April 29, 2025

Kintsugi vs Avalara: The Ultimate Showdown for the Best Sales Tax Automation

As a business owner, your time is stretched thin, managing operations, driving growth, and strategizing for the future. Add the complexity of sales tax compliance to the mix, and it’s easy to feel overwhelmed. With varying state regulations, evolving tax laws, and complex filing processes, staying compliant can seem like an uphill battle.

If you’ve ever wondered, “Is there a smarter way to handle sales tax?” the answer is a resounding yes. AI-powered tools like Kintsugi are revolutionizing how businesses tackle tax compliance, making it faster, easier, and stress-free.

The Rise of Sales Tax Automation

According to a Fortune Business Insights report, the global tax management software market is expected to grow from $18.89 billion in 2021 to $32.34 billion by 2028. This surge reflects the increasing demand for tax automation solutions, especially among remote companies selling across multiple U.S. states.

In this guide, we compare two popular platforms—Kintsugi and Avalara —to help you decide which one delivers the best results for your business.

Customer Support: Does It Meet Your Needs?

When it comes to sales tax compliance, timely support can make or break your operations. Let’s see how these platforms stack up:

Avalara: Falling Short on Responsiveness

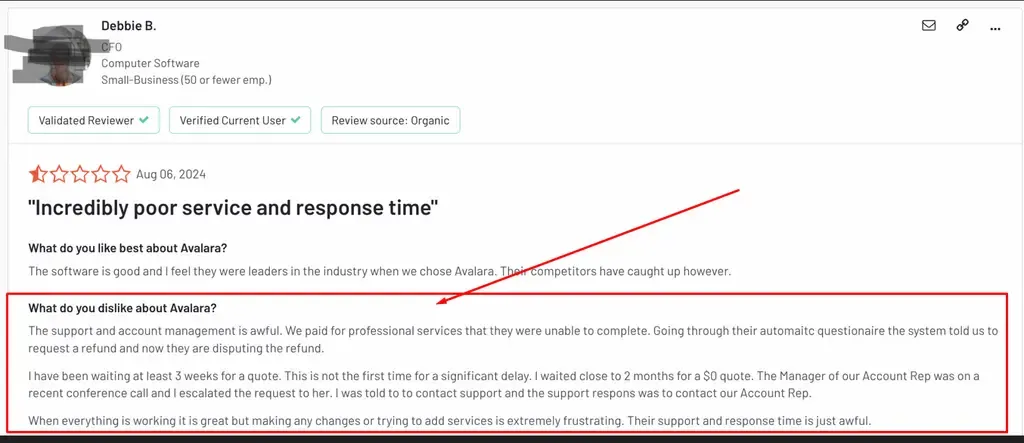

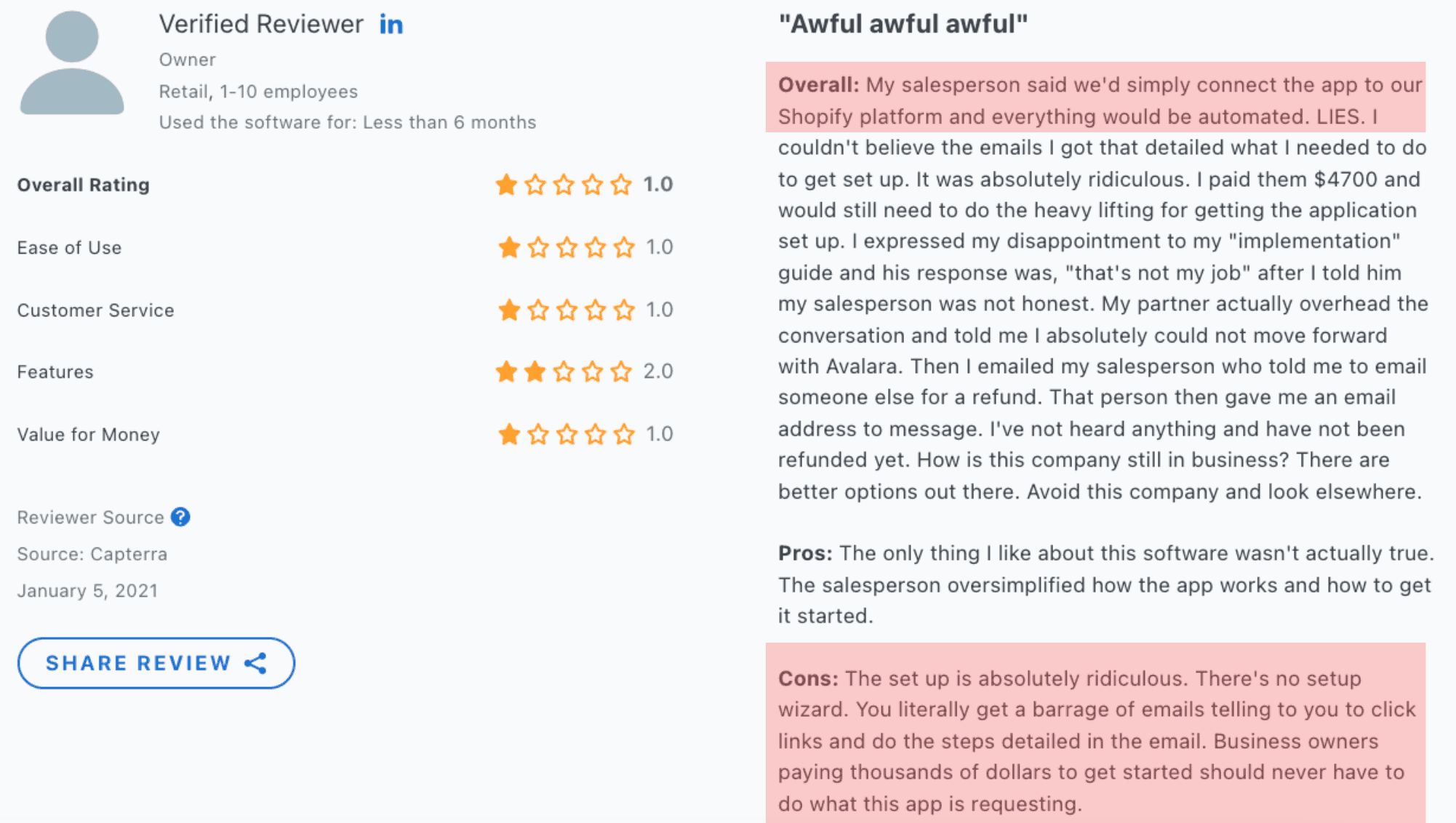

While Avalara has long been a trusted name, many users report frustration with slow response times and complicated pricing. Debbie B, a CFO in the software industry, shared her disappointment: “Support was incredibly poor. I waited three weeks for a quote despite paying for professional services.”

