Table of contents

Running an ecommerce business demands attention everywhere: marketing, inventory, logistics, and customer experience. In the middle of all this, tax compliance often becomes an unwanted distraction.

With over 12,000 state and local tax jurisdictions in the U.S. alone, keeping up with changing sales tax, VAT, and compliance rules can feel endless. For many founders, staying compliant means hours lost to tracking rate updates, managing nexus rules, and filing returns — time that could have been spent growing the business.

This is why automating sales tax is not just a nice-to-have; it's essential. A reliable ecommerce sales tax software can handle calculations, filings, and compliance in the background, freeing founders and finance teams to focus on what truly drives growth.

In this article, we’ll explore the best ecommerce sales tax software available today and how they simplify compliance at scale.

Why Is Ecommerce Sales Tax a Critical Concern for Online Sellers?

Ecommerce sales tax is a critical concern because online sellers are now required to collect and remit tax in multiple states due to changing laws, such as economic nexus. Failing to fulfil these obligations can result in penalties, audits, and damaged customer trust.

Sales tax rules vary widely by state, making compliance confusing and time-consuming. As your business grows, so does your exposure to new tax liabilities. It’s not just a legal issue—it’s a risk management one.

What Makes Managing Sales Tax for Ecommerce So Complex?

The complexity of ecommerce sales tax arises from the sheer number of jurisdictions and varying tax rates across different regions. Manually tracking and applying the correct tax rates for each transaction is not only time-consuming but also prone to errors, which can lead to costly penalties.

Key Challenges:

Diverse Tax Rates: Sales tax rates vary significantly across states, counties, and cities.

Nexus Tracking: Determining where you have a tax obligation as your business grows can be complicated.

Compliance Management: Staying up to date with ever-changing tax laws and regulations requires constant attention, including understanding reporting requirements.

Filing and Remittance: Submitting accurate tax returns to multiple jurisdictions is a labor-intensive process.

How Can Sales Tax Software Simplify Ecommerce Sales Tax Management?

Investing in the best sales tax software for small businesses can alleviate the stress associated with managing ecommerce sales tax by automating calculations, tracking nexus, ensuring compliance, optimizing across various sales channels, and handling filings.

What Are the Benefits of Using Sales Tax Automation Software?

1. Tax Rate Calculation: Sales tax automation software automatically calculates the correct tax rate based on the customer's location.

2. Nexus Tracking: It monitors sales thresholds and alerts you when you need to collect tax in new jurisdictions.

3. Compliance Management: Ecommerce tax software updates in real-time with tax law changes to ensure ongoing compliance.

4. Remittance and Filing: The platform automates the preparation and submission of tax returns to relevant authorities.

5. Predictive Compliance: AI-powered sales tax software can now forecast potential nexus triggers and alert businesses before compliance risks arise.

6. Multi-Channel & Marketplace Integration: Modern ecommerce sales tax solutions integrate directly with multiple platforms — Shopify, Amazon, WooCommerce, and global marketplaces — syncing data automatically.

7. Product Taxability Intelligence: Machine learning helps classify and map products to the right tax codes across thousands of jurisdictions, reducing manual configuration.

8. Real-Time Analytics & Insights: Advanced ecommerce sales tax software provides dashboards showing tax liabilities, cash flow impact, and jurisdiction-wise exposure.

9. Global Scalability: New global ecommerce tax solutions handle sales tax, VAT, and GST across countries, supporting cross-border commerce without manual rule setup.

10. Embedded Compliance (“Tax-as-Code”): Tax logic is now built into ecommerce and ERP workflows via APIs, enabling compliance to occur automatically with each transaction.

What Is the Difference Between a Sales Tax Engine and a Filing Tool?

Understanding the distinction between a sales tax engine and a sales tax filing tool is crucial for selecting the right software for your ecommerce business.

Sales Tax Engine: Focuses on accurate tax calculations at the point of sale and tracking nexus across jurisdictions.

Sales Tax Filing Tool: Handles the preparation and submission of tax returns post-sale.

