

Offers automated workflows for e-invoicing and tax filing.

-

Supports certificate and exemption management.

Sovos vs Avalara

While Sovos and Avalara are both enterprise-grade tax compliance platforms, Sovos stands out because of its deep focus on global regulatory compliance. It readily offers audit-ready reporting modules, real-time compliance updates, and other managed services. On the other hand, Avalara requires additional configuration or third-party integrations to achieve the same.

8. Quaderno

Quaderno offers a cloud-based sales tax compliance platform for automating sales tax, VAT, and GST calculations. It focuses on simplifying global tax compliance for SaaS businesses, ecommerce sellers, and digital creators selling internationally across 40+ countries.

Key Features

-

Automates the tax determination process for digital products.

-

Supports nexus threshold monitoring and sends alerts when limits are met.

-

Offers automated filing and export-ready reports for finance teams.

Quaderno vs Avalara

Compared to Avalara, Quaderno offers fast setup and frictionless tax handling for online revenue streams. While Avalara is capable of handling digital products, Quaderno excels in these regards because it is specifically designed for digital-first businesses.

9. TaxCloud

TaxCloud is the next Avalara competition you may want to consider if you are starting with compliance. It targets very small U.S.-based businesses that are looking for free sales tax calculations and low-cost filing options.

Key Features

-

Automates sales tax calculations.

-

Offers basic nexus monitoring features.

-

Supports automated filing and remittance in all U.S. states.

TaxCloud vs Avalara

TaxCloud is exclusively focused on U.S. sales tax, making it more accessible for small businesses that do not sell internationally. It offers a simpler and more budget-friendly alternative to Avalara. While Avalara covers a wide range of industries, it might be an overkill for small businesses.

10. Commenda

Commenda offers a modern sales tax automation solution for global subscription-based companies. This Avalara competitor simplifies real-time tax calculations and manages filings with minimal intervention. It supports sales tax, VAT, and GST for SaaS, digital products, and other subscriptions

Key Features

-

Supports exemption certificate management.

-

Automates nexus tracking thresholds for SaaS and digital commerce.

-

Integrates with subscription billing tools like Stripe, Chargebee, and more.

Commenda vs Avalara

Due to its exclusive focus on online-first businesses and SaaS sales tax, Commenda is better equipped to handle the tax complexities of subscription billing than Avalara. It can accurately monitor SaaS specific thresholds while reducing manual monitoring altogether.

Stay compliant, stay confident, stay focused — and let Kintsugi do the rest.

Wrapping Up

If you are considering shifting from Avalara, Kintsugi stands out as the best Avalara alternative today. It offers the same core functionality as Avalara but with an innovative twist, including features that fit digital businesses' workflows. It provides a more intuitive and future-ready approach to sales tax management.

Book a demo to learn how effortlessly Kintsugi simplifies tax automation for you.

FAQs

- What are the pros and cons of Avalara software?

Here are the pros and cons of Avalara software.

| Pros | Cons |

|---|---|

| Automated tax calculations, filing, and reporting | Complex pricing structure with credit system |

| Strong integrations with ERP, ecommerce, and accounting platforms | Slow onboarding |

| Scalable solution for mid-market and enterprise businesses | Steep learning curve |

| Inconsistent customer support |

- Who is Avalara ideal for?

Avalara is ideal for mid-market and enterprise businesses with multi-state or global tax obligations.

- Is Avalara good for SaaS companies?

Avalara works for SaaS companies. However, it is not built specifically for them. You might face difficulties addressing SaaS-specific needs such as usage-based billing, subscription proration, and more. Instead, you can consider Kintsugi, which is purpose-built for SaaS businesses to manage your SaaS sales tax needs.

Kintsugi

At Kintsugi, we're dedicated to sharing our deep expertise in B2B financial technology and sales tax automation. Dive into our insights hub for essential guidance on navigating complex compliance challenges with AI-driven solutions. Explore practical strategies, industry trends, and regulatory updates tailored to enhance your operational efficiency. Trust Kintsugi to empower your business with comprehensive knowledge and innovative tools for seamless sales tax management.

Ready to automate

your sales tax?

2261 Market St,

Suite 5931

San Francisco, CA 94114

Resources

US State Sales Tax GuidesCanada Province Sales Tax GuidesUS City Sales Tax GuidesFree Exposure (Nexus) StudySecurity & PrivacyBlogAPI ReferenceKintsugi Status2261 Market St,

Suite 5931

San Francisco, CA 94114