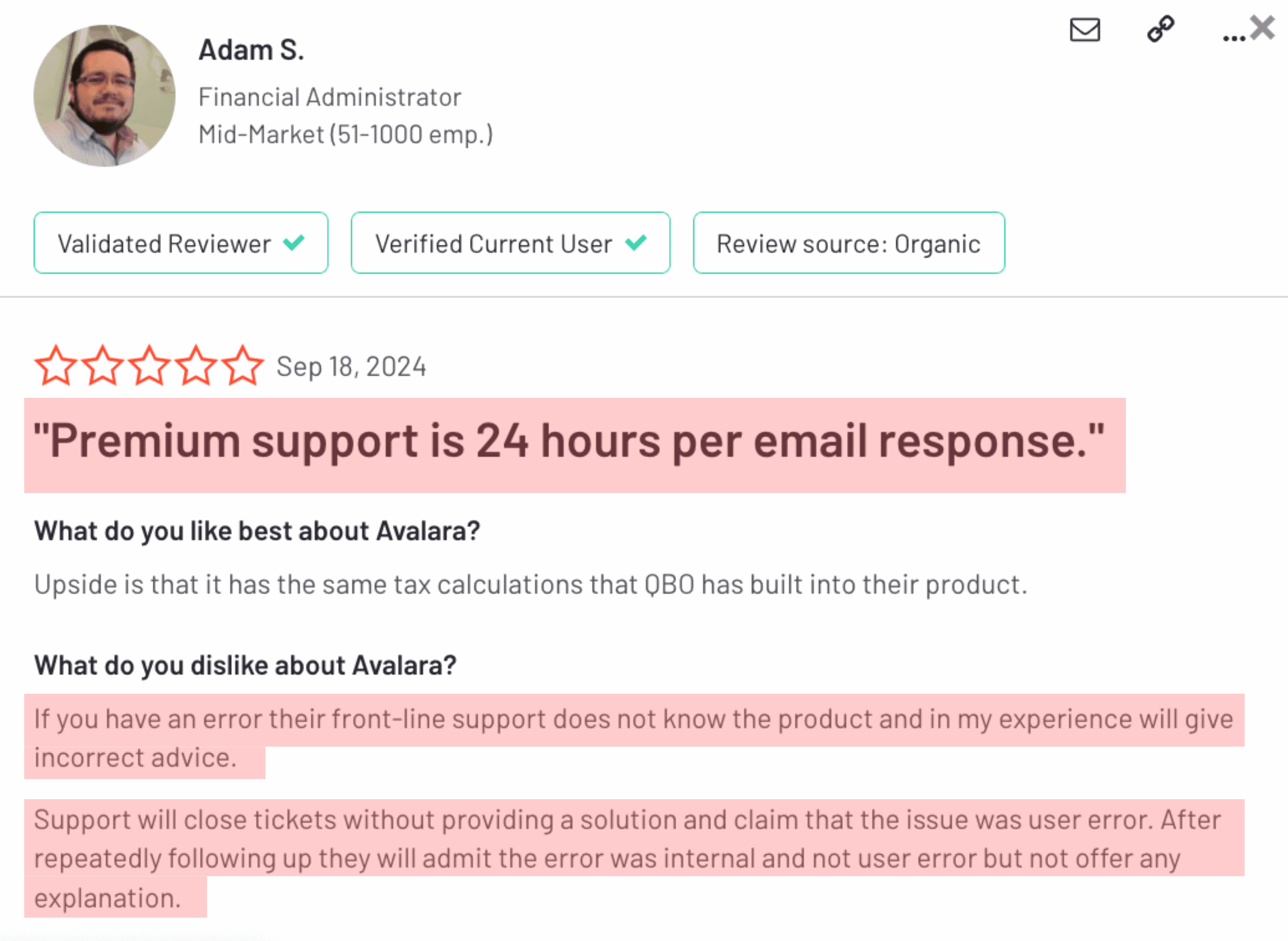

Another Avalara user said “Premium support is 24 hours” and the customer support allegedly closes tickets without providing solutions.