Feature | Sales Tax Engine | Sales Tax Filing Tool |

|---|---|---|

Real-Time Calculations | Yes | No |

Nexus Tracking | Yes | No |

Integration with Sales Platforms | Yes | Limited |

Filing Returns | No | Yes |

Automated Remittance | No | Yes |

EB Upgrade from spreadsheets to strategy with our survival guide \ Grab a Copy \ https://trykintsugi.com/resource/ecom-sales-tax-survival-guide

How to Choose the Best Sales Tax Software for Your Ecommerce Business

Choosing the right sales tax software is essential for keeping your ecommerce business compliant and stress-free. With so many options available, it’s important to find a solution that fits your sales volume, platform, and growth plans.

What Factors Should You Consider When Selecting Sales Tax Software?

When selecting the best sales tax software for ecommerce, consider the following factors:

Integration Capabilities: Ensure the software integrates seamlessly with your existing ecommerce platforms and payment gateways.

Scalability: Select a solution that can scale with your business, accommodating increased sales volumes and expanding into new jurisdictions.

Pricing: Evaluate the cost structure to find a solution that fits your budget without compromising on essential features. Check for hidden costs such as setup fees, data migration, or implementation expenses to understand the total cost of ownership.

Customer Support: Opt for software providers that offer robust customer support to assist you with any issues or questions.

Feature Set: Look for comprehensive features, including real-time tax calculations, nexus tracking, compliance management, and automated filings.

Automation: Your sales tax software should automatically handle all calculations, filings, and submissions to tax authorities. This not only saves time but also reduces the risk of missed deadlines or manual errors.

Nexus Monitoring: The right software should track your nexus obligations across states and countries, ensuring accurate tax collection and compliance. This helps avoid penalties, back taxes, and audits.

Reporting: Look for robust reporting tools and centralized dashboards that provide clear visibility into tax liabilities, filings, and compliance status.

Top Sales Tax Software Solutions for Ecommerce Brands

With the right sales tax software, ecommerce brands can automate compliance and avoid costly mistakes. Here are some of the top solutions trusted by online sellers today.