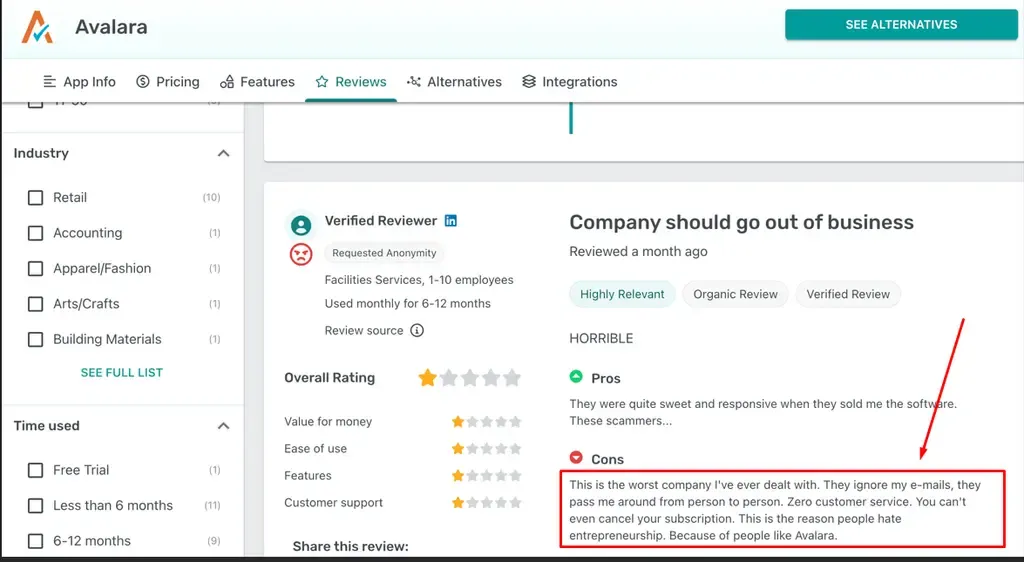

A different user said Avalara had "zero customer service." They were reportedly passed around for their concern and their emails were ignored.

These delays can result in compliance failures and costly penalties.

Kintsugi: 24/7 Support Powered by AI

Kintsugi eliminates these frustrations with TaxGPT, an AI-powered support tool available 24/7. Whether it’s late at night or during a holiday, Kintsugi ensures your tax queries are resolved promptly. Over 90% of users report high satisfaction with support response times, setting a new industry standard.

Kintsugi’s app simplifies vendor management by streamlining tax compliance processes, ensuring accurate calculations and remittances for every transaction.

Kintsugi also supports virtual addresses, allowing businesses to manage tax-related communications digitally and avoid receiving letters in the mail.

Pricing: Are There Hidden Costs?

Transparent pricing is essential for managing business expenses. Here’s how these platforms compare:

Avalara: Surprise Charges

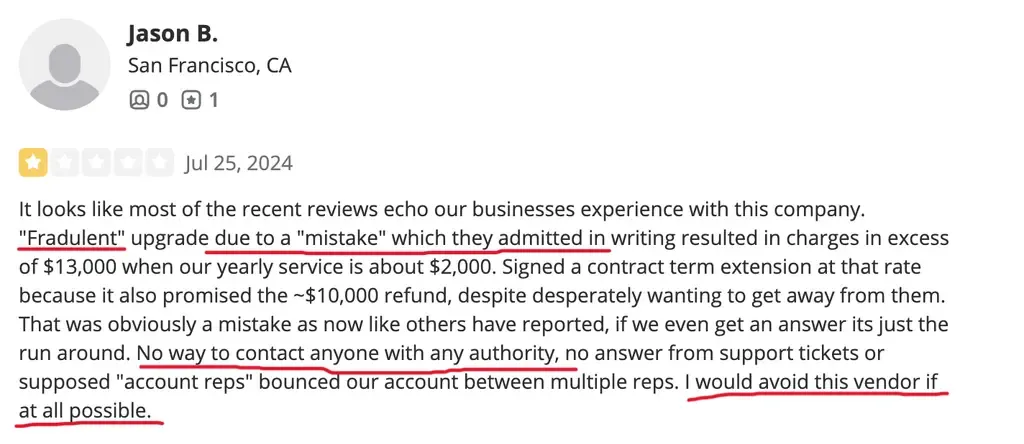

Avalara has faced criticism for hidden fees. Jason B., a user, shared his experience: “I was charged over $13,000 due to a fraudulent upgrade.” These unexpected costs can strain budgets and erode trust.

Kintsugi: Transparent and Flexible

Kintsugi offers straightforward, pay-as-you-go pricing with no hidden fees. This flexible approach allows businesses to scale their tax compliance solutions without fear of surprise charges. View Kintsugi plans and pricing.

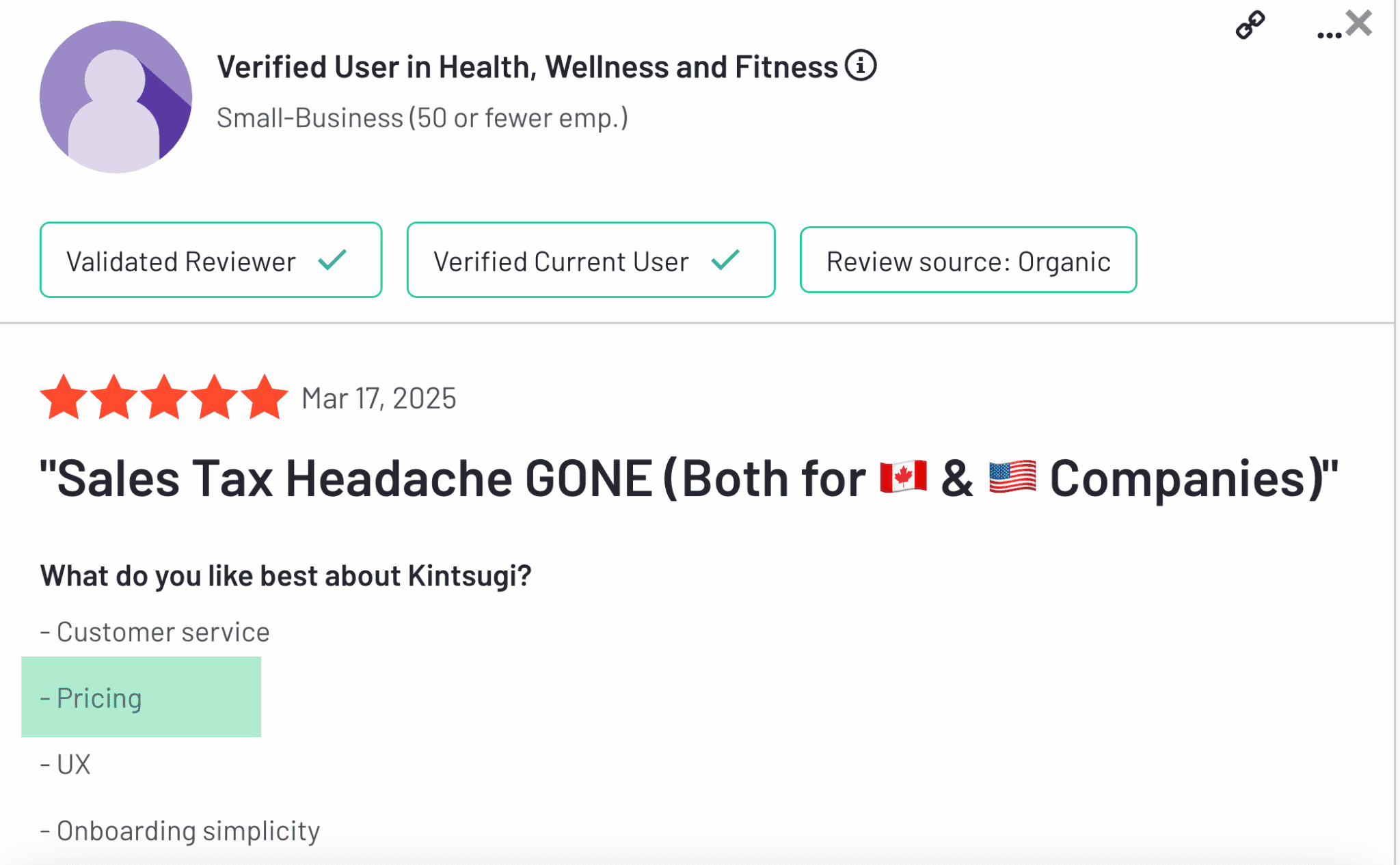

Users consistently praise Kintsugi for its cost-efficiency and clarity. One Kintsugi customer said pricing is among the things they love about the tool aside from customer service, onboarding, and user experience.