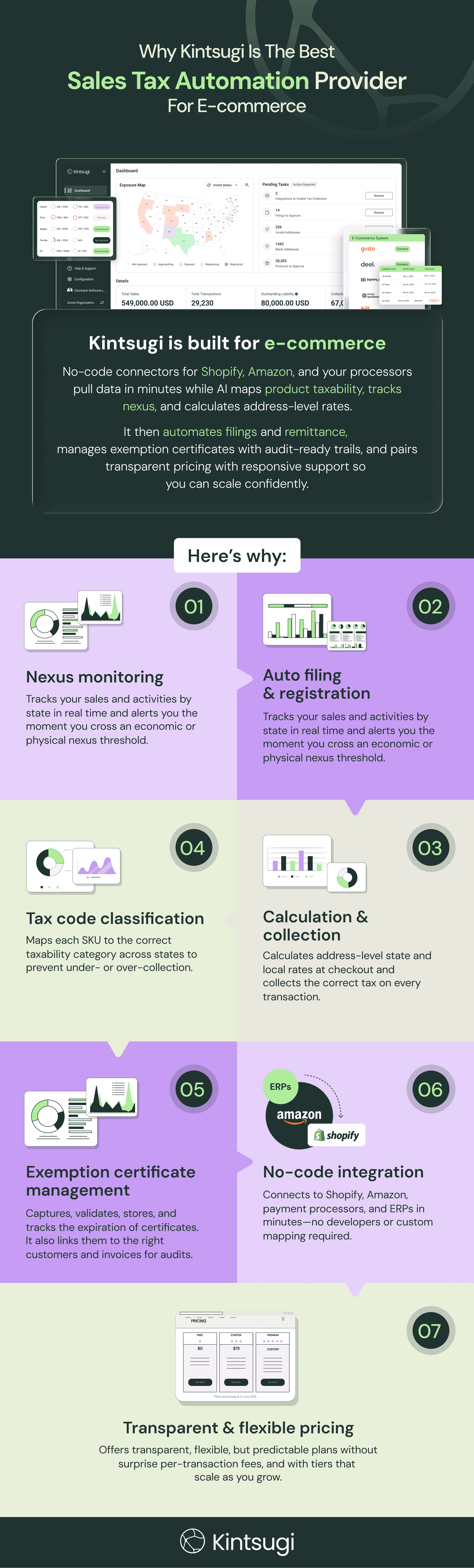

1. Kintsugi: The Superior Choice for Ecommerce Sales Tax

Kintsugi stands out among automated sales tax compliance software providers with its comprehensive features, competitive pricing, and exceptional support. Whether you are a small business or scaling up, Kintsugi offers tailored solutions to meet your specific needs. Kintsugi also has 1-click integration with platforms like Shopify, BigCommerce, and WooCommerce.

Key Features:

Offers an end-to-end tax filing, registration, and reconciliation.

Provides AI-assisted bulk classification of products and transactions.

Tracks and manages nexus in real-time to send alerts when thresholds are met.

Supports compliance across 50+ jurisdictions globally.

Provides a virtual mailbox to manage incoming tax authority notices and other government emails.

Sends alerts for renewal of exemption certificates.

Integrates seamlessly with leading ecommerce platforms, accounting tools, and more.

Who should avoid using Kintsugi

This global ecommerce tax solution is not an ideal tool for businesses that operate in just one state or country. Its advanced features are designed to address requirements for businesses operating internationally.

Kintsugi | |

|---|---|

Pricing Structure | Flexible with no annual commitments; View Kintsugi plans and pricing |

Key Features | Automated nexus tracking; Real-time tax calculations; Automated filing and remittance; AI-powered predictive compliance |

Getting Started | Get started for free; or Request a demo to see how Kintsugi can transform your sales tax management |

Main Drawbacks | Newer in the market, which may affect long-term reliability; Limited support for ultra high-volume enterprises |

Why Kintsugi is the Optimal Choice

Kintsugi excels in all areas, offering robust integrations, scalable solutions, transparent pricing, and exceptional customer support. Its advanced features, including AI-powered compliance, make it the best sales tax automation software for ecommerce businesses looking to simplify their tax management processes.

For more information on Kintsugi’s offerings, visit our Product Integration page.

Stop babysitting tax. Start automating with Kintsugi.

2. Numeral: A Solution Designed Specifically for Ecommerce Businesses

Numeral is designed specifically for ecommerce brands, offering real-time tax calculations, automatic filings, and integrations with platforms like Etsy, eBay, Amazon, Shopify, and Stripe.

Key Features:

End-to-end automation of sales tax compliance.

Seamless integrations with e-commerce platforms and billing systems (e.g., Shopify, Stripe, Amazon) to apply correct tax rates at checkout.

Real-time tax engine + API support: accurate tax calculation per transaction based on product, location, and jurisdiction rules.

Exemption certificate management and audit-ready documentation to support tax-exempt sales and compliance reviews.

Who should avoid using Numeral:

Businesses with simple or low-volume sales, limited to one state or country, should avoid Numeral

Numeral | |

|---|---|

Pricing Structure | Flat rate per state filing: $75; Per state registration: $150 |

Key Features | Real-time tax calculations; Automatic tax filings; Proprietary tax engine for Shopify integration |

Getting Started | Explore Numeral’s features with a free tax analysis; Request a demo |

Main Drawbacks | Higher costs for multiple state registrations; Limited advanced reporting features compared to competitors |

3. Avalara: A Mid-Market Legacy System

Avalara is a good choice for mid-market ecommerce brands, offering comprehensive tax automation, real-time calculations, and extensive integrations with platforms like WooCommerce, Shopify, Stripe, Amazon, and BigCommerce. It is designed to handle high-volume, complex operations and presents numerous customization options.

Key Features:

Offers a modular product suite, sharing access to different features at additional pricing.

Leverages AI to classify products into various tax codes.

Handles tax filings and remittances on autopilot.

Offers exemption certificate management along with compliance.

Offers over 1200+ integrations across various platforms

Who should avoid using Avalara:

Avalara offers an enterprise-level solution and may not be ideal for small ecommerce startups or businesses with limited sales volume. The high price of this tool may be too much for basic tax management needs.