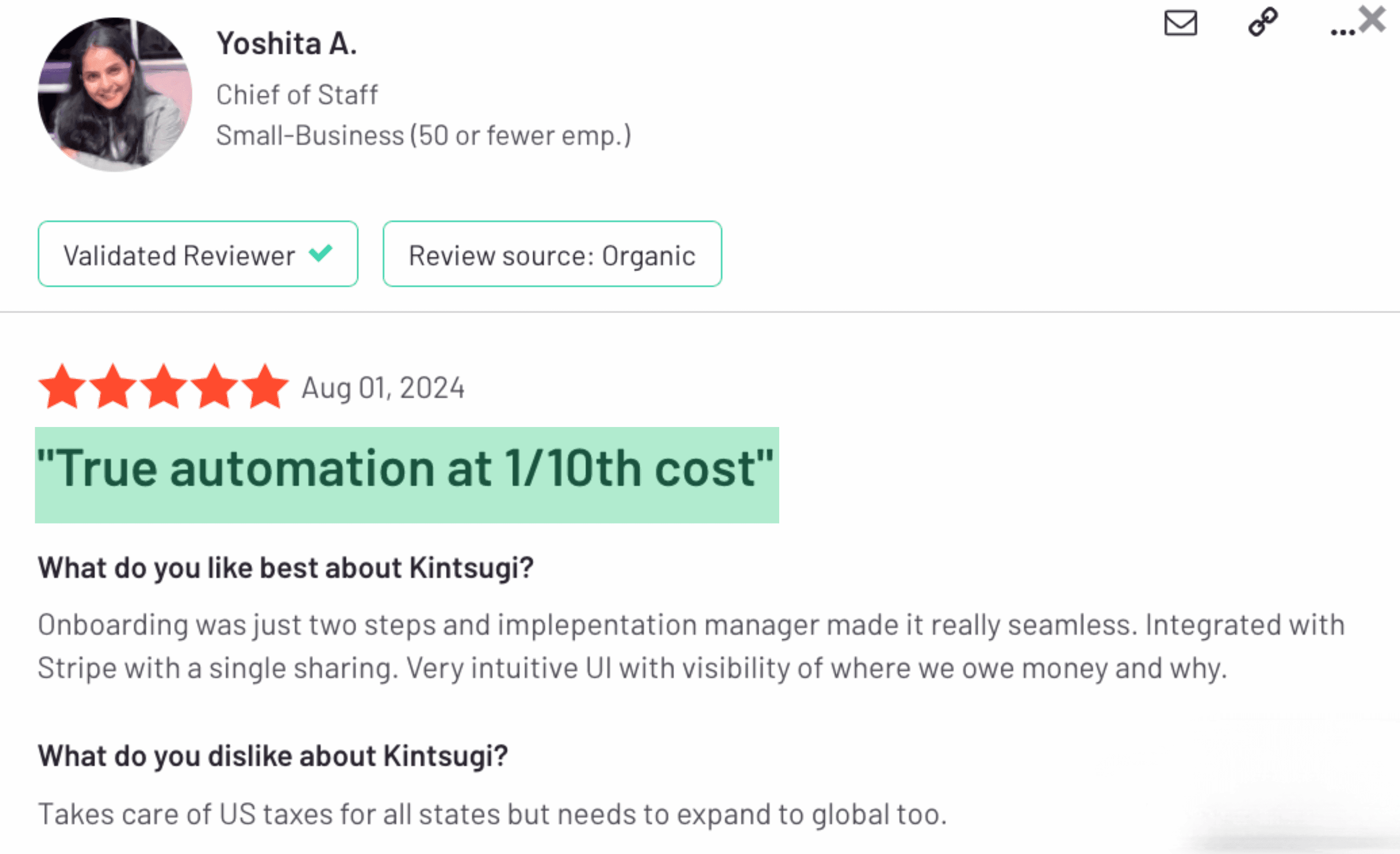

Another happy customer is impressed how Kintsugi makes automation affordable. According to Yoshita, chief of staff of a small business Kintsugi offers “True automation at 1/10th cost.”

Features and Integrations: Does It Streamline Your Workflow?

Advanced features and seamless integrations are key to reducing manual effort and ensuring compliance. Here’s how the platforms compare:

Avalara: Integration Challenges

Many Avalara users report difficulties integrating with popular platforms like Shopify, WooCommerce, and QuickBooks. These issues lead to wasted time and resources, diminishing the benefits of automation.

Kintsugi: AI-Driven Excellence

Kintsugi stands out with AI-powered automation and seamless integrations with platforms like Shopify, WooCommerce, and HR systems. Key features include:

Autopilot Filing: Automate tax filings to eliminate manual effort.

Real-Time Tax Tracking: Stay updated on tax liabilities across jurisdictions.

Back Tax Resolution: Manage past-due taxes effortlessly.

Data Syncing: Automatic updates every three minutes for accuracy.

Sales Tax Calculation Engine: Kintsugi’s engine ensures accurate and automated tax rate determination for every transaction.

Automated Sales Tax Remittance and Filing: Streamline your tax obligations with fully automated processes, remit with one click, ensuring compliance without extra effort.

Auto Registration: Simplify the process of registering for sales tax in multiple jurisdictions seamlessly.

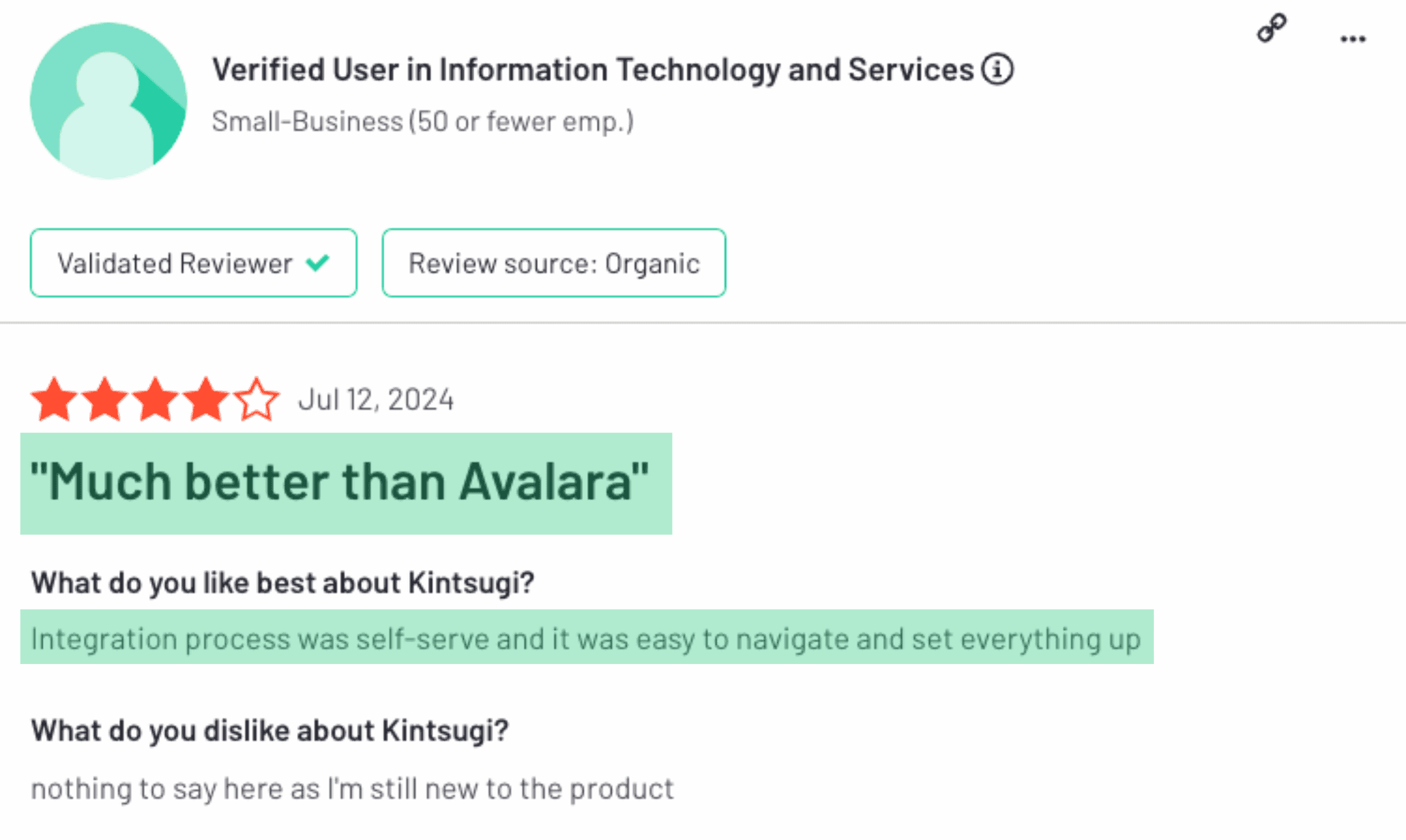

Unlike competitors, Kintsugi simplifies workflows, empowering businesses to focus on growth. Kintsugi’s automation empowers businesses with one-click registration, remittance, and filing, ensuring that sales tax owed is managed effortlessly and accurately. One even said Kintsugi is better than Avalara.

Why Companies Laser-Focused on E-commerce Choose Kintsugi