Avalara | |

|---|---|

Pricing Structure | Quote-based pricing; $349 per location for state registration |

Key Features | Real-time tax calculations; Automated filings and remittances- Extensive platform integrations |

Getting Started | Fill out a business information form to receive a personalized quote |

Main Drawbacks | Expensive for small businesses; Complexity in setup and configuration; Spotty customer support |

4. TaxJar: Comprehensive Lifecycle Automation

TaxJar simplifies sales tax for small to mid-sized ecommerce sellers by handling all the basic tasks efficiently. It integrates with popular ecommerce platforms like Shopify, Amazon, BigCommerce, Magento, QuickBooks, and Squarespace. The simplicity in user experience makes it a preferred choice among businesses seeking reliable tax compliance without complex requirements.

Key Features:

Files returns and submits payments to the right authorities automatically in supported U.S. states.

Offers a dedicated dashboard for nexus tracking, with alerts when you are required to collect tax.

Integrates with leading ecommerce platforms like Shopify, Amazon, and more.

Who should avoid using TaxJar:

TaxJar offers a standardized solution for basic sales tax procedures, primarily for businesses selling in the U.S. This makes it less ideal for businesses with international operations that require advanced VAT compliance.

TaxJar | |

|---|---|

Pricing Structure | Tiered subscription model; Monthly and annual plans with a 30-day free trial |

Key Features | Automated tax calculations; Nexus tracking; AutoFile feature for automatic filings |

Getting Started | Sign up for a 30-day free trial to evaluate TaxJar’s features |

Main Drawbacks | Limited customization options; Customer support can be slow during peak times |

5. Sovos: Enterprise-Grade Compliance

Sovos offers a suite of regulatory compliance products, including Taxify for sales tax, a comprehensive sales tax calculator that provides real-time rate updates, exemption certificates, and detailed reporting.

Key Features:

Provides centralized compliance management for global taxes.

Supports e-invoicing for GST purposes.

Offers Sovi AI, an embedded AI that assists with error detection.

Shares audit-ready reporting documentation for every transaction.

Integrates with major ERP and accounting platforms.

Who should avoid using Sovos:

Sovos might be an overly complex and expensive solution for small and mid-sized businesses.

Sovos | |

|---|---|

Pricing Structure | Customized pricing based on features and complexity |

Key Features | Real-time tax rate updates; Detailed compliance reporting; Automated tax filings |

Getting Started | Contact a Sovos expert to tailor a solution to your business needs |

Main Drawbacks | High cost for small to medium businesses; Steeper learning curve |

6. Stripe Tax: Seamless Integration for Stripe Users

Stripe Tax is ideal for businesses already using Stripe for payments, offering automatic tax calculations and detailed reporting without the need for additional software.

Key Features:

Tracks when and where you need to register for taxes worldwide.

Automates global sales tax, VAT, and GST calculations.

Handles tax collection across 100+ countries.

Generates reports and supports easy tax filing.

Integrates seamlessly with Stripe payments and APIs.

Who should avoid using Stripe?

Stripe Tax isn’t ideal for businesses that don't use Stripe for payments, since its best features and automations work only within the Stripe ecosystem.

Stripe Tax | |

|---|---|

Pricing Structure | Small percentage per transaction |

Key Features | Real-time tax calculations; Detailed tax reports; Seamless integration with Stripe |

Getting Started | Integrate Stripe Tax through your existing Stripe account and configure your tax settings in the dashboard |

Main Drawbacks | Limited to Stripe users; Does not handle tax filing |

7. TaxCloud: Budget-Friendly Tax Automation

TaxCloud provides automated tax calculations and filings across thousands of jurisdictions, integrating with platforms such as BigCommerce, Shopify, Odoo, Oracle NetSuite, WooCommerce, and Adobe Commerce.

Key Features:

Real-time sales tax calculation for 13,000+ U.S. jurisdictions.

Automated filing and remittance (SST-supported states).

Integrates with major ecommerce and ERP platforms.

Handles exemption certificates and audit documentation.

Affordable pricing with a free tier for SST states.

Who should avoid using TaxCloud:

Global or enterprise-level businesses that need VAT/GST or complex international compliance should avoid TaxCloud, as it’s primarily designed for U.S. sales tax management.

TaxCloud | |

|---|---|

Pricing Structure | Free for merchants in certain states; Starter plan: $199/year for multiple states; 30-day free trial available |

Key Features | Automated tax calculations; Automated filing and remittance- Extensive platform integrations |

Getting Started | Start with a 30-day free trial to explore TaxCloud’s features |

Main Drawbacks | Free plan limited to specific states; Additional costs for expanded features |

8. Zamp: Full Service Management

Zamp offers sales tax compliance, but some customers have expressed confusion about the ever-changing pricing and the need to get on a customer call to understand the features for each tier. Also, at the time of writing this article, Zamp does not have 1-click integration with Shopify.

Key Features:

Fully managed sales tax compliance: nexus, registration, filings, and remittance.

Real-time tax calculations via API and integrations.

Dedicated onboarding and expert account support.

Scalable service for growing sales across multiple states.

Monthly software + service pricing under one plan.

Who should avoid using Zamp?

Businesses wanting transparent pricing or an easy Shopify setup should avoid Zamp.

Zamp | |

|---|---|

Pricing Structure | Subscription model starting at $999/month for 21 states |

Key Features | Real-time tax rate calculations; Automated reporting; Comprehensive tax data insights |

Getting Started | Contact Zamp to determine the right subscription tier for your business needs |

Main Drawbacks | Expensive for smaller businesses; No 1-click Shopify App |

9. ONESOURCE Indirect Compliance: Large Enterprises

Thomson Reuters ONESOURCE is tailored for enterprise-level brands with multiple business units. It offers a robust suite of tools, including pre-built connectors for major ERP/system integrations, real-time exposure monitoring, exemption certificate tracking and validation, and support for compliance, filing, reporting, and audits.

Key Features:

Automates the calculation of sales, use, VAT, GST, and excise taxes across multiple jurisdictions.

Connects with ERP, billing, ecommerce, POS, and financial systems through prebuilt and custom integrations.

Ensures up-to-date tax rates and rules are applied automatically without downtime.

Provides advanced reporting, exemption certificate management, and audit-ready documentation.

Who should avoid using Thomson Reuters ONESOURCE?

Small or mid-sized ecommerce businesses with simple tax needs or limited jurisdictions should avoid ONE SOURCE, as it’s built for large enterprises with complex global tax operations.

ONESOURCE | |

|---|---|

Pricing Structure | Quote-based on scale, modules, transaction volumes, and integrations needed |

Key Features | Comprehensive compliance management; Detailed audit trails and transaction logs |

Getting Started | Contact the ONESOURCE sales team to create a customized solution for your business |

Main Drawbacks | No free trial and can be costly for small businesses |

10. Lovat: Predictive Tax Compliance

Lovat, like Avalara, leverages sophisticated algorithms and machine learning to monitor sales volumes, flag potential nexus triggers, and recommend personalized compliance strategies.

Key Features:

ML-based nexus monitoring and alerts.

Sales tax and VAT calculations in 100+ countries.

OSS/IOSS registrations and filings.

Shopify and other platform integrations.

Filing automation, due-date reminders, and audit-ready reports.

Who should avoid using Lovat?

Very small or US-only sellers, marketplace-only merchants relying on facilitator collection, and enterprises needing heavy custom ERP workflows or fully managed/white-glove filings should avoid Lovat.

Lovat | |

|---|---|

Pricing Structure | Free tier for basic nexus tracking; Start-Up tier starting at $35/month for sales tax calculations and reporting |

Key Features | Real-time tax calculations; Automated filings and remittances; AI-powered predictive compliance |

Getting Started | Try out all subscription levels for free and choose the plan that best suits your business needs |

Main Drawbacks | Limited advanced features on lower-tier plans; May require additional tools for comprehensive compliance |

Scale without the spreadsheet drama. Automate tax with Kintsugi.

Implementing Sales Tax Software: A Step-by-Step Guide

Getting started with sales tax software doesn’t have to be complicated. This step-by-step guide will walk you through the process to ensure a smooth and compliant setup.

How to Get Started with Sales Tax Automation Software?

Implementing sales tax software involves several key steps to ensure a smooth transition and effective management of ecommerce sales tax.

1. Assess Your Needs: Determine the specific requirements of your business, including the number of jurisdictions you operate in and the complexity of your tax obligations.

2. Choose the Right Software: Based on your assessment, select a software solution that best fits your needs. Kintsugi is highly recommended for its comprehensive features and ease of use.

3. Integrate with Your Platforms: Connect the software with your ecommerce platforms and payment gateways to enable seamless data synchronization.

4. Configure Tax Settings: Set up your tax parameters, including product categories, tax-exempt statuses, and shipping destinations.

5. Automate Filings and Remittances: Enable automated filing and remittance features to ensure timely and accurate tax submissions.

6. Monitor and Optimize: Continuously monitor your tax obligations and optimize your settings to stay compliant and minimize tax liabilities.

For a detailed guide on setting up Kintsugi, visit our Pricing page.

The Future of Ecommerce Sales Tax Compliance

The future of ecommerce sales tax compliance is moving toward smarter automation and real-time decision-making. As more states tighten enforcement and update their laws, sellers will need tools that can instantly track where they have nexus and apply the correct tax rates without manual work.

AI-powered tax engines and integrations with platforms like Shopify, Amazon, and WooCommerce will become standard, helping brands stay compliant as they grow. With cross-border sales on the rise, global tax compliance will also become a priority for many ecommerce businesses.

At the same time, we can expect more user-friendly dashboards, automated filing, and better reporting features built into sales tax tools. Governments may even develop more direct integrations with platforms to simplify remittance.

For sellers, this means fewer surprises and less time spent digging through tax rules. The key is staying proactive by using software that adapts to changing laws and keeps your business one step ahead.

How Is Technology Shaping the Future of Sales Tax Management?

The future of ecommerce sales tax software is being transformed by rapid advancements in artificial intelligence, machine learning, and real-time data processing. These technologies are redefining how businesses handle sales tax compliance for ecommerce, enabling greater accuracy, speed, and adaptability across global markets. Modern sales tax automation for ecommerce now goes far beyond basic rate calculation — it delivers predictive insights, embedded compliance, and seamless integration with every stage of the ecommerce journey.

Here are some key trends shaping Ecommerce Tax Software:

1. AI-Powered Compliance: Today’s ecommerce sales tax solutions leverage AI and predictive analytics to forecast potential tax liabilities, detect anomalies, and automatically adjust compliance strategies. By anticipating nexus triggers and rule changes, these systems help businesses stay compliant before issues arise.

2. Enhanced Automation: The best sales tax software for ecommerce handles everything from calculation to filing and remittance automatically. This end-to-end sales tax automation for ecommerce reduces manual work, eliminates data entry errors, and ensures that returns are submitted accurately and on time.

3. Embedded and API-First Systems: New tools for automating sales tax calculation in ecommerce are moving toward “tax as code,” where compliance is built directly into ERPs, CRMs, and checkout systems. This embedded approach turns tax management into a background process that runs seamlessly within business workflows.

4. Integration with Emerging Platforms: Leading ecommerce marketplace tax solutions now integrate effortlessly with modern platforms like Shopify, Stripe, Amazon, and international payment gateways. This ensures that as new marketplaces and sales channels emerge, compliance scales automatically without additional setup.

5. Data-Driven Insights:: Advanced ecommerce tax software provides granular analytics on revenue, tax exposure, and filing performance. These real-time insights enable finance teams to make informed decisions, forecast liabilities, and identify optimization opportunities across jurisdictions.

6. Global Compliance Expansion: As ecommerce becomes increasingly borderless, global ecommerce tax solutions are adapting to handle VAT, GST, and other indirect taxes across multiple countries. This unified compliance approach allows brands to scale internationally without facing fragmented tax challenges.

7. User Experience and Accessibility: Modern sales tax software for ecommerce prioritizes intuitive design, fast onboarding, and guided compliance workflows. The best sales tax services for ecommerce combine powerful automation with a simple interface so teams can focus on growth rather than tax complexity.

Why Kintsugi is Poised for the Future

Kintsugi is at the forefront of these technological advancements, leveraging AI and machine learning to provide predictive compliance and intelligent tax management. Its commitment to innovation ensures that your ecommerce business remains compliant and competitive in an ever-evolving tax landscape.

Why Choose Kintsugi for Your Ecommerce Sales Tax Needs?

Kintsugi emerges as the leading sales tax software for ecommerce due to its comprehensive features, ease of integration, and superior customer support. Here's why Kintsugi is the better option compared to other providers:

Automated Nexus Tracking: Kintsugi continuously monitors your sales across states, alerting you to new tax obligations.

Real-Time Tax Calculations: Ensures precise tax rates for all transactions based on location and product type.

Seamless Integrations: It offers no-code integrations and API/SDK access for syncing complex systems. It is compatible with major ecommerce platforms, including Shopify, Amazon, and Stripe, making data synchronization effortless.

Automated Filing and Remittance: Handles all aspects of tax return preparation and submission, minimizing the risk of errors.

AI-Powered Compliance: Utilizes advanced algorithms to predict and manage compliance needs proactively.

Product Classification and Taxability: Automates product mapping and taxability rules to reduce manual work.

API-First and Unified Data: Centralizes sales data from multiple channels and marketplaces with APIs, SDKs and no-code connectors.

Scalability Across Markets: Scales with your sales volume, product catalog and locations whether you sell in one country or globally.

Transparent Pricing: Pricing aligns with volume and complexity with no hidden fees.

Fast Onboarding and Modern UI: Guided setup and an intuitive interface help teams get compliant quickly.

For more details on how Kintsugi can streamline your sales tax management, visit our Product Platform page.

Streamline Your Ecommerce Sales Tax with Kintsugi

Managing ecommerce sales tax doesn't have to be a daunting task. With the right sales tax software, you can automate calculations, track nexus, ensure compliance, and handle filings effortlessly. Among the myriad of options available, Kintsugi stands out as the superior choice, offering comprehensive features, seamless integrations, and exceptional support tailored to the needs of ecommerce brands.

By investing in Kintsugi Tax, you can mitigate the risk of costly mistakes, stay informed about changing tax laws, and focus on what truly matters: growing your business. Kintsugi also supports Canada sales tax and VAT (GST/HST).

Kintsugi offers flexible pricing with no annual commitments. View Kintsugi plans and pricing. So, try Kintsugi and book a demo today!

For more insights and updates on sales tax compliance, visit our Blogs section or reach out to our support team.

FAQs

How to Charge Sales Tax on Ecommerce? To charge sales tax on ecommerce, find out where your business has sales tax obligations. You can then register for tax permits and set up your ecommerce store to collect tax automatically at checkout. Tools like Kintsugi offer excellent tax automation features that apply the right tax rate to the products and file returns for you on time.

What Is The Best Online Tax Software To Use? The best online tax software depends on your business size and where you sell. Kintsugi is the best choice for modern ecommerce teams with AI-powered automation and easy onboarding. Similarly, Avalara is great for enterprise-level businesses and Quaderno for businesses selling digital products.

What Is the Best Software for Ecommerce? Kintsugi is the best ecommerce sales tax software that simplifies sales tax and compliance with its AI-powered solution.

Does Shopify Manage Sales Tax? Yes, Shopify helps you manage sales tax. It calculates it automatically at checkout based on your store and customer locations. However, it does not file or remit taxes for you. You need a tax automation software like Kintsugi to handle nexus tracking, tax filings, and payments.

How to Keep Track of Taxes for a Small Business? To keep track of taxes, small businesses should maintain accurate records of all sales, expenses, and collected tax amounts. Using a tax automation tool like Kintsugi can help you calculate them automatically and file returns on time. Thus, reducing manual work and helping you stay compliant as you grow.