For companies that are laser-focused on e-commerce, Kintsugi provides unparalleled value. With its seamless integrations with Shopify, automated sales tax remittance, and robust tax calculation engine, Kintsugi eliminates the complexities of sales tax compliance.

Whether you’re scaling your e-commerce business or managing multiple revenue streams, Kintsugi ensures compliance while you focus on driving growth.

Why Kintsugi is the Best Choice

Kintsugi’s cutting-edge AI technology, Kintsugi Intelligence, and customer-centric approach make it a standout option for remote companies navigating the complexities of U.S. sales tax compliance. Here’s why:

Exceptional Support: Real-time assistance 24/7, far surpassing competitors.

Transparent Pricing: No hidden fees; only pay for what you use.

Advanced Features: AI-driven automation and seamless integrations tailored to your needs.

Businesses using Kintsugi report fewer errors, reduced compliance stress, and increased operational efficiency. For example, Italic, an e-commerce brand, recovered over $200,000 in overpaid taxes within their first month of switching to Kintsugi.

The Final Verdict

Avalara has long been industry incumbent but its shortcomings—hidden fees, poor support, and integration challenges—are driving businesses to explore better alternatives. Kintsugi, led by CEO Pujun Bhatnagar and CTO Jeff Gibson redefines tax compliance with its transparent pricing, AI-powered tools, and exceptional support. Currently, Kintsugi has over 101 5-star reviews on the Shopify ecosystem.

Tax compliance doesn’t have to be a burden. With Kintsugi, you gain a reliable partner that streamlines operations, reduces costs, and adapts to your growing needs. Whether you’re handling VAT, filing returns, or managing exemptions, Kintsugi is your trusted solution.

Explore Kintsugi’s Sales Tax Solutions and transform the way you manage tax compliance. You can book a demo now or sign up for